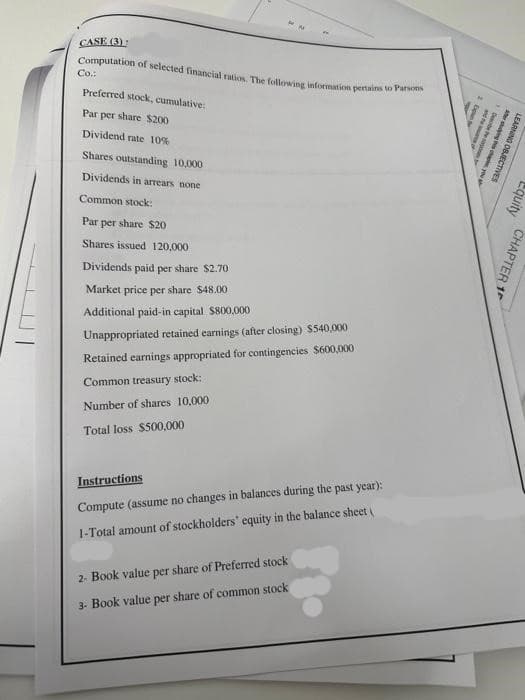

CASE (3) Computation of selected financial ration. The following information pertains to Parsons Co.: Preferred stock, cumulative: Par per share $200 Dividend rate 10% Shares outstanding 10,000 Dividends in arrears none Common stock: Par per share $20 Shares issued 120,000 Dividends paid per share $2.70 Market price per share $48.00 Additional paid-in capital $800,000 Unappropriated retained earnings (after closing) $540,000 Retained earnings appropriated for contingencies $600,000 Common treasury stock: Number of shares 10,000 Total loss $500,000 Instructions Compute (assume no changes in balances during the past year): 1-Total amount of stockholders' equity in the balance sheet 2- Book value per share of Preferred stock 3- Book value per share of common stock ng ECTIVES

CASE (3) Computation of selected financial ration. The following information pertains to Parsons Co.: Preferred stock, cumulative: Par per share $200 Dividend rate 10% Shares outstanding 10,000 Dividends in arrears none Common stock: Par per share $20 Shares issued 120,000 Dividends paid per share $2.70 Market price per share $48.00 Additional paid-in capital $800,000 Unappropriated retained earnings (after closing) $540,000 Retained earnings appropriated for contingencies $600,000 Common treasury stock: Number of shares 10,000 Total loss $500,000 Instructions Compute (assume no changes in balances during the past year): 1-Total amount of stockholders' equity in the balance sheet 2- Book value per share of Preferred stock 3- Book value per share of common stock ng ECTIVES

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter20: Corporations: Organization And Capital Stock

Section: Chapter Questions

Problem 7SPA: STATED VALUE, COMMON AND PREFERRED STOCK, AND NONCASH ASSETS Kris Kraft Stores had the following...

Related questions

Question

dont give answer in image format

Transcribed Image Text:CASE (3)

Computation of selected financial ratios. The following information pertains to Parsons

Co.:

Preferred stock, cumulative

Par per share $200

Dividend rate 10%

Shares outstanding 10.000

Dividends in arrears none

Common stock:

Par per share $20

Shares issued 120,000

Dividends paid per share $2.70

Market price per share $48.00

Additional paid-in capital $800,000

Unappropriated retained earnings (after closing) $540,000

Retained earnings appropriated for contingencies $600,000

Common treasury stock:

Number of shares 10,000

Total loss $500,000

Instructions

Compute (assume no changes in balances during the past year);

1-Total amount of stockholders' equity in the balance sheet

2- Book value per share of Preferred stock

3- Book value per share of common stock

2. Exp

To

and the

Describe the

ter studying this chape you a

LEARNING OBJECTIVES

Equity

CHAPTER 1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub