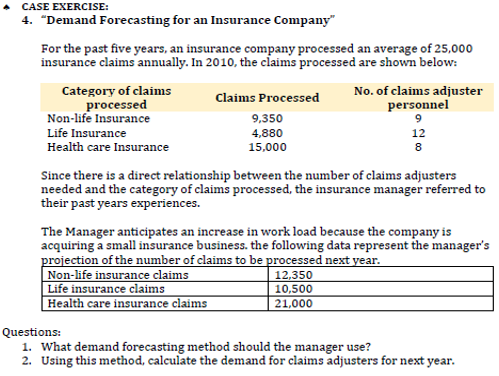

CASE EXERCISE: 4. "Demand Forecasting for an Insurance Company" For the past five years, an insurance company processed an average of 25,000 insurance claims annually. In 2010, the claims processed are shown below: Category of claims No. of claims adjuster personnel Claims Processed processed Non-life Insurance 9,350 9 4,880 15,000 Life Insurance 12 Health care Insurance Since there is a direct relationship between the number of claims adjusters needed and the category of claims processed, the insurance manager referred to their past years experiences. The Manager anticipates an increase in work load because the company is acquiring a small insurance business. the following data represent the manager's projection of the number of claims to be processed next year. Non-life insurance claims Life insurance claims | Health care insurance claims 12,350 10,500 21,000 Questions: 1. What demand forecasting method should the manager use? 2. Using this method, calculate the demand for claims adjusters for next year.

CASE EXERCISE: 4. "Demand Forecasting for an Insurance Company" For the past five years, an insurance company processed an average of 25,000 insurance claims annually. In 2010, the claims processed are shown below: Category of claims No. of claims adjuster personnel Claims Processed processed Non-life Insurance 9,350 9 4,880 15,000 Life Insurance 12 Health care Insurance Since there is a direct relationship between the number of claims adjusters needed and the category of claims processed, the insurance manager referred to their past years experiences. The Manager anticipates an increase in work load because the company is acquiring a small insurance business. the following data represent the manager's projection of the number of claims to be processed next year. Non-life insurance claims Life insurance claims | Health care insurance claims 12,350 10,500 21,000 Questions: 1. What demand forecasting method should the manager use? 2. Using this method, calculate the demand for claims adjusters for next year.

Purchasing and Supply Chain Management

6th Edition

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

ChapterC: Cases

Section: Chapter Questions

Problem 5.3SD: Scenario 4 Sharon Gillespie, a new buyer at Visionex, Inc., was reviewing quotations for a tooling...

Related questions

Question

Transcribed Image Text:CASE EXERCISE:

4. "Demand Forecasting for an Insurance Company"

For the past five years, an insurance company processed an average of 25,000

insurance claims annually. In 2010, the claims processed are shown below:

Category of claims

processed

Non-life Insurance

No. of claims adjuster

personnel

9

Claims Processed

9,350

Life Insurance

4,880

12

Health care Insurance

15,000

8

Since there is a direct relationship between the number of claims adjusters

needed and the category of claims processed, the insurance manager referred to

their past years experiences.

The Manager anticipates an increase in work load because the company is

acquiring a small insurance business. the following data represent the manager's

projection of the number of claims to be processed next year.

Non-life insurance claims

Life insurance claims

Health care insurance claims

12,350

10,500

21,000

Questions:

1. What demand forecasting method should the manager use?

2. Using this method, calculate the demand for claims adjusters for next year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Recommended textbooks for you

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Management, Loose-Leaf Version

Management

ISBN:

9781305969308

Author:

Richard L. Daft

Publisher:

South-Western College Pub

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Management, Loose-Leaf Version

Management

ISBN:

9781305969308

Author:

Richard L. Daft

Publisher:

South-Western College Pub