Cash-Basis and Accrual-Basis Income George Hathaway, an electrician, entered into an agreement with a real estate management company to perform all maintenance of basic electrie systems and air-conditioning equipment in the apartment buildings under the company's management. The agreement, which is subject to annua renewal, provides for the payment of a fixed fee of $6,420 on January 1 of each year plus amounts for parts and materials billed separately at the end of each month. Amounts billed at the end of one month are collected at some point in the future. During the first three months of 2022, Geor makes the following additional billings and cash collections: Billings for Parts and Materials $510 0 January February March 380 "Includes $110 for parts and materials billed in December 2021. Cash Collected $6,530 435 D 0 Cash Paid for Parts and Materials $375 280 315 Cost of Parts and Materials Used $360 270 330

Cash-Basis and Accrual-Basis Income George Hathaway, an electrician, entered into an agreement with a real estate management company to perform all maintenance of basic electrie systems and air-conditioning equipment in the apartment buildings under the company's management. The agreement, which is subject to annua renewal, provides for the payment of a fixed fee of $6,420 on January 1 of each year plus amounts for parts and materials billed separately at the end of each month. Amounts billed at the end of one month are collected at some point in the future. During the first three months of 2022, Geor makes the following additional billings and cash collections: Billings for Parts and Materials $510 0 January February March 380 "Includes $110 for parts and materials billed in December 2021. Cash Collected $6,530 435 D 0 Cash Paid for Parts and Materials $375 280 315 Cost of Parts and Materials Used $360 270 330

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter3: Accrual Accounting

Section: Chapter Questions

Problem 62APSA: Problem 3-62A Cash-Basis and Accrual-Basis Income George Hathaway, an electrician, entered into an...

Related questions

Topic Video

Question

100%

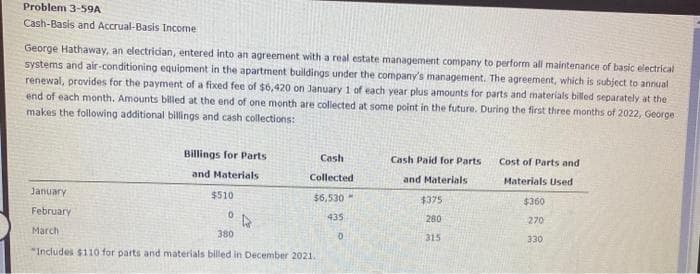

Transcribed Image Text:Problem 3-59A

Cash-Basis and Accrual-Basis Income

George Hathaway, an electrician, entered into an agreement with a real estate management company to perform all maintenance of basic electrical

systems and air-conditioning equipment in the apartment buildings under the company's management. The agreement, which is subject to annual

renewal, provides for the payment of a fixed fee of $6,420 on January 1 of each year plus amounts for parts and materials billed separately at the

end of each month. Amounts billed at the end of one month are collected at some point in the future. During the first three months of 2022, George

makes the following additional billings and cash collections:

January

February

March

Billings for Parts

and Materials

$510

4

Cash

Collected

$6,530

435

D

380

"Includes $110 for parts and materials billed in December 2021.

Cash Paid for Parts

and Materials

$375

280

315

Cost of Parts and

Materials Used

$360

270

330

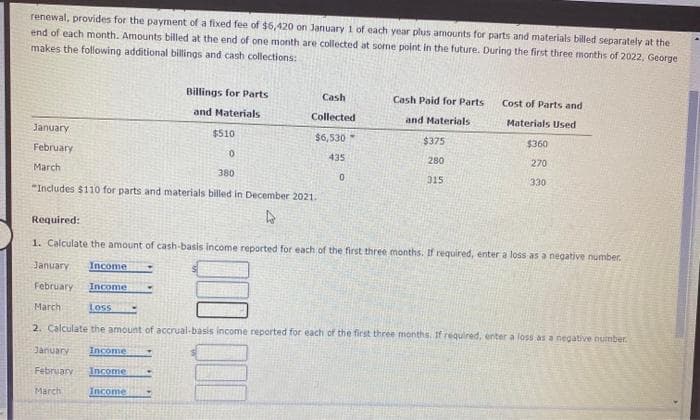

Transcribed Image Text:renewal, provides for the payment of a fixed fee of $6,420 on January 1 of each year plus amounts for parts and materials billed separately at the

end of each month. Amounts billed at the end of one month are collected at some point in the future. During the first three months of 2022, George

makes the following additional billings and cash collections:

January

February

March

Billings for Parts

and Materials

Required:

Cash

Collected

$6,530-

$510

0

380

Includes $110 for parts and materials billed in December 2021.

4

435

0

Cash Paid for Parts

and Materials

$375

280

315

Cost of Parts and

Materials Used

$360

270

330

1. Calculate the amount of cash-basis income reported for each of the first three months. If required, enter a loss as a negative number.

January Income

February

Income

March

Loss

2. Calculate the amount of accrual-basis income reported for each of the first three months. If required, enter a loss as a negative number.

January Income

February Income

March

Income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning