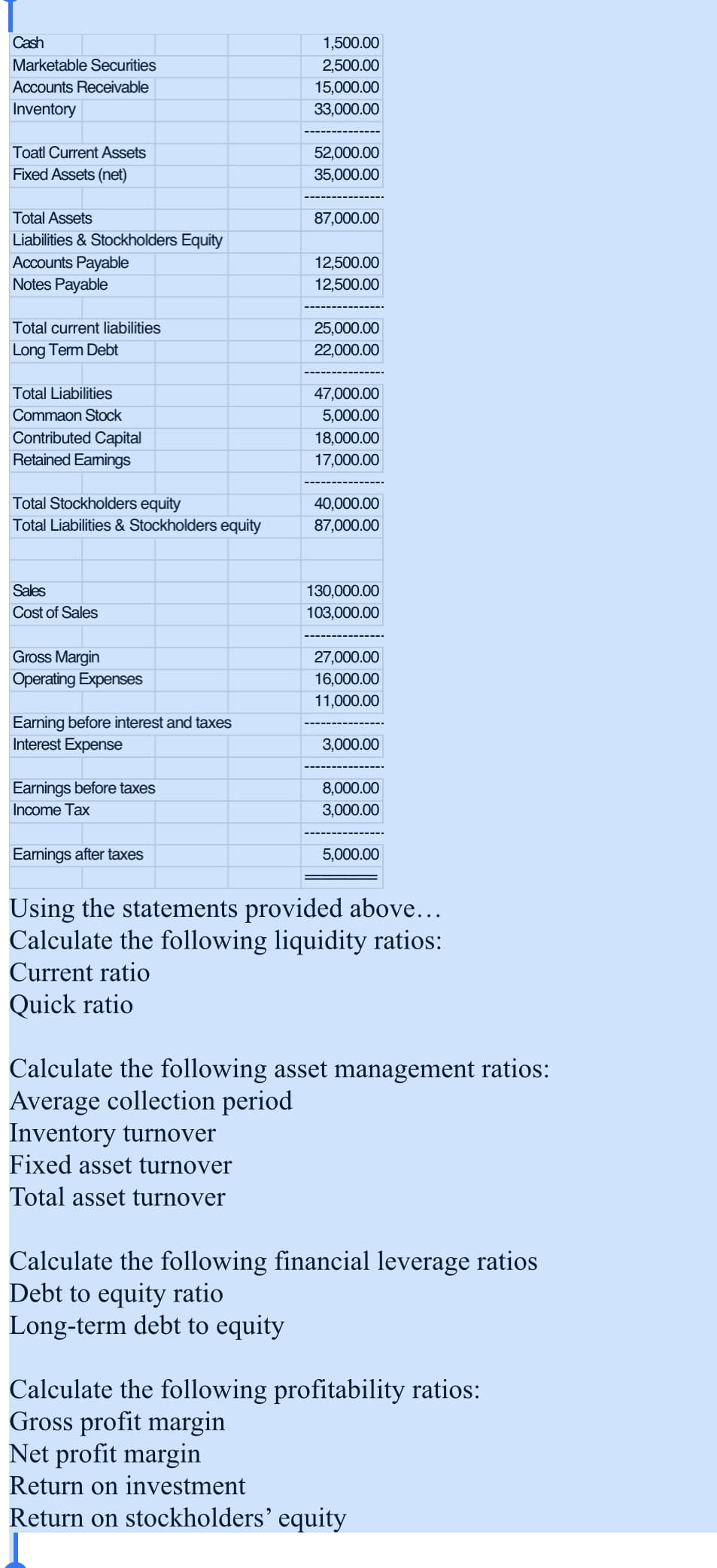

Cash 1,500.00 Marketable Securities 2,500.00 Accounts Receivable 15,000.00 Inventory 33,000.00 Toatl Current Assets 52,000.00 Fixed Assets (net) 35,000.00 Total Assets 87,000.00 Liabilities & Stockholders Equity Accounts Payable Notes Payable 12,500.00 12,500.00 Total current liabilities 25,000.00 Long Term Debt 22,000.00 Total Liabilities 47,000.00 Commaon Stock 5,000.00 Contributed Capital Retained Eamings 18,000.00 17,000.00 Total Stockholders equity Total Liabilities & Stockholders equity 40,000.00 87,000.00 Sales 130,000.00 Cost of Sales 103,000.00 Gross Margin 27,000.00 Operating Expenses 16,000.00 11,000.00 Earning before interest and taxes Interest Expense 3,000.00 Earnings before taxes Income Tax 8,000.00 3,000.00 Eamings after taxes 5,000.00 Using the statements provided above... Calculate the following liquidity ratios: Current ratio Quick ratio Calculate the following asset management ratios: Average collection period Inventory turnover Fixed asset turnover Total asset turnover Calculate the following financial leverage ratios Debt to equity ratio Long-term debt to equity Calculate the following profitability ratios: Gross profit margin Net profit margin Return on investment Return on stockholders’ equity

Using the statements provided

Calculate the following

Quick ratio

Calculate the following asset management ratios:

Average collection period

Inventory turnover

Fixed asset turnover

Total asset turnover

Calculate the following financial leverage ratios

Debt to equity ratio

Long-term debt to equity

Calculate the following profitability ratios:

Gross profit margin

Net profit margin

Return on assets

Return on

For example: you should present it like the text, or as:Gross margin = 1,933 divided by 8,689 = 22.2%

A competitor of ACME has for the same time period reported the following three ratios:

Current ratio 1.52

Long-term debt to equity .25 or 25%

Net profit margin .08 or 8%

Given these three ratios only which company is performing better on each ratio? Also overall who would you say has the best financial performance and position. Support your answer.

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps with 12 images