Cash Accounts receivable. $ 28,250 Liabilities..... Larson, capital (20%). Norris, capital (30%) . Spencer, capital (20%) . Harrison, capital (30%). Total liabilities and capital... $ 47,000 44,000 Inventory..... Land and buildings. Equipment . Total assets 60,000 75,000 41,250 104,000 $238,250 $238,250

Cash Accounts receivable. $ 28,250 Liabilities..... Larson, capital (20%). Norris, capital (30%) . Spencer, capital (20%) . Harrison, capital (30%). Total liabilities and capital... $ 47,000 44,000 Inventory..... Land and buildings. Equipment . Total assets 60,000 75,000 41,250 104,000 $238,250 $238,250

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 13MCQ

Related questions

Question

The

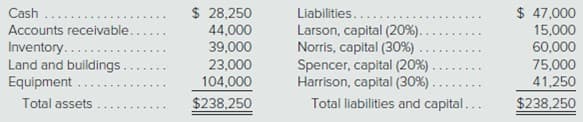

The balance sheet reported by this partnership at the time that the liquidation commenced follows. The percentages indicate the allocation of

Based on the information provided, prepare a predistribution plan for liquidating this partnership.

Transcribed Image Text:Cash

Accounts receivable.

$ 28,250

Liabilities.....

Larson, capital (20%).

Norris, capital (30%) .

Spencer, capital (20%) .

Harrison, capital (30%).

Total liabilities and capital...

$ 47,000

44,000

Inventory.....

Land and buildings.

Equipment .

Total assets

60,000

75,000

41,250

104,000

$238,250

$238,250

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning