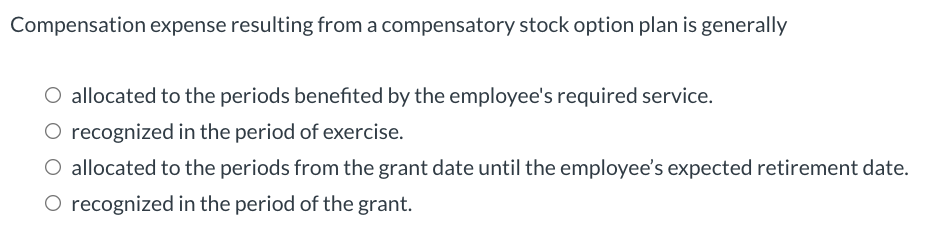

Compensation expense resulting from a compensatory stock option plan is generally O allocated to the periods benefited by the employee's required service. O recognized in the period of exercise. O allocated to the periods from the grant date until the employee's expected retirement date

Q: Exercise 11-2 (Algorithmic) (LO. 2) Mio was transferred from New York to Germany. He lived and…

A: Foreign earned income exclusion limit means how much amount earned on account of foreign, country…

Q: Prepare an incremental analysis of Twilight Hospital. (In the first two columns, enter costs and…

A: The company has some assets to run the business, before buying the assets company should compare the…

Q: Required information [The following information applies to the questions displayed below.] Seiko's…

A: Answer:- Fringe benefit:- Fringe benefits are extra perks provided to the employees over and above…

Q: With regard to the irrevocable trust, how much is included in Gene's gross estate?

A: The value of the irrevocable trust at the time of Gene's death would be included in his gross estate…

Q: Quilcene Oysteria farms and sells oysters in the Pacific Northwest. The company harvested and sold…

A: Revenue and spending variance :— It is the difference between flexible budget and actual results.…

Q: Franklin Glass Works uses a standard cost system in which manufacturing overhead is applied to units…

A: calculation of fixed overhead applied to production are as follows. Fixed overhead are those which…

Q: On August 1, Handley Ltd. accepted a $25,200 note from Borges Ltd. in settlement of an account…

A: August 1: Accounts Receivable $25,200 To Notes Receivable $25,200 (Recording…

Q: Thermal Rising, Incorporated, makes paragliders for sale through specialty sporting goods stores.…

A: The total cost includes direct materials, direct labor and overhead costs. The customer margin is…

Q: Arthur Ltd acquires all the equity of Martha Ltd for a cash payment of $3 000 000 on 30 June 2025.…

A: To calculate the goodwill or bargain purchase on consolidation, we need to compare the fair value of…

Q: On December 31, 2019, Akron, Inc., purchased 5 percent of Zip Company's common shares on the open…

A: Equity method of Accounting: The equity technique is used to account for company investments. This…

Q: What are the criteria for classifying a lease as operating or capital? Why is there a difference…

A: A lease is a contract between a lessor (owner of an asset) and a lessee (user of the asset) that…

Q: On January 1, 2021, Tonge Industries had outstanding 760,000 common shares ($1 par) that originally…

A: Answer:- Formula:- Earnings per share = (Net income - Preferred dividends) / Weighted average of…

Q: For March 2024, The Jacksonville shirt company compiled the following data for the Cutting and…

A: The Jacksonville shirt company has two departments - The cutting and sewing department

Q: Tony is a MIB. Which of the following would not be a discreditable act that he should definitely…

A: A discreditable act is an action or behavior that brings shame, dishonor, or loss of reputation to…

Q: Sales ( $63 per unit) Cost of goods sold ($29 per unit) Gross margin Selling and administrative…

A: Absorption costing entails allocating fixed overhead costs to all units produced for an accounting…

Q: Daosta Inc. uses the FIFO method in its process costing system. The following data concern the…

A: The equivalent units are calculated on the basis of the percentage of the work completed during the…

Q: The information below relates to the operations of Khan Corporation for the year ended December 31,…

A: Single -step Income statement : The main purpose of financial accounting is to provide useful…

Q: Rowena is turning 65 in June 01, 2022. She wants to stop paying into CPP. As she gets paid twice a…

A: CPP stands for Canada Pension Plan, which is a government-run retirement savings program in Canada.…

Q: Given the trade prices for Jefferson Crab surrounding Eric's date of death, at what value will the…

A: To determine the value of the 1,000 shares of Jefferson Crab stock in Eric's gross estate, we need…

Q: There are some excellent free personal finance apps available: Mint.com, GoodBudget, Mvelopes,…

A: The notes can be long term or short-term. The notes are the debt instrument. The notes are accepted…

Q: Pacific Fishing Inc.'s actively traded non-strategic investments as of December 31, 2023, are as…

A: Under fair value adjustment we need to record investment at fair value. If there is any gain or loss…

Q: Regular Company produces audio equipment, specifically headphones and speakers. A new CEO has just…

A: Profit Margin: The difference between the entire revenue and the total operating expenses of your…

Q: direct labor-hour, respectively. The company's direct labor wage rate is $18.00 per hour. The…

A: Answer : Calculation of the total manufacturing cost of Job N - 60 : Particular Assembly Testing…

Q: Minden Company is a wholesale distributor of premium European chocolates. The company's balance…

A: Expected Cash Collection for May (Amounts in $) Particulars Amount Cash Sales…

Q: www.daveramsey.com’s Financial Peace University (FPU), Dave recommends Seven Baby Steps. One of…

A: Effective interest rate is interest rate after considering the impact of compounding on the interest…

Q: All but which of the following may not be seized to satisfy a debtor's financial obligations?…

A: In most jurisdictions, there are laws and regulations in place that dictate which types of property…

Q: ng 2024, Shereld constructed a small manufacturing fa

A: Asset retirement obligation = Estimated cost of remediation after 10 years * PVF(9% for 10 years)…

Q: The general ledger of Black Cloud Cleaners at January 1, 2024, includes the following account…

A: An adjusted trial balance lists the general ledger account balances after any adjustments have been…

Q: PREPARE a statement apportioning the costs of service departments over the production departments…

A: Meaning of step down cost allocation method In this method amount of service department are…

Q: Who among the following CPAs would be only a MIB, and not also a MIPP?

A: The auditor is responsible to certify that the financial statements prepared by…

Q: The research, based on 63 patients, showed the following regression results: R-squared: 56%…

A: According to the regression model, It's important to note that this is an estimate based on the…

Q: A company buys a piece of equipment for $50,000 with a salvage value of $5,000 and an estimated…

A: Depreciation :— It is the allocation of depreciable cost over the life of asset. Depreciation…

Q: Engberg Company installs lawn sod in home yards. The company's most recent monthly contribution…

A: Degree of operating leverage :— It is calculated by dividing contribution margin by net operating…

Q: Great American Oilchange (GAO) sells a combined oil change service and parts package for $40. A…

A: Journal entries are the primary reporting of the business transactions in the books of accounts.…

Q: Edlie Accessories (EA) makes travel bags, both for sale under their own label ("Branded") and for…

A: INFORMATION:- This question presents a scenario where Edlie Accessories (EA) manufactures travel…

Q: Johnson Brothers Co. has a non-contributory qualified profit sharing plan with 310 employees in…

A: To determine if the Johnson Brothers Co. plan meets the ratio percentage test and the average…

Q: For financial reporting. Clinton Poultry Farms has used the declining-balance method of depreciation…

A: The depreciation expense is charged on fixed assets as reduced value of the fixed asset with usage…

Q: COMPUTE FOR YOUR BASIC EARNING PER SHARE * BASIC EARNINGS PER SHARE Entity A had 50, 000, P15 PAR,…

A: Answer:- Formula:- BEPS = (Net income - Preferred dividends) / Weighted average of common shares…

Q: Tamarisk Corporation purchased a computer on December 31, 2024, for $138,600, paying $39,600 down…

A: Solution: Equipment value = cash paid + Installment * Cumulative PV of $1@ 9% for 5 Years =…

Q: ipany going ugh a Cash Receivables (25% collectible) Inventory (worth $34,850) apter Land (worth…

A:

Q: Fogerty Company makes two products-titanium Hubs and Sprockets. Data regarding the two pre Direct…

A: The overhead is applied to the production on the basis of pre-determined overhead rate. The units…

Q: 3. Which among these alternatives would you prefer, assuming the payout period is 10 years and your…

A: Present value of annuity is the current value of the future payments that are calculated using the…

Q: Boyne University offers an extensive continuing education program in many cities throughout the…

A: Spending variance :— It is the difference between actual cost and flexible cost. Flexible cost :—…

Q: For a recent year, McDonald's Company-owned restaurants had the following sales and expenses (in…

A: MARGINAL COSTING INCOME STATEMENT Marginal Costing Income Statement is One of the Important Cost…

Q: Required information Skip to question [The following information applies to the questions displayed…

A: Absorption costing is a method of accounting that includes all of the costs associated with…

Q: Q4) below are the actual statements of operating income for Microsoft & Proctor Gamble (In $$…

A: Variable costs are those costs which changes along with change in activity level. Contribution…

Q: Use the following information to prepare a multistep income statement and a balance sheet for…

A: Financial Statements Income statement is a financial statement its show a…

Q: The Sweetwater Candy Company would like to buy a new machine that would automatically dip…

A: Solution: Net Annual cash inflows = Annual savings in operating costs + Contribution margin from…

Q: steven Company has fixed costs of $137,862. The unit selling price, variable cost per unit, and…

A: Break-even point is the point where there is no profit or loss or in other words, we can say that…

Q: Finch Company is considering the replacement of some equipment and the potential replacement…

A: A replacement decision refers to a business decision where a company must decide whether to replace…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- A stock option plan may or may not be intended to compensate employees for their work. The compensation expense for compensatory stock option plans should be recognized in the periods the a. employees become eligible to exercise the options. b. employees perform services. c. stock is issued. d. options are granted.if there are no vesting conditions, the fair value of employee share options is recognized as expense and an increase in __________. A. equity over the vesting period B. liability at grant date C. equity at grant date D. liability over the vesting periodIf there is a vesting period, the fair value of employee share appreciation rights is recognized as expense and an increase in __________. liability over the vesting period equity at grant date equity over the vesting period liability at grant date

- An increase in OCI related to plan assets occurs when: Select one: a. The accumulated benefit obligation is more than expected. b. The vested benefit obligation is less than expected. c. Retiree benefits paid out are less than expected. d. The return on plan assets is higher than expected. e. The employer contributes an amount greater than it was liable to do.When a share-based payment transaction is with an employee and others providing similar services, the goods or services received are measured at thea. fair value of the equity instrument issuedb. intrinsic value a. a or b at the option of the entity b. b c. a d. a if determinable, otherwise, b 2. If there are no vesting conditions, the fair value of employee share options is recognized as expense, and an increase in a. equity at grant date b. liability over the vesting period c. liability at grant date d. equity over the vesting period 3. If there is a vesting period, the fair value of employee share appreciation rights is recognized as expense and an increase in a. liability at grant date b. equity at grant date c. liability over the vesting period d. equity over the vesting periodQualified plan assets are placed into and held by a trust. What can the trust distribute to the employer? Select one: a. Nothing b. Special distributions and dividends c. Excess contributions d. Annual forfeitures

- Indicate by letter whether each of the events listed below increase (l), decreases (D), or has no effect (N) on an employer’s projected benefit obligation. Events Interest cost. ________ Amortization of prior service cost. ________ A decrease in the average life expectancy of employees. ________ An increase in the average life expectancy of employees. ________ A plan amendment that increases benefits is made retroactive to prior years. ________ An increase in the actuary’s assumed discount rate. ________ Cash contributions to the pension fund by the employer.…Nonqualified deferred compensation plan benefits constitute income when: Select one: a. The company acquires a life insurance policy on the employee. b. The company funds the benefits through allocation of its assets. c. The allocated assets are available to the employee with substantial limitations, conditions and risk of forfeiture. d. The allocated assets are available to the employee without substantial limitations, conditions and risk of forfeiture.Vested benefits a. Usually require a certain minimum number of years of service b. Are those that the employee is entitled to receive even if fired c. Are not contingent upon conditional service under the plan d. Are defined by all of the above statements

- Which of the following items on the statement of net assets available for benefits would indicate a plan failed nondiscrimination testing? Select one: a. Excess contributions refundable/payable b. Employee contributions receivable c. Adjustment from fair value to contract value d. Adjustment from contract value to fair value(Based on Appendix B) LTV Corporation grants SARs to key executives. Upon exercise, the SARs entitleexecutives to receive either cash or stock equal in value to the excess of the market price at exercise over theshare price at the date of grant. How should LTV account for the awards?Which of the following is NOT computed by an Acturay on behlaf of a firm Select one: a. Total sales revenue b. The pension obligation c. THe annual cost of servicing the pension plan d. The cost of amendments to the pension plan Clear my choice