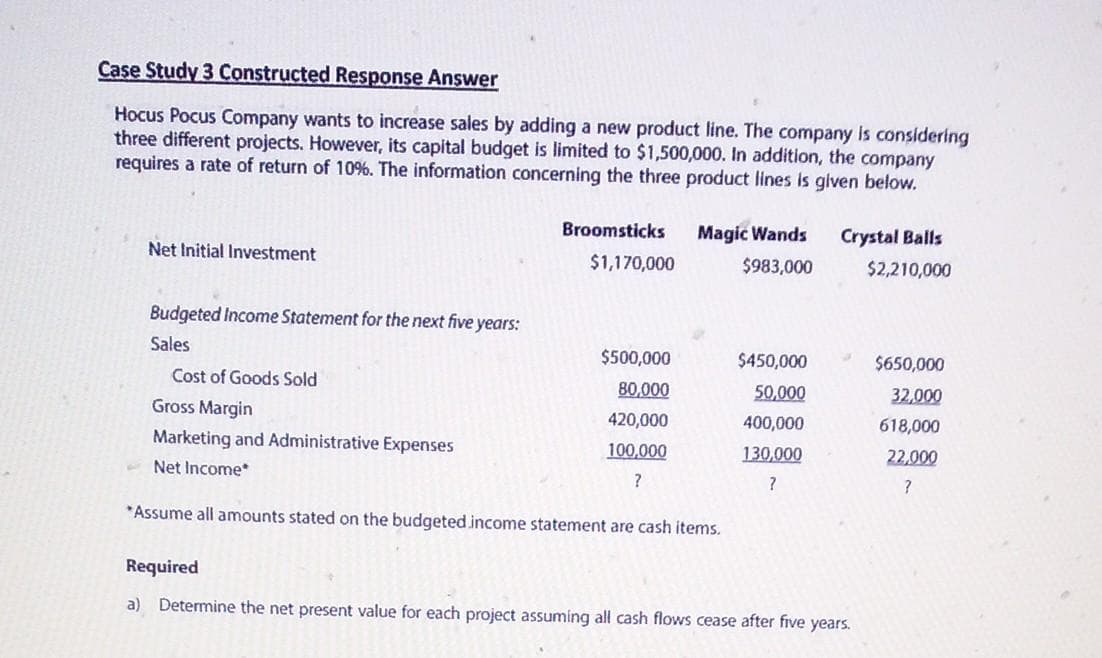

Case Study 3 Constructed Response Answer Hocus Pocus Company wants to increase sales by adding a new product line. The company is considering three different projects. However, its capital budget is limited to $1,500,000. In addition, the company requires a rate of return of 10%. The information concerning the three product lines is given below. Net Initial Investment Budgeted Income Statement for the next five years: Sales Cost of Goods Sold Gross Margin Marketing and Administrative Expenses Net Income Broomsticks $1,170,000 $500,000 80,000 420,000 100,000 ? Magic Wands $983,000 *Assume all amounts stated on the budgeted income statement are cash items. $450,000 50,000 400,000 130,000 ? Crystal Balls $2,210,000 Required a) Determine the net present value for each project assuming all cash flows cease after five years. $650,000 32,000 618,000 22,000 ?

Case Study 3 Constructed Response Answer Hocus Pocus Company wants to increase sales by adding a new product line. The company is considering three different projects. However, its capital budget is limited to $1,500,000. In addition, the company requires a rate of return of 10%. The information concerning the three product lines is given below. Net Initial Investment Budgeted Income Statement for the next five years: Sales Cost of Goods Sold Gross Margin Marketing and Administrative Expenses Net Income Broomsticks $1,170,000 $500,000 80,000 420,000 100,000 ? Magic Wands $983,000 *Assume all amounts stated on the budgeted income statement are cash items. $450,000 50,000 400,000 130,000 ? Crystal Balls $2,210,000 Required a) Determine the net present value for each project assuming all cash flows cease after five years. $650,000 32,000 618,000 22,000 ?

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 3E: Average rate of returnnew product Hana Inc. is considering an investment in new equipment that will...

Related questions

Question

Transcribed Image Text:Case Study 3 Constructed Response Answer

Hocus Pocus Company wants to increase sales by adding a new product line. The company is considering

three different projects. However, its capital budget is limited to $1,500,000. In addition, the company

requires a rate of return of 10%. The information concerning the three product lines is given below.

Net Initial Investment

Budgeted Income Statement for the next five years:

Sales

Cost of Goods Sold

Gross Margin

Marketing and Administrative Expenses

Net Income*

Broomsticks

$1,170,000

$500,000

80,000

420,000

100,000

?

Magic Wands

$983,000

*Assume all amounts stated on the budgeted income statement are cash items.

$450,000

50,000

400,000

130,000

?

Crystal Balls

$2,210,000

Required

a) Determine the net present value for each project assuming all cash flows cease after five years.

$650,000

32,000

618,000

22,000

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning