cash you have saved to manufacture the dou ase the equipment on the day you start the business. You will deprec ng 3-year straight-line depreciation to a salvage value of $20,000. co have $20,000 of inventory and you will need to have $5,000 in cash You will need to have the inventory and cash in place the day you sta t will remain in place throughout the life of the business. You will owe D0 at all times, beginning the day

cash you have saved to manufacture the dou ase the equipment on the day you start the business. You will deprec ng 3-year straight-line depreciation to a salvage value of $20,000. co have $20,000 of inventory and you will need to have $5,000 in cash You will need to have the inventory and cash in place the day you sta t will remain in place throughout the life of the business. You will owe D0 at all times, beginning the day

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 1E: A firm has the opportunity to invest in a project having an initial outlay of $20,000. Net cash...

Related questions

Question

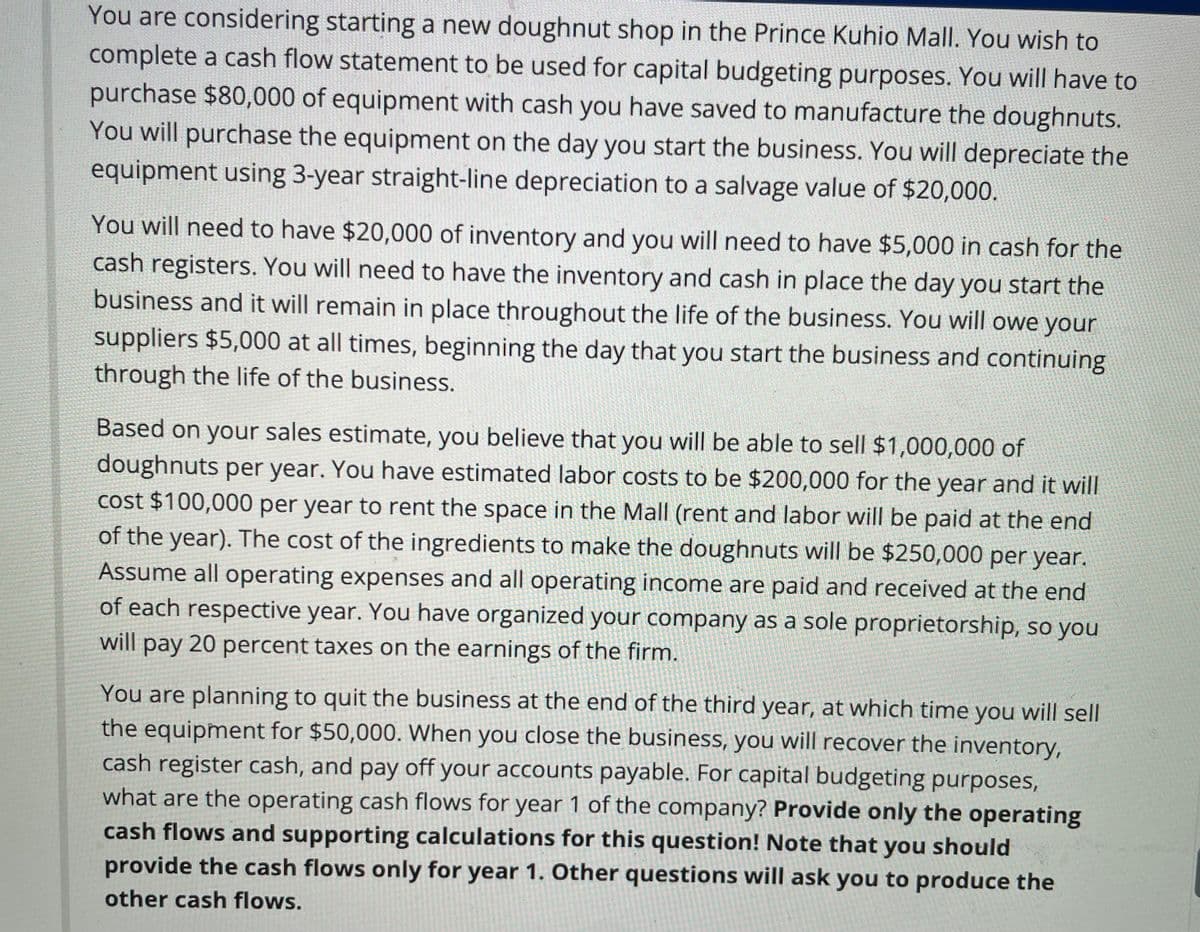

Transcribed Image Text:You are considering starting a new doughnut shop in the Prince Kuhio Mall. You wish to

complete a cash flow statement to be used for capital budgeting purposes. You will have to

purchase $80,000 of equipment with cash you have saved to manufacture the doughnuts.

You will purchase the equipment on the day you start the business. You will depreciate the

equipment using 3-year straight-line depreciation to a salvage value of $20,000.

You will need to have $20,000 of inventory and you will need to have $5,000 in cash for the

cash registers. You will need to have the inventory and cash in place the day you start the

business and it will remain in place throughout the life of the business. You will owe your

suppliers $5,000 at all times, beginning the day that you start the business and continuing

through the life of the business.

Based on your sales estimate, you believe that you will be able to sell $1,000,000 of

doughnuts per year. You have estimated labor costs to be $200,000 for the year and it will

cost $100,000 per year to rent the space in the Mall (rent and labor will be paid at the end

of the year). The cost of the ingredients to make the doughnuts will be $250,000 per year.

Assume all operating expenses and all operating income are paid and received at the end

of each respective year. You have organized your company as a sole proprietorship, so you

will pay 20 percent taxes on the earnings of the firm.

You are planning to quit the business at the end of the third year, at which time you will sell

the equipment for $50,000. When you close the business, you will recover the inventory,

cash register cash, and pay off your accounts payable. For capital budgeting purposes,

what are the operating cash flows for year 1 of the company? Provide only the operating

cash flows and supporting calculations for this question! Note that you should

provide the cash flows only for year 1. Other questions will ask you to produce the

other cash flows.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning