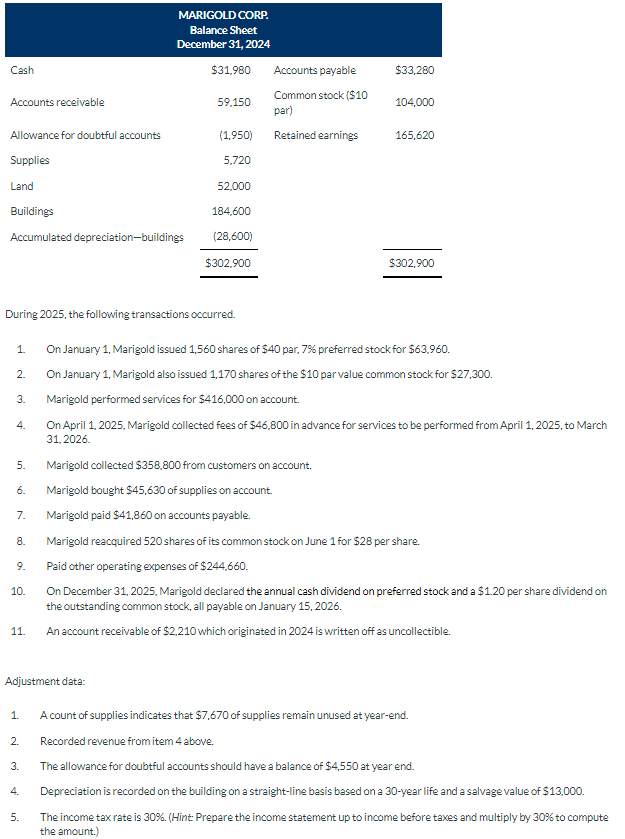

Cash Accounts receivable Allowance for doubtful accounts Supplies Land Buildings Accumulated depreciation-buildings 1. 2. 3. During 2025, the following transactions occurred. 4. 5. 6. 7. 8. 9. 10. 11. 1. 2. MARIGOLD CORP. Balance Sheet December 31, 2024 $31,980 Adjustment data: 3. 4. 5. 59,150 (1,950) 5.720 52,000 184,600 (28,600) $302,900 Accounts payable Common stock ($10 par) Retained earnings Marigold collected $358,800 from customers on account. Marigold bought $45,630 of supplies on account. Marigold paid $41,860 on accounts payable. $33,280 104,000 165,620 On January 1, Marigold issued 1,560 shares of $40 par, 7% preferred stock for $63,960. On January 1, Marigold also issued 1,170 shares of the $10 par value common stock for $27,300. Marigold performed services for $416,000 on account. On April 1, 2025, Marigold collected fees of $46,800 in advance for services to be performed from April 1, 2025, to March 31, 2026. $302,900 Marigold reacquired 520 shares of its common stock on June 1 for $28 per share. Paid other operating expenses of $244,660. On December 31, 2025, Marigold declared the annual cash dividend on preferred stock and a $1.20 per share dividend on the outstanding common stock, all payable on January 15, 2026. An account receivable of $2,210 which originated in 2024 is written off as uncollectible. A count of supplies indicates that $7,670 of supplies remain unused at year-end. Recorded revenue from item 4 above. The allowance for doubtful accounts should have a balance of $4,550 at year end. Depreciation is recorded on the building on a straight-line basis based on a 30-year life and a salvage value of $13,000. The income tax rate is 30%. (Hint: Prepare the income statement up to income before taxes and multiply by 30% to compute the amount.)

Cash Accounts receivable Allowance for doubtful accounts Supplies Land Buildings Accumulated depreciation-buildings 1. 2. 3. During 2025, the following transactions occurred. 4. 5. 6. 7. 8. 9. 10. 11. 1. 2. MARIGOLD CORP. Balance Sheet December 31, 2024 $31,980 Adjustment data: 3. 4. 5. 59,150 (1,950) 5.720 52,000 184,600 (28,600) $302,900 Accounts payable Common stock ($10 par) Retained earnings Marigold collected $358,800 from customers on account. Marigold bought $45,630 of supplies on account. Marigold paid $41,860 on accounts payable. $33,280 104,000 165,620 On January 1, Marigold issued 1,560 shares of $40 par, 7% preferred stock for $63,960. On January 1, Marigold also issued 1,170 shares of the $10 par value common stock for $27,300. Marigold performed services for $416,000 on account. On April 1, 2025, Marigold collected fees of $46,800 in advance for services to be performed from April 1, 2025, to March 31, 2026. $302,900 Marigold reacquired 520 shares of its common stock on June 1 for $28 per share. Paid other operating expenses of $244,660. On December 31, 2025, Marigold declared the annual cash dividend on preferred stock and a $1.20 per share dividend on the outstanding common stock, all payable on January 15, 2026. An account receivable of $2,210 which originated in 2024 is written off as uncollectible. A count of supplies indicates that $7,670 of supplies remain unused at year-end. Recorded revenue from item 4 above. The allowance for doubtful accounts should have a balance of $4,550 at year end. Depreciation is recorded on the building on a straight-line basis based on a 30-year life and a salvage value of $13,000. The income tax rate is 30%. (Hint: Prepare the income statement up to income before taxes and multiply by 30% to compute the amount.)

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter10: Forecasting Financial Statement

Section: Chapter Questions

Problem 15PC

Related questions

Question

Prepare an adjusted trail balance for dec 31 2025

Transcribed Image Text:Cash

Accounts receivable

Allowance for doubtful accounts

Supplies

Land

Buildings

Accumulated depreciation-buildings

1.

2.

3.

4.

5.

During 2025, the following transactions occurred.

6.

7.

8.

9.

10.

11.

1.

2.

MARIGOLD CORP.

Balance Sheet

December 31, 2024

$31,980

Adjustment data:

3.

4.

5.

59,150

(1,950)

5,720

52,000

184,600

(28,600)

$302,900

Accounts payable

Common stock ($10

par)

Retained earnings

$33,280

104,000

165,620

$302,900

On January 1, Marigold issued 1,560 shares of $40 par, 7% preferred stock for $63,960.

On January 1, Marigold also issued 1,170 shares of the $10 par value common stock for $27,300.

Marigold performed services for $416,000 on account.

On April 1, 2025, Marigold collected fees of $46,800 in advance for services to be performed from April 1, 2025, to March

31, 2026.

Marigold collected $358,800 from customers on account.

Marigold bought $45,630 of supplies on account.

Marigold paid $41,860 on accounts payable.

Marigold reacquired 520 shares of its common stock on June 1 for $28 per share.

Paid other operating expenses of $244,660.

On December 31, 2025, Marigold declared the annual cash dividend on preferred stock and a $1.20 per share dividend on

the outstanding common stock, all payable on January 15, 2026.

An account receivable of $2,210 which originated in 2024 is written off as uncollectible.

A count of supplies indicates that $7,670 of supplies remain unused at year-end.

Recorded revenue from item 4 above.

The allowance for doubtful accounts should have a balance of $4,550 at year end.

Depreciation is recorded on the building on a straight-line basis based on a 30-year life and a salvage value of $13,000.

The income tax rate is 30%. (Hint: Prepare the income statement up to income before taxes and multiply by 30% to compute

the amount.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning