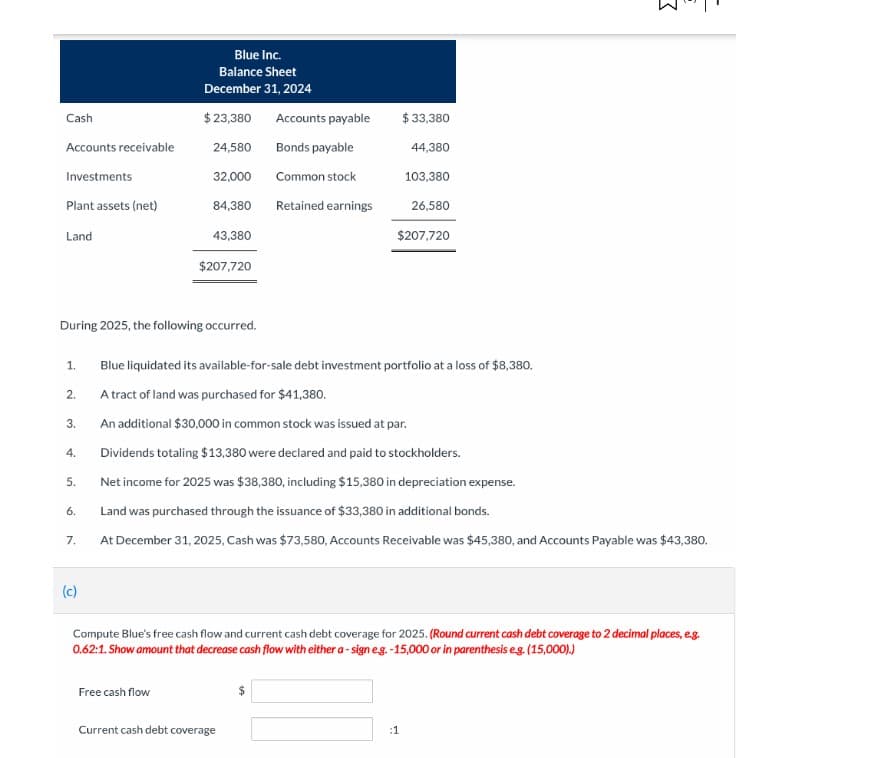

Cash Accounts receivable Investments Plant assets (net) Land 1. 2. During 2025, the following occurred. 3. 4. 5. 6. 7. Blue Inc. Balance Sheet December 31, 2024 $23,380 Accounts payable 24,580 Bonds payable 32,000 Common stock 84,380 Retained earnings (c) 43,380 $207,720 $ 33,380 44,380 103,380 26,580 $207,720 Blue liquidated its available-for-sale debt investment portfolio at a loss of $8,380. A tract of land was purchased for $41,380. An additional $30,000 in common stock was issued at par. Dividends totaling $13,380 were declared and paid to stockholders. Net income for 2025 was $38,380, including $15,380 in depreciation expense. Land was purchased through the issuance of $33,380 in additional bonds. At December 31, 2025, Cash was $73,580, Accounts Receivable was $45,380, and Accounts Payable was $43,380. Compute Blue's free cash flow and current cash debt coverage for 2025. (Round current cash debt coverage to 2 decimal places, e.g. 0.62:1. Show amount that decrease cash flow with either a-sign e.g.-15,000 or in parenthesis eg. (15,000).)

Cash Accounts receivable Investments Plant assets (net) Land 1. 2. During 2025, the following occurred. 3. 4. 5. 6. 7. Blue Inc. Balance Sheet December 31, 2024 $23,380 Accounts payable 24,580 Bonds payable 32,000 Common stock 84,380 Retained earnings (c) 43,380 $207,720 $ 33,380 44,380 103,380 26,580 $207,720 Blue liquidated its available-for-sale debt investment portfolio at a loss of $8,380. A tract of land was purchased for $41,380. An additional $30,000 in common stock was issued at par. Dividends totaling $13,380 were declared and paid to stockholders. Net income for 2025 was $38,380, including $15,380 in depreciation expense. Land was purchased through the issuance of $33,380 in additional bonds. At December 31, 2025, Cash was $73,580, Accounts Receivable was $45,380, and Accounts Payable was $43,380. Compute Blue's free cash flow and current cash debt coverage for 2025. (Round current cash debt coverage to 2 decimal places, e.g. 0.62:1. Show amount that decrease cash flow with either a-sign e.g.-15,000 or in parenthesis eg. (15,000).)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 32BE

Related questions

Question

Transcribed Image Text:Cash

Accounts receivable

Investments

Plant assets (net)

Land

During 2025, the following occurred.

1.

2.

3.

4.

5.

6.

7.

(c)

Blue Inc.

Balance Sheet

December 31, 2024

$23,380 Accounts payable

24,580 Bonds payable

32,000

Common stock

84,380

Retained earnings

43,380

$207,720

Free cash flow

$33,380

44,380

103,380

26,580

$207,720

Blue liquidated its available-for-sale debt investment portfolio at a loss of $8,380.

A tract of land was purchased for $41,380.

An additional $30,000 in common stock was issued at par.

Dividends totaling $13,380 were declared and paid to stockholders.

Net income for 2025 was $38,380, including $15,380 in depreciation expense.

Land was purchased through the issuance of $33,380 in additional bonds.

At December 31, 2025, Cash was $73,580, Accounts Receivable was $45,380, and Accounts Payable was $43,380.

Compute Blue's free cash flow and current cash debt coverage for 2025. (Round current cash debt coverage to 2 decimal places, e.g.

0.62:1. Show amount that decrease cash flow with either a-sign e.g.-15,000 or in parenthesis e.g. (15,000).)

Current cash debt coverage

3

:1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning