Cash Accounts receivable Inventories Total current assets Net fixed assets Total assets X Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Total common equity Total liabilities and equity 2021 $103,013 103,108 37,155 $243,276 66,107 $309,383 $ 30,823 30,366 15,132 $76,321 76,643 $152,964 95,000 61,419 $156,419 $309,383 2020 $ 89,685 85,708 33,809 $209,202 41,616 $250,818 $ 22,190 21,920 12,782 $ 56,892 63,593 $120,485 85,000 45,333 $130,333 $250,818 The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Enter your answers in thousands. For example, an answer of $1 thousand should be entered as 1, not 1,000. Round your answers to the nearest whole number. Use a minus sign to enter negative values, if any.

Cash Accounts receivable Inventories Total current assets Net fixed assets Total assets X Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Total common equity Total liabilities and equity 2021 $103,013 103,108 37,155 $243,276 66,107 $309,383 $ 30,823 30,366 15,132 $76,321 76,643 $152,964 95,000 61,419 $156,419 $309,383 2020 $ 89,685 85,708 33,809 $209,202 41,616 $250,818 $ 22,190 21,920 12,782 $ 56,892 63,593 $120,485 85,000 45,333 $130,333 $250,818 The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Enter your answers in thousands. For example, an answer of $1 thousand should be entered as 1, not 1,000. Round your answers to the nearest whole number. Use a minus sign to enter negative values, if any.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.17E: Profitability metrics The following selected data were taken from the financial statements of The...

Related questions

Topic Video

Question

Transcribed Image Text:bmit

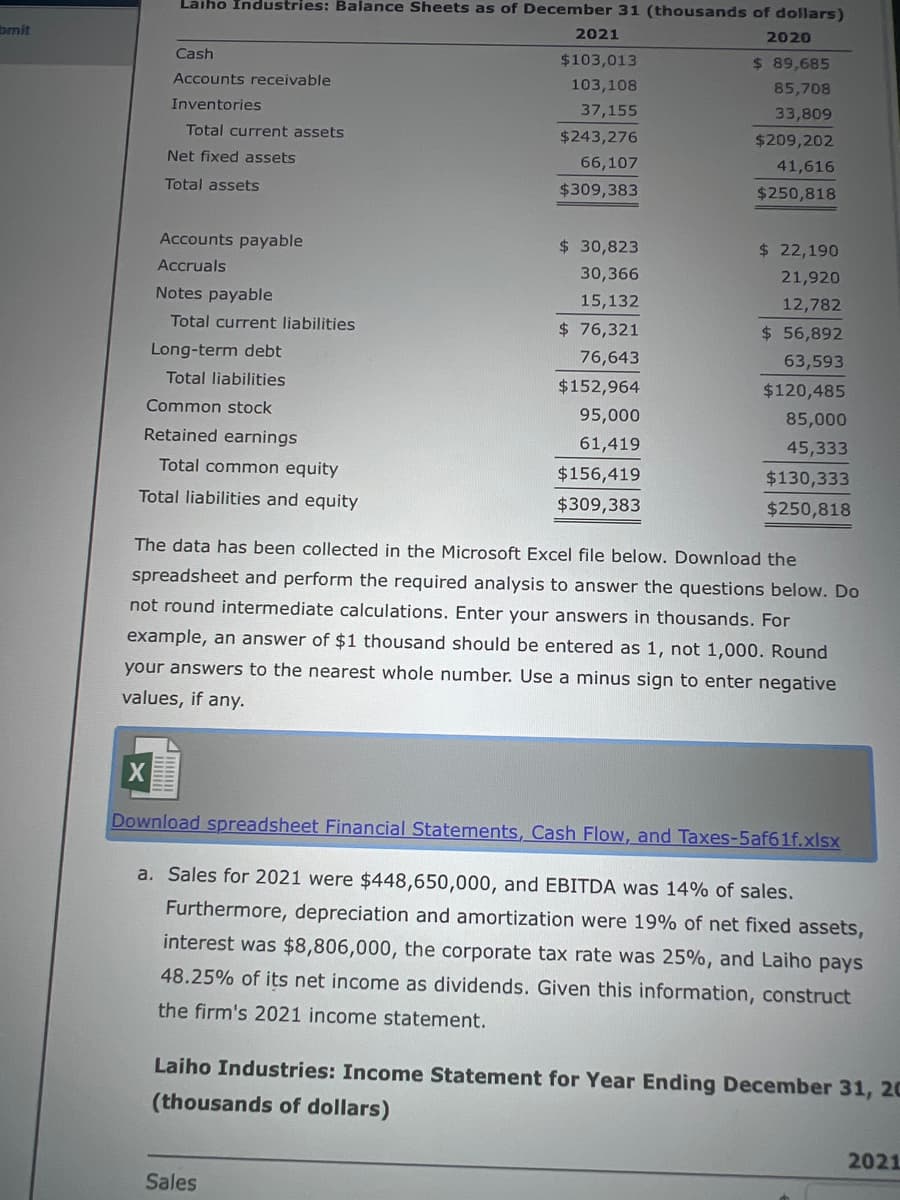

Laiho Industries: Balance Sheets as of December 31 (thousands of dollars)

Cash

Accounts receivable

Inventories

Total current assets

Net fixed assets

Total assets

Accounts payable

Accruals

Notes payable

Total current liabilities

Long-term debt

Total liabilities

Common stock

Retained earnings

Total common equity

Total liabilities and equity

2021

$103,013

103,108

37,155

$243,276

66,107

$309,383

$ 30,823

30,366

15,132

$ 76,321

76,643

$152,964

95,000

61,419

$156,419

$309,383

2020

Sales

$ 89,685

85,708

33,809

$209,202

41,616

$250,818

$ 22,190

21,920

12,782

$56,892

63,593

$120,485

85,000

45,333

$130,333

$250,818

The data has been collected in the Microsoft Excel file below. Download the

spreadsheet and perform the required analysis to answer the questions below. Do

not round intermediate calculations. Enter your answers in thousands. For

example, an answer of $1 thousand should be entered as 1, not 1,000. Round

your answers to the nearest whole number. Use a minus sign to enter negative

values, if any.

Download spreadsheet Financial Statements, Cash Flow, and Taxes-5af61f.xlsx

a. Sales for 2021 were $448,650,000, and EBITDA was 14% of sales.

Furthermore, depreciation and amortization were 19% of net fixed assets,

interest was $8,806,000, the corporate tax rate was 25%, and Laiho pays

48.25% of its net income as dividends. Given this information, construct

the firm's 2021 income statement.

Laiho Industries: Income Statement for Year Ending December 31, 20

(thousands of dollars)

2021

Transcribed Image Text:and Laino pays

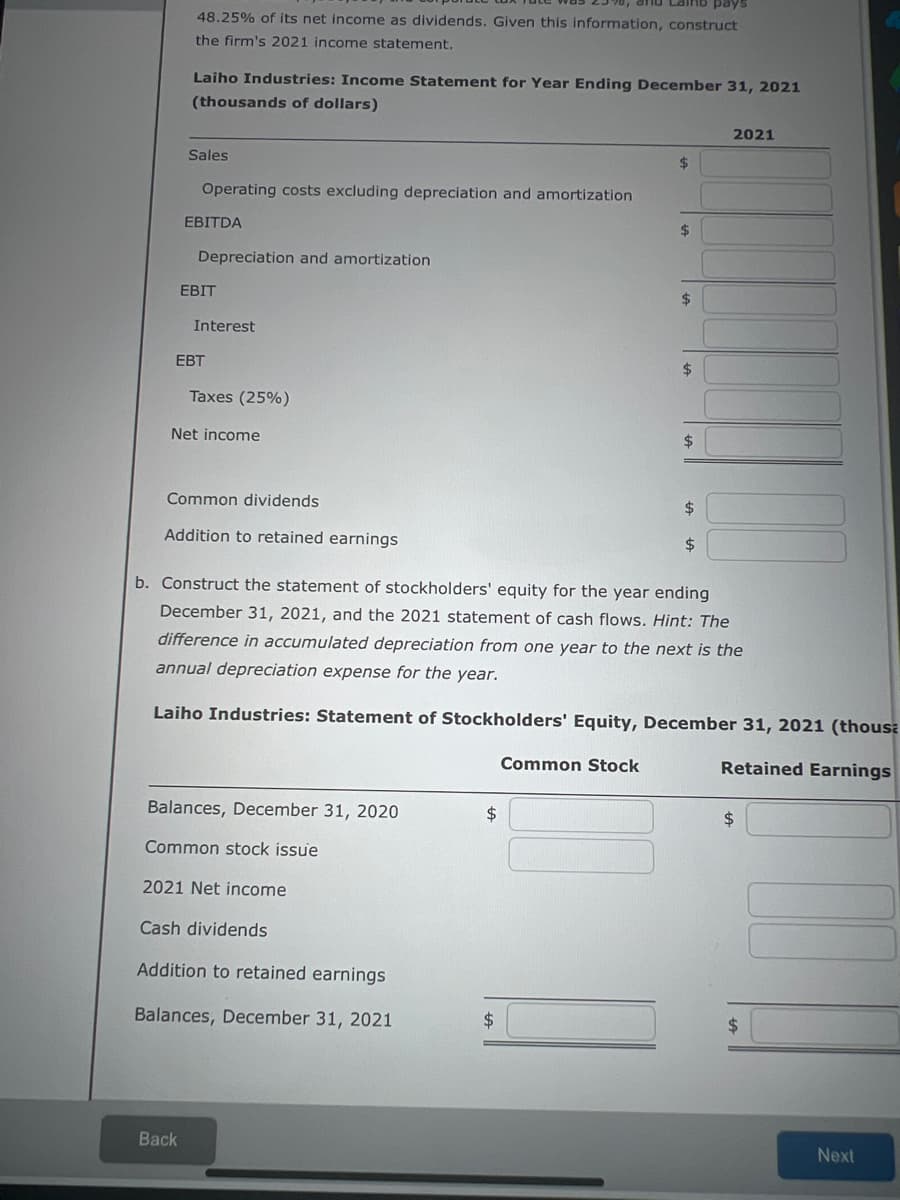

48.25% of its net income as dividends. Given this information, construct

the firm's 2021 income statement.

Laiho Industries: Income Statement for Year Ending December 31, 2021

(thousands of dollars)

Sales

Operating costs excluding depreciation and amortization

EBITDA

Depreciation and amortization

Back

EBIT

Interest

EBT

Taxes (25%)

Net income

Common dividends

Addition to retained earnings

Balances, December 31, 2020

Common stock issue

2021 Net income

Cash dividends

Addition to retained earnings

Balances, December 31, 2021

$

$

$

$

$

b. Construct the statement of stockholders' equity for the year ending

December 31, 2021, and the 2021 statement of cash flows. Hint: The

difference in accumulated depreciation from one year to the next is the

annual depreciation expense for the year.

Laiho Industries: Statement of Stockholders' Equity, December 31, 2021 (thousa

Common Stock

Retained Earnings

$

$

$

$

2021

$

$

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning