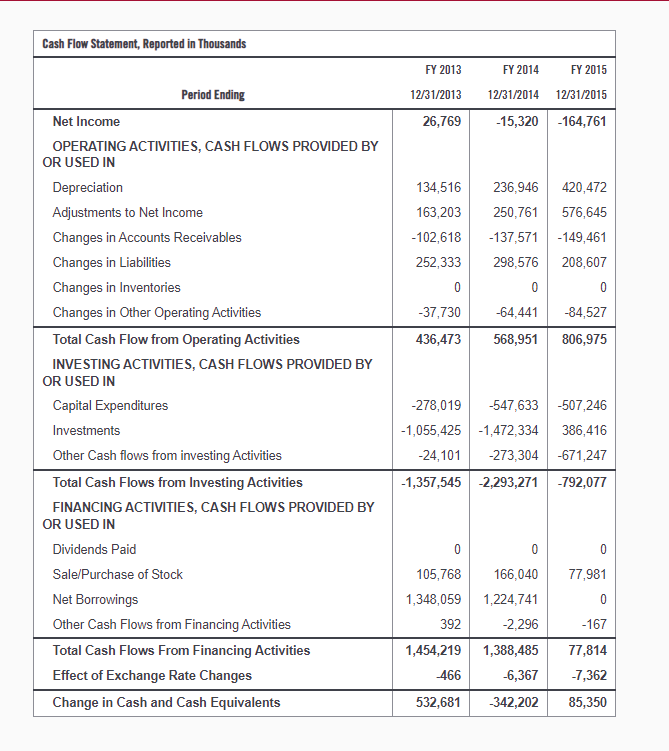

Cash Flow Statement, Reported in Thousands Period Ending Net Income OPERATING ACTIVITIES, CASH FLOWS PROVIDED BY OR USED IN Depreciation Adjustments to Net Income Changes in Accounts Receivables Changes in Liabilities Changes in Inventories Changes in Other Operating Activities Total Cash Flow from Operating Activities INVESTING ACTIVITIES, CASH FLOWS PROVIDED BY OR USED IN Capital Expenditures Investments Other Cash flows from investing Activities Total Cash Flows from Investing Activities FINANCING ACTIVITIES, CASH FLOWS PROVIDED BY OR USED IN Dividends Paid Sale/Purchase of Stock Net Borrowings Other Cash Flows from Financing Activities Total Cash Flows From Financing Activities Effect of Exchange Rate Changes Change in Cash and Cash Equivalents FY 2013 12/31/2013 26,769 FY 2014 FY 2015 12/31/2014 12/31/2015 -15,320 -164,761 134,516 236,946 420,472 163,203 250,761 576,645 -102,618 -137,571 -149,461 252,333 298,576 208,607 0 0 0 -37,730 -64,441 -84,527 436,473 568,951 806,975 -278,019 -547,633 -507,246 -1,055,425 -1,472,334 386,416 -24,101 -273,304 -671,247 -2,293,271 -1,357,545 -792,077 0 0 0 105,768 166,040 77,981 1,348,059 1,224,741 0 392 -2,296 -167 1,454,219 1,388,485 77,814 466 -6,367 -7,362 532,681 -342,202 85,350

Cash Flow Statement, Reported in Thousands Period Ending Net Income OPERATING ACTIVITIES, CASH FLOWS PROVIDED BY OR USED IN Depreciation Adjustments to Net Income Changes in Accounts Receivables Changes in Liabilities Changes in Inventories Changes in Other Operating Activities Total Cash Flow from Operating Activities INVESTING ACTIVITIES, CASH FLOWS PROVIDED BY OR USED IN Capital Expenditures Investments Other Cash flows from investing Activities Total Cash Flows from Investing Activities FINANCING ACTIVITIES, CASH FLOWS PROVIDED BY OR USED IN Dividends Paid Sale/Purchase of Stock Net Borrowings Other Cash Flows from Financing Activities Total Cash Flows From Financing Activities Effect of Exchange Rate Changes Change in Cash and Cash Equivalents FY 2013 12/31/2013 26,769 FY 2014 FY 2015 12/31/2014 12/31/2015 -15,320 -164,761 134,516 236,946 420,472 163,203 250,761 576,645 -102,618 -137,571 -149,461 252,333 298,576 208,607 0 0 0 -37,730 -64,441 -84,527 436,473 568,951 806,975 -278,019 -547,633 -507,246 -1,055,425 -1,472,334 386,416 -24,101 -273,304 -671,247 -2,293,271 -1,357,545 -792,077 0 0 0 105,768 166,040 77,981 1,348,059 1,224,741 0 392 -2,296 -167 1,454,219 1,388,485 77,814 466 -6,367 -7,362 532,681 -342,202 85,350

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 20BEA: The income statement, statement of retained earnings, and balance sheet for Somerville Company are...

Related questions

Question

Make at least three observations about these three sets of financial statements.

Transcribed Image Text:Cash Flow Statement, Reported in Thousands

Period Ending

Net Income

OPERATING ACTIVITIES, CASH FLOWS PROVIDED BY

OR USED IN

Depreciation

Adjustments to Net Income

Changes in Accounts Receivables

Changes in Liabilities

Changes in Inventories

Changes in Other Operating Activities

Total Cash Flow from Operating Activities

INVESTING ACTIVITIES, CASH FLOWS PROVIDED BY

OR USED IN

Capital Expenditures

Investments

Other Cash flows from investing Activities

Total Cash Flows from Investing Activities

FINANCING ACTIVITIES, CASH FLOWS PROVIDED BY

OR USED IN

Dividends Paid

Sale/Purchase of Stock

Net Borrowings

Other Cash Flows from Financing Activities

Total Cash Flows From Financing Activities

Effect of Exchange Rate Changes

Change in Cash and Cash Equivalents

FY 2013

12/31/2013

26,769

FY 2014

FY 2015

12/31/2014 12/31/2015

-15,320 -164,761

134,516

163,203

-102,618

252,333

0

-37,730

-64,441

-84,527

436,473 568,951 806,975

236,946

420,472

250,761

576,645

-137,571 -149,461

298,576

208,607

0

-278,019 -547,633 -507,246

-1,055,425 -1,472,334 386,416

-24,101 -273,304 -671,247

-792,077

-1,357,545 -2,293,271

0

0

105,768

166,040

1,348,059 1,224,741

392

-2,296

1,454,219 1,388,485

-466

-6,367

532,681 -342,202

77,981

0

-167

77,814

-7,362

85,350

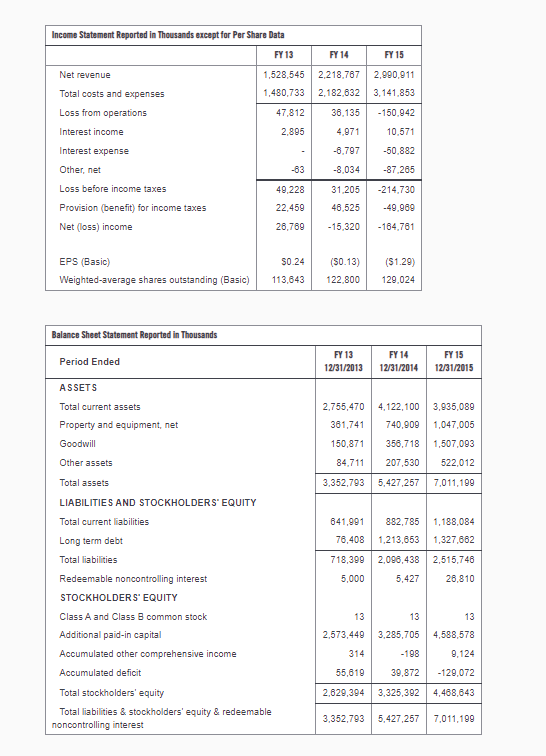

Transcribed Image Text:Income Statement Reported in Thousands except for Per Share Data

FY 13

1,528,545

1,480,733

47,812

2,895

Net revenue

Total costs and expenses

Loss from operations

Interest income

Interest expense

Other, net

Loss before income taxes

Provision (benefit) for income taxes

Net (loss) income

Balance Sheet Statement Reported in Thousands

Period Ended

EPS (Basic)

$0.24

Weighted-average shares outstanding (Basic) 113,643

ASSETS

Total current assets

Property and equipment, net

Goodwill

Other assets

Total assets

LIABILITIES AND STOCKHOLDERS' EQUITY

Total current liabilities

Long term debt

Total liabilities

Redeemable noncontrolling interest

STOCKHOLDERS' EQUITY

Class A and Class B common stock

Additional paid-in capital

Accumulated other comprehensive income

Accumulated deficit

-63

Total stockholders' equity

Total liabilities & stockholders' equity & redeemable

noncontrolling interest

49,228

22,459

26,769

FY 14

2,218,767

2,182,632

36,135

4,971

-6,797

-8,034

31,205 -214,730

46,525

-49,909

-15,320

-164,761

(S0.13)

122,800

FY 15

2,990,911

3,141,853

-150,942

10,571

-50,882

-87,265

FY 13

FY 14

12/31/2013 12/31/2014

($1.29)

129,024

13

2,755,470 4,122,100

3,935,089

361,741 740,909 1,047,005

150,871

356,718

1,507,093

84,711 207,530

522,012

3,352,793 5,427,257

7,011,199

FY 15

12/31/2015

641,991 882,785

1,188,084

76,408 1,213,653 1,327,662

718,399

2,096,438 2,515,748

5,000

5,427

26,810

2,573,449

13

3,285,705

4,588,578

314

-198

9,124

55,619

39,872

-129,072

2,629,394 3,325,392

4,488,643

3,352,793 5,427,257 7,011,199

13

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage