Cash flow of accounts receivable. Myers and Associates, a famous law firm in California, bills its clients on the first of each month. Clients pay in the following fashion: 40% pay at the end of the first month, 30% pay at the end of the second month, 20% pay at the end of the third month, 5% pay at the end of the fourth month, and 5% default on their bills. The company has hired a new accountant, who promises to increase the speed of payment by clients. The new collection times will be 60% at the end of the first month, 25% at the end of the second month, and 10% at the end of the third month. The uncollectible accounts will remain at 5%. What will be the new cash flow with this change for the first quarter of 2015 if the new system takes effect in January? Assume payments from the fourth quarter will stay on the old payment schedule. Click on the icon O in order to copy its content into a spreadsheet Fourth Quarter Actual Billings Oc, First Quarter Anticipated Billings Nov. Dec. Jan. Feb. Mar. $489,000 $393,000 $376,000 $435,000 $463,000 $510,000 What is the anticipated cash flow for January of 2015 if past billings follow the old billing patter and anticipated billings follow the new billing pattern? $ (Round to the nearest dollar.)

Cash flow of accounts receivable. Myers and Associates, a famous law firm in California, bills its clients on the first of each month. Clients pay in the following fashion: 40% pay at the end of the first month, 30% pay at the end of the second month, 20% pay at the end of the third month, 5% pay at the end of the fourth month, and 5% default on their bills. The company has hired a new accountant, who promises to increase the speed of payment by clients. The new collection times will be 60% at the end of the first month, 25% at the end of the second month, and 10% at the end of the third month. The uncollectible accounts will remain at 5%. What will be the new cash flow with this change for the first quarter of 2015 if the new system takes effect in January? Assume payments from the fourth quarter will stay on the old payment schedule. Click on the icon O in order to copy its content into a spreadsheet Fourth Quarter Actual Billings Oc, First Quarter Anticipated Billings Nov. Dec. Jan. Feb. Mar. $489,000 $393,000 $376,000 $435,000 $463,000 $510,000 What is the anticipated cash flow for January of 2015 if past billings follow the old billing patter and anticipated billings follow the new billing pattern? $ (Round to the nearest dollar.)

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 20E: Rosita Flores owns Rositas Mexican Restaurant in Tempe, Arizona. Rositas is an affordable restaurant...

Related questions

Question

Chapter 13, Question 5. Attached is a similar question with answers. Please answer the same three parts for the new question

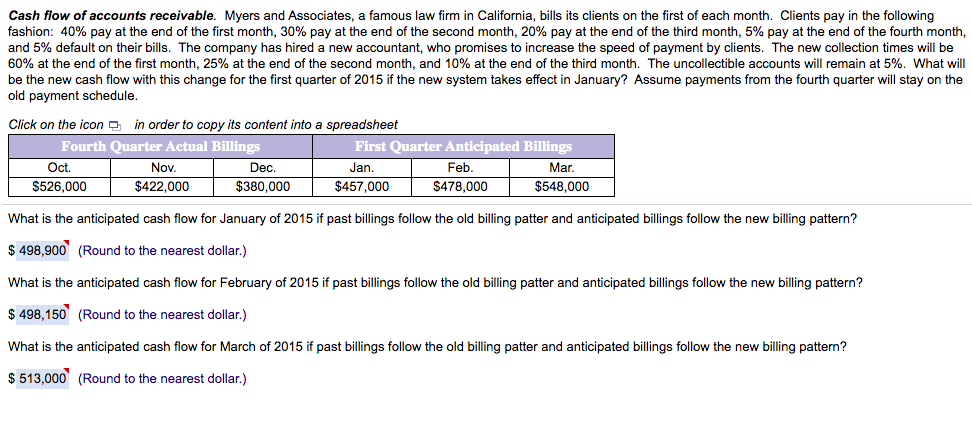

Transcribed Image Text:Cash flow of accounts receivable. Myers and Associates, a famous law firm in California, bills its clients on the first of each month. Clients pay in the following

fashion: 40% pay at the end of the first month, 30% pay at the end of the second month, 20% pay at the end of the third month, 5% pay at the end of the fourth month,

and 5% default on their bills. The company has hired a new accountant, who promises to increase the speed of payment by clients. The new collection times will be

60% at the end of the first month, 25% at the end of the second month, and 10% at the end of the third month. The uncollectible accounts will remain at 5%. What will

be the new cash flow with this change for the first quarter of 2015 if the new system takes effect in January? Assume payments from the fourth quarter will stay on the

old payment schedule.

Click on the icon

in order to copy its content into a spreadsheet

Fourth Quarter Actual Billings

First Quarter Anticipated Billings

Oc.

Nov.

Dec.

Jan.

Feb.

Mar.

$526,000

$422,000

$380,000

$457,000

$478,000

$548,000

What is the anticipated cash flow for January of 2015 if past billings follow the old billing patter and anticipated billings follow the new billing pattern?

$ 498,900 (Round to the nearest dollar.)

What is the anticipated cash flow for February of 2015 if past billings follow the old billing patter and anticipated billings follow the new billing pattern?

$ 498,150 (Round to the nearest dollar.)

What is the anticipated cash flow for March of 2015 if past billings follow the old billing patter and anticipated billings follow the new billing pattern?

$ 513,000 (Round to the nearest dollar.)

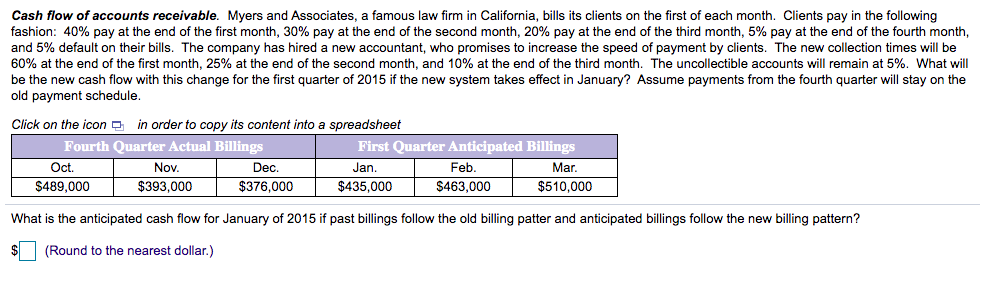

Transcribed Image Text:Cash flow of accounts receivable. Myers and Associates, a famous law firm in California, bills its clients on the first of each month. Clients pay in the following

fashion: 40% pay at the end of the first month, 30% pay at the end of the second month, 20% pay at the end of the third month, 5% pay at the end of the fourth month,

and 5% default on their bills. The company has hired a new accountant, who promises to increase the speed of payment by clients. The new collection times will be

60% at the end of the first month, 25% at the end of the second month, and 10% at the end of the third month. The uncollectible accounts will remain at 5%. What will

be the new cash flow with this change for the first quarter of 2015 if the new system takes effect in January? Assume payments from the fourth quarter will stay on the

old payment schedule.

Click on the icon a in order to copy its content into a spreadsheet

Fourth Quarter Actual Billings

First Quarter Anticipated Billings

Feb,

Ot.

Nov.

Dec.

Jan.

Mar.

$489,000

$393,000

$376,000

$435,000

$463,000

$510,000

What is the anticipated cash flow for January of 2015 if past billings follow the old billing patter and anticipated billings follow the new billing pattern?

(Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning