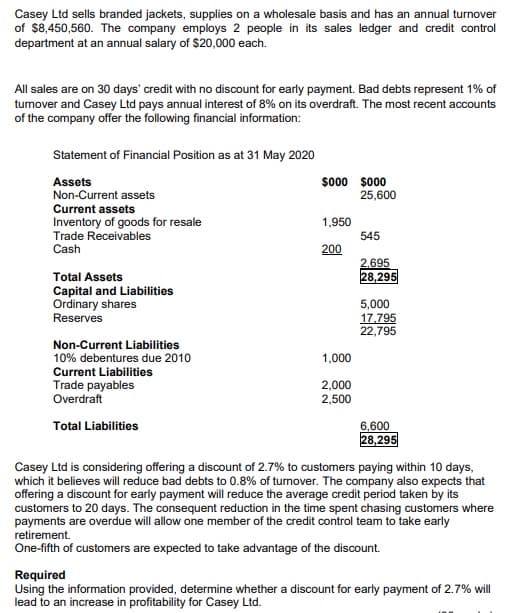

Casey Ltd sells branded jackets, supplies on a wholesale basis and has an annual turnover of $8,450,560. The company employs 2 people in its sales ledger and credit control department at an annual salary of $20,000 each. All sales are on 30 days' credit with no discount for early payment. Bad debts represent 1% of tumover and Casey Ltd pays annual interest of 8% on its overdraft. The most recent accounts of the company offer the following financial information: Statement of Financial Position as at 31 May 2020 so00 so0 25,600 Assets Non-Current assets Current assets Inventory of goods for resale Trade Receivables Cash 1,950 545 200 2.695 28,295 Total Assets Capital and Liabilities Ordinary shares Reserves 5,000 17.795 22,795 Non-Current Liabilities 10% debentures due 2010 1,000 Current Liabilities Trade payables Overdraft 2,000 2,500 Total Liabilities 6.600 28,295 Casey Ltd is considering offering a discount of 2.7% to customers paying within 10 days, which it believes will reduce bad debts to 0.8% of turnover. The company also expects that offering a discount for early payment will reduce the average credit period taken by its customers to 20 days. The consequent reduction in the time spent chasing customers where payments are overdue will allow one member of the credit control team to take early retirement. One-fifth of customers are expected to take advantage of the discount. Required Using the information provided, determine whether a discount for early payment of 2.7% will lead to an increase in profitability for Casey Ltd.

Casey Ltd sells branded jackets, supplies on a wholesale basis and has an annual turnover of $8,450,560. The company employs 2 people in its sales ledger and credit control department at an annual salary of $20,000 each. All sales are on 30 days' credit with no discount for early payment. Bad debts represent 1% of tumover and Casey Ltd pays annual interest of 8% on its overdraft. The most recent accounts of the company offer the following financial information: Statement of Financial Position as at 31 May 2020 so00 so0 25,600 Assets Non-Current assets Current assets Inventory of goods for resale Trade Receivables Cash 1,950 545 200 2.695 28,295 Total Assets Capital and Liabilities Ordinary shares Reserves 5,000 17.795 22,795 Non-Current Liabilities 10% debentures due 2010 1,000 Current Liabilities Trade payables Overdraft 2,000 2,500 Total Liabilities 6.600 28,295 Casey Ltd is considering offering a discount of 2.7% to customers paying within 10 days, which it believes will reduce bad debts to 0.8% of turnover. The company also expects that offering a discount for early payment will reduce the average credit period taken by its customers to 20 days. The consequent reduction in the time spent chasing customers where payments are overdue will allow one member of the credit control team to take early retirement. One-fifth of customers are expected to take advantage of the discount. Required Using the information provided, determine whether a discount for early payment of 2.7% will lead to an increase in profitability for Casey Ltd.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter21: Supply Chains And Working Capital Management

Section: Chapter Questions

Problem 6P

Related questions

Question

100%

Transcribed Image Text:Casey Ltd sells branded jackets, supplies on a wholesale basis and has an annual turnover

of $8,450,560. The company employs 2 people in its sales ledger and credit control

department at an annual salary of $20,000 each.

All sales are on 30 days' credit with no discount for early payment. Bad debts represent 1% of

turnover and Casey Ltd pays annual interest of 8% on its overdraft. The most recent accounts

of the company offer the following financial information:

Statement of Financial Position as at 31 May 2020

Assets

Non-Current assets

$000 $000

25,600

Current assets

Inventory of goods for resale

Trade Receivables

1,950

545

Cash

200

2.695

28,295

Total Assets

Capital and Liabilities

Ordinary shares

Reserves

5,000

17.795

22,795

Non-Current Liabilities

10% debentures due 2010

1,000

Current Liabilities

Trade payables

Overdraft

2,000

2,500

Total Liabilities

6,600

28,295

Casey Ltd is considering offering a discount of 2.7% to customers paying within 10 days,

which it believes will reduce bad debts to 0.8% of turnover. The company also expects that

offering a discount for early payment will reduce the average credit period taken by its

customers to 20 days. The consequent reduction in the time spent chasing customers where

payments are overdue will allow one member of the credit control team to take early

retirement.

On-fifth of customers are expected to take advantage of the discount.

Required

Using the information provided, determine whether a discount for early payment of 2.7% will

lead to an increase in profitability for Casey Ltd.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT