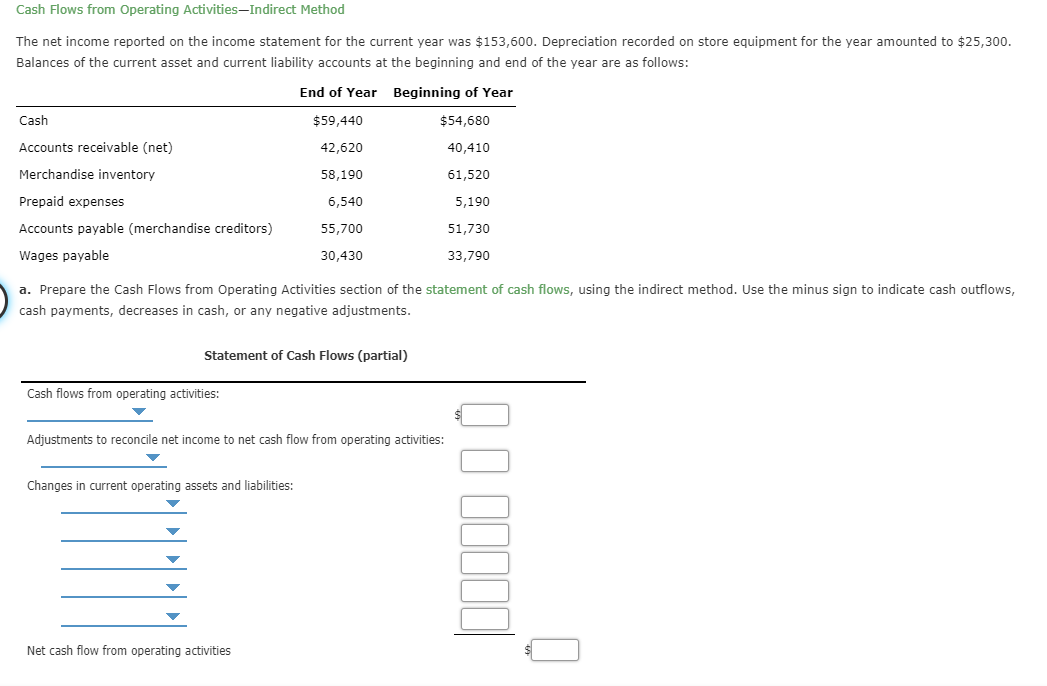

Cash Flows from Operating Activities-Indirect Method The net income reported on the income statement for the current year was $153,600. Depreciation recorded on store equipment for the year amounted to $25,300. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: End of Year Beginning of Year Cash $59,440 $54,680 Accounts receivable (net) 42,620 40,410 Merchandise inventory 58,190 61,520 Prepaid expenses 6,540 5,190 Accounts payable (merchandise creditors) 55,700 51,730 Wages payable 33,790 30,430 a. Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Statement of Cash Flows (partial) Cash flows from operating activities: Adjustments to reconcile net income to net cash flow from operating activities: Changes in current operating assets and liabilities: Net cash flow from operating activities Statement of Cash Flows (partial) Cash flows from operating activities: Adjustments to reconcile net income to net cash flow from operating activities: Changes in current operating assets and liabilities: Net cash flow from operating activities b. Cash flows from operating activities differs from net income because it does not use the of accounting. For example revenues are recorded on the income statement when

Cash Flows from Operating Activities-Indirect Method The net income reported on the income statement for the current year was $153,600. Depreciation recorded on store equipment for the year amounted to $25,300. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: End of Year Beginning of Year Cash $59,440 $54,680 Accounts receivable (net) 42,620 40,410 Merchandise inventory 58,190 61,520 Prepaid expenses 6,540 5,190 Accounts payable (merchandise creditors) 55,700 51,730 Wages payable 33,790 30,430 a. Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Statement of Cash Flows (partial) Cash flows from operating activities: Adjustments to reconcile net income to net cash flow from operating activities: Changes in current operating assets and liabilities: Net cash flow from operating activities Statement of Cash Flows (partial) Cash flows from operating activities: Adjustments to reconcile net income to net cash flow from operating activities: Changes in current operating assets and liabilities: Net cash flow from operating activities b. Cash flows from operating activities differs from net income because it does not use the of accounting. For example revenues are recorded on the income statement when

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter15: Statement Of Cash Flows

Section: Chapter Questions

Problem 5E: Cash flows from operating activitiesindirect method The net income reported on the income statement...

Related questions

Question

Transcribed Image Text:Cash Flows from Operating Activities-Indirect Method

The net income reported on the income statement for the current year was $153,600. Depreciation recorded on store equipment for the year amounted to $25,300.

Balances of the current asset and current liability accounts at the beginning and end of the year are as follows:

End of Year

Beginning of Year

Cash

$59,440

$54,680

Accounts receivable (net)

42,620

40,410

Merchandise inventory

58,190

61,520

Prepaid expenses

6,540

5,190

Accounts payable (merchandise creditors)

55,700

51,730

Wages payable

33,790

30,430

a. Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows,

cash payments, decreases in cash, or any negative adjustments.

Statement of Cash Flows (partial)

Cash flows from operating activities:

Adjustments to reconcile net income to net cash flow from operating activities:

Changes in current operating assets and liabilities:

Net cash flow from operating activities

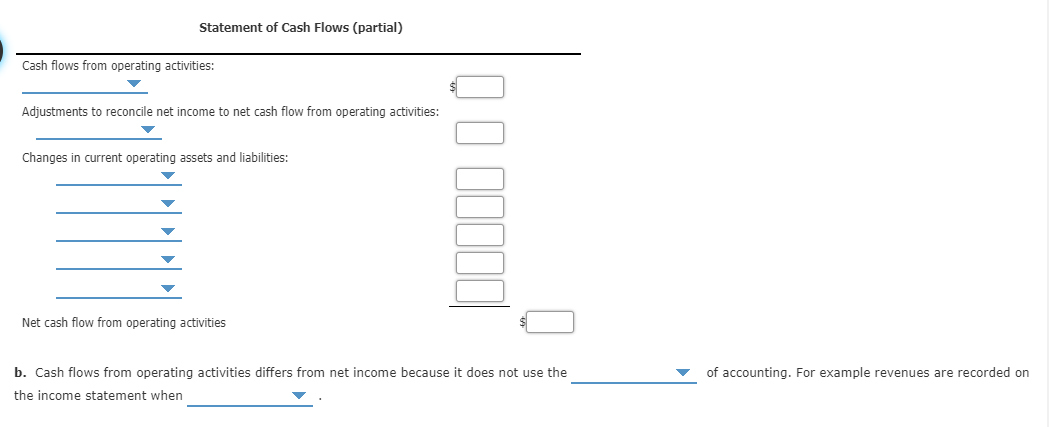

Transcribed Image Text:Statement of Cash Flows (partial)

Cash flows from operating activities:

Adjustments to reconcile net income to net cash flow from operating activities:

Changes in current operating assets and liabilities:

Net cash flow from operating activities

b. Cash flows from operating activities differs from net income because it does not use the

of accounting. For example revenues are recorded on

the income statement when

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning