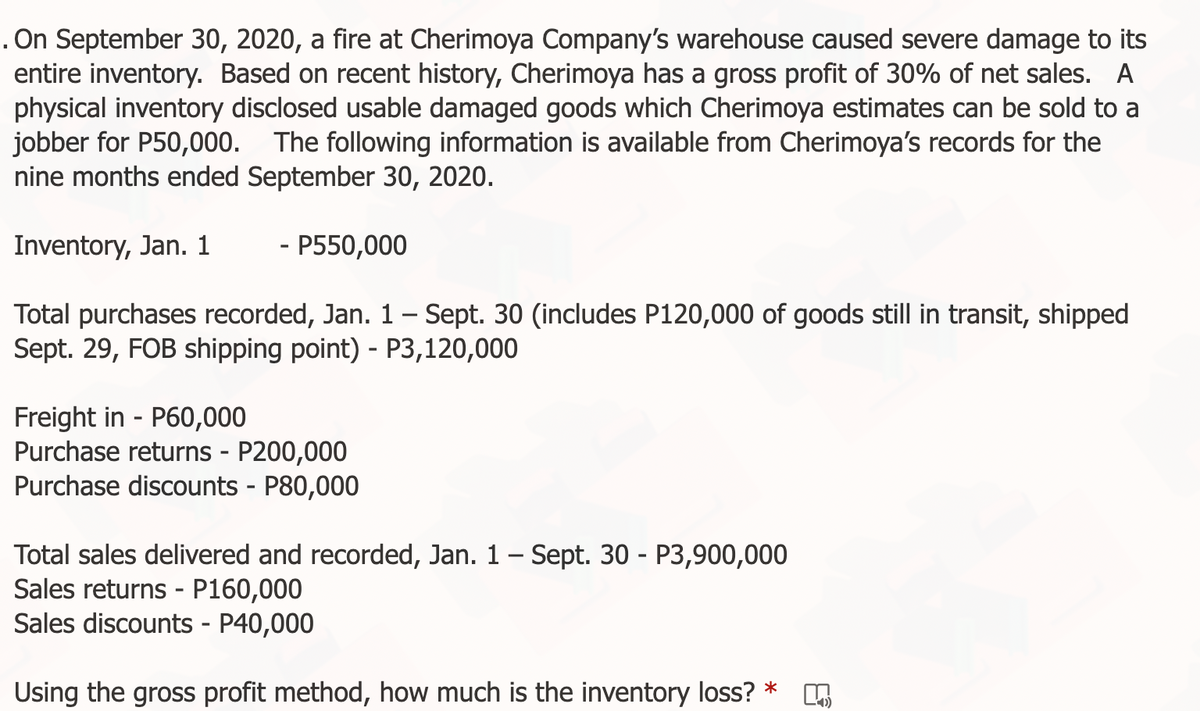

On September 30, 2020, a fire at Cherimoya Company's warehouse caused severe damage to its entire inventory. Based on recent history, Cherimoya has a gross profit of 30% of net sales. A physical inventory disclosed usable damaged goods which Cherimoya estimates can be sold to a jobber for P50,000. The following information is available from Cherimoya's records for the nine months ended September 30, 2020. Inventory, Jan. 1 - P550,000 Total purchases recorded, Jan. 1– Sept. 30 (includes P120,000 of goods still in transit, shipped Sept. 29, FOB shipping point) - P3,120,000 Freight in - P60,000 Purchase returns - P200,000 Purchase discounts - P80,000 Total sales delivered and recorded, Jan. 1- Sept. 30 - P3,900,000 Sales returns - P160,000 Sales discounts - P40,000 Using the gross profit method, how much is the inventory loss? *

On September 30, 2020, a fire at Cherimoya Company's warehouse caused severe damage to its entire inventory. Based on recent history, Cherimoya has a gross profit of 30% of net sales. A physical inventory disclosed usable damaged goods which Cherimoya estimates can be sold to a jobber for P50,000. The following information is available from Cherimoya's records for the nine months ended September 30, 2020. Inventory, Jan. 1 - P550,000 Total purchases recorded, Jan. 1– Sept. 30 (includes P120,000 of goods still in transit, shipped Sept. 29, FOB shipping point) - P3,120,000 Freight in - P60,000 Purchase returns - P200,000 Purchase discounts - P80,000 Total sales delivered and recorded, Jan. 1- Sept. 30 - P3,900,000 Sales returns - P160,000 Sales discounts - P40,000 Using the gross profit method, how much is the inventory loss? *

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 2MC: Moore Company uses the LIFO cost flow assumption and carries Product A in inventory on December 31,...

Related questions

Topic Video

Question

Transcribed Image Text:. On September 30, 2020, a fire at Cherimoya Company's warehouse caused severe damage to its

entire inventory. Based on recent history, Cherimoya has a gross profit of 30% of net sales. A

physical inventory disclosed usable damaged goods which Cherimoya estimates can be sold to a

jobber for P50,000. The following information is available from Cherimoya's records for the

nine months ended September 30, 2020.

Inventory, Jan. 1

- P550,000

Total purchases recorded, Jan. 1 – Sept. 30 (includes P120,000 of goods still in transit, shipped

Sept. 29, FOB shipping point) - P3,120,000

-

Freight in - P60,000

Purchase returns - P200,000

Purchase discounts - P80,000

Total sales delivered and recorded, Jan. 1 - Sept. 30 - P3,900,000

Sales returns - P160,000

Sales discounts - P40,000

Using the gross profit method, how much is the inventory loss? *

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning