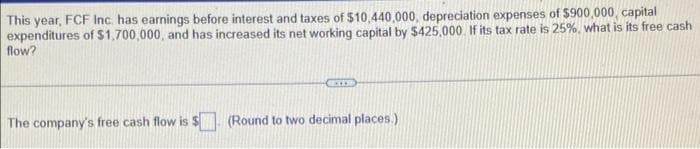

This year, FCF Inc, has earnings before interest and taxes of $10,440,000, depreciation expenses of $900,000, capital expenditures of $1,700,000, and has increased its net working capital by $425,000. If its tax rate is 25%, what is its free cash flow? The company's free cash flow is $. (Round to two decimal places.)

Q: An industry "cluster" arises because of the increase of productivity of the firms participating in…

A: An industry "cluster" refers to many industries popping up at the same place i.e. nearby each other…

Q: Peter's Pipers producers plumbing pipe. The long-run total cost of Peter's pipes is LTC =…

A: Average cost is the per unit cost of production

Q: Explanation it correctly and details Q)Suppose that economists observe than an increase in…

A: Crowding out is a situation when there is a reduction in private investment spending due to an…

Q: According to Hickel how do rich countries de-develop? And the effects on it to the countries

A: *Answer:

Q: Industrialization should start from a sound agricultural base. Why? What can be a contribution of…

A: When talking about agriculture and industrialization, it can be said that agriculture is the primary…

Q: When investors worldwide become more willing to substitute their domestic assets for US assets…

A: In the international market, the value of a currency depends upon its demand and supply and the…

Q: "Product may be an idea, a physical entity or a service or any combination of the three." a.…

A: The process of economic production is an activity that is carried out under the supervision and…

Q: Microsoft selling Excel and Word together while allowing customers to buy the two products…

A: There two products by a single firm and firm can sell them together or separately.

Q: Martin commutes 4 hours every weekday in his combustion-engine vehicle to his job in downtown…

A: Here, it is given that Martin commuted 4 hours in his combustion-engine vehicle on weekdays to reach…

Q: Can you answer me as soon as possible , urgentttttt!!!!!!!!!!! This is the case nothing more You…

A: A Business Development Manager holds the specialty in charge of the department's growth. They work…

Q: You are presented with the following information from Atlantis: Quarter 2, 2020 Quarter 3, 2020…

A: The table shows the manufacturing output, interest rates, inflation and unemployment rate in three…

Q: From the information given in the table, calculate the marginal cost of the 3rd unit of output.…

A: Marginal cost measures the change in total cost due to change in output produced. Marginal cost =…

Q: Despite much internal variation and diversity, and many changes over time, historians still consider…

A: In the European economy there were several wars happened and many religions came into existence.…

Q: Fill in the missing values for a, b and c. Units Total Marginal Average product of product product…

A: MP is the marginal product which is the change in total product by employing one more worker AP is…

Q: Question 2 Which of the following statements is true? OExternalities exist when the private costs…

A: Externality refers to spill-over effects of a good on society.

Q: Find an example where an International Risk is realized. Describe what happened, how the issue was…

A: Market risk is the risk of losing money as a result of factors that affect a whole market or asset…

Q: Suppose that the following equations describe goods and money market equilibrium (symbols are as…

A: IS curve shows an inverse relationship between output level and interest rate. LM curve shows…

Q: Question 2 Ani Given the perfect competitor firm's supply curve below, what is the shutdown price?…

A: A perfectly competitive firm produces output where P=MC and price is given to it.

Q: Which of the assumptions of comparative advantage seem unrealistic? Fixed technology and imperfect…

A: Trade is defined as the exchange of commodities and services across the boundary of the country.

Q: the demand which is not affected by the price changes is called ? derived demand inelastic demand…

A: Demand: willingness and ability to buy a good or service.

Q: What is the goal of a firm?

A: Total cost (TC): - it is the sum of fixed and variable costs incurred in the production process.…

Q: Argue why,by going mulinational ,corporations can reduce their total business risk

A: corporations that move assets, products, administrations, and abilities across public limits…

Q: What is the Related Diversification of Alibaba Group: The Rise of a Platform Giant?

A: Alibaba is a Chinese multinational technology corporation focusing on e-commerce, retail, the…

Q: Georgina decides to take a dozen cupcakes to school to sell so she can raise money for her school…

A: Equilibrium happens when the quantity supplied equals the quantity demanded at the same price.At a…

Q: 1. It shows the peak of a business cycle. A. Recession B. Recovery C. Prosperity D. Depression…

A: Business cycle is a cycle which tells about the change in demand of a product. It is of four types -…

Q: Uberya Towing Services repair vehicles that break down at an average 7.5 vehicles per day. The…

A: Cost is a sort of expense that occur while procuring any good or service. In this question we are…

Q: Economics Question 9 Which of the following is not true about Lindahl pricing? O a. There is…

A: The Lindahl price is a hypothetical pricing for a little bit more of a good if someone offered her a…

Q: Miguel and Jake run a paper company. Each week they need to produce 1,000 reams of paper to ship to…

A: Cost is minimized at the point where ratio of marginal product of inputs is equal to price ratio of…

Q: Question#4 [CLO-2] alternative at MARR 16%. Interpret the results and give explanation for each…

A: Alternative A Alternative B Alternative C Alternative D Initial Cost 6000 7000 9000 17000 AOC…

Q: 3. Minimum wage legislation The following graph shows the labour market in the fast-food industry in…

A: The demand curve in a market is a downward sloping curve that shows that there is an inverse…

Q: Question Three. 1. Look at the diagram below. Consider the scenario where citizens have almost all…

A: Hi! Thank you for the question. As per the honor code, We’ll answer the first question since the…

Q: A company manufactures and sells x cellphones per week. The weekly price-demand and cost equations…

A: In part A, we are maximizing the total revenue of the firm and in part B we are maximizing the total…

Q: EXERCISE 11.6 Suppose capital and labour are perfect complements in a wage to-one ratio. That is,…

A: Rental price is the quantity that could be paid for rental of similar actual assets withinside the…

Q: 10.Which of the following would cause the demand curve for brooms to shift to the right, assuming…

A: We will answer the first question since the exact one was not specified. Please submit a new…

Q: Suppose the nominal median household income for a family of four in the United States was $24,118.00…

A: Real Income = CPI in base year / CPI in current year * 100

Q: 2. Briefly explain four ways in which sellers can convince buyers that they are offering a product…

A: Following below mentioned are the four techniques to persuade a consumer that your product is of…

Q: Two mutually exclusive alternatives are being considered for the environmental protection equipment…

A:

Q: Figure 1 The vertical distance between points A and B represents a tax in the market. Price 12 11+…

A: Equilibrium in the market occurs at the intersection of demand and supply curves

Q: 1- Refer to the information provided in Table1. The table sets out Sue's Surfboards' total product…

A: Average product is the output per worker and marginal product is the change in total product by…

Q: 2. A company has five salespeople and 100 sofas to sell each day. Salespeople get $ commission for…

A: Given information: Number of salespeople = 5 Sofas to sell each day = 100 Commission to sell first…

Q: Sampling is the main technique for . the size of data from the population size to a manageable size.

A: Sampling is the process of choosing a sample from a larger population for the purpose of statistical…

Q: 1) Explain what factors cause shifts of the aggregate demand curve in the open economy model.

A: The amount of products and services demanded by all customers in a given economy over a given time…

Q: Computer Depot, a national computer retailer, has kept a record of the number af laptop computers…

A: Percentage:(number of days above 40/total days)*100

Q: QUESTION 1 How long is "the short" run in economics? A a period in which all inputs are fixed & a…

A: We will answer the first question since the exact one was not specified. Please submit a new…

Q: Suppose an individual is looking to build a house in a plain that is prone to flooding. Because of…

A: The concept that depicts when the assets are being moved from lower-valued to higher-valued use is…

Q: Titan manufactures and sells gas powered electricity generators, It can purchase a new fine of fuel…

A:

Q: The J. Godfrey, Capital account has a credit balance of $19,000 before closing entries are made. If…

A: capital refers to the resources invested in the business. Capital accounts have a normal credit…

Q: A shoe factory has a production capacity of 9,600 units per month. The fixed and variable costs are…

A: The total revenue is the revenue that is generated by selling given units of a commodity. The rise…

Q: The table below shows the values for several different components of GDP. Billions of Dollars…

A: Note:- Since we can only answer up to three subparts, we'll answer the first three. Please repost…

Please don't copy ans

Step by step

Solved in 2 steps

- In 2015, a firm has receipts of $8 million and expenses (excluding depreciation) of $4 million. Its depreciation for 2015 amounts to $2 million. If the effective income tax rate is 40%, what is this firm’s net operating income after taxes (NOPAT)?A company paid $200,000 for a machine to make a new product. The machine has a 5 year life and a salvage value of $20,000. The company makes $49,500 per year on the new product. Assuming a 31% tax rate and straight-line depreciation, what is the before tax and after tax rates of return on the investment over its 5 year life? (Do not interpolate. Round to the closest rate in appendix C of the book). And Please show work and also post on excel sheetSolve correctly in excel Six years ago, a company purchased $30,000 of equipment. The equipment has just been sold for $5000. The equipment was depreciated using 50% bonus depreciation / 50% MACRS (using a 5-year recovery period). The actual savings due to the purchase of the equipment is shown below. The firm's MARR is 12% and it's tax rate is 25%. What is the after-tax present worth of the investment? Year 1 2 3 4 5 6 Savings 5000 6000 7000 7000 4000 3000

- The effective combined tax rate in a firm is 28%. An outlay of $2 million for certain new assets is under consideration. Over the next 9 years, these assets will be responsible for annual receipts of $650,000 and annual disbursements (other than for income taxes) of $225,000. After this time, they will be used only for stand-by purposes with no future excess of receipts over disbursements.(a) What is the prospective rate of return before income taxes?(b) What is the prospective rate of return after taxes if straight-line depreciation can be used to write off these assets for tax purposes in 9 years?(c) What is the prospective rate of return after taxes if it is assumed that these assets must be written off for tax purposes over the next 20 years, using straight-line depreciation?The effective combined tax rate in a firm is 28%. An outlay of $2 million for certain new assets is under consideration. Over the next 9 years, these assets will be responsible for annual receipts of $650,000 and annual disbursements (other than for income taxes) of $225,000. After this time, they will be used only for stand-by purposes with no future excess of receipts over disbursements. (a) What is the prospective rate of return before income taxes? (b) What is the prospective rate of return after taxes if straight-line depreciation can be used to write off these assets for tax purposes in 9 years? (c) What is the prospective rate of return after taxes if it is assumed that these assets must be written off for tax purposes over the next 20 years, using straight-line depreciation? please solve it step by stepOmar Shipping Company bought a tugboat for $75,000 (year 0) and expectedto use it for five years after which it will be sold for $12,000. Suppose the companyestimates the following revenues and expenses from the tugboat investmentfor the first operating year:Operating revenue $200,000Operating expenses $8400Depreciation $4000 If the company pays taxes at the rate of 30% on its taxable income, what is the net income during the first year?

- Only typed answer Chanveida finds a home listed for $48k. Similar homes in good condition sell for $60k (market value). She pays $35k. Closing costs are $2k, estimated fix-up is $7k, and holding costs are $3k. She ‘flips’ the property after 3 months for $58k. Her closing costs upon sale are 7% of the sell price. Her overall tax rate is 30%. Assume no financing is used and there is no depreciation taken. Determine Chanveida's Net Sell Price. (Do not show a decimal or cents in your answer)A manufacturing company purchased an equipment for methods improvement for P 53,000. Paid P 1,500 for freight and delivery charges to the job site. What is the yearly depreciation cost using the sinking fund method at 6% interest. The machine has P 5,000 trade in cost and 10 yrs life.A): Calculate the total cost, total depreciation, and annual depreciation (in $) for the following assets by using the straight-line method. (Round your answers to the nearest cent.) *chart attached* B): Mason Industries purchased a drilling rig for $75,900. Delivery costs totaled $2,831. The useful life is 7 years and the salvage value is $12,938. Prepare a depreciation schedule using the straight-line method. *CHART ATTACHED*

- 6. The equipment bought at a price of Php 450,000 has an economic life of 5 years and a salvage value of Php 50,000. The cost of money is 12% per year. Compute the first-year depreciation using Declining Balance Method.i will 10 upvotes urgent. Which of the following statement correctly describes 'depreciation' ? (a) It is a monthly allowance for wear and tear of a capital good. (b) It is based on the demand and supply of consumer goods in market. (c) It is calculated as the cost of good divided by number of years of its useful life. (d) It accounts for sudden destruction of capital caused due to natural calamities.Calculate Lopez Enterprises' gross profit at a CFAT of $2.5 million, $900,000 in expenses, $900,000 in depreciation costs, and a 26.4% effective tax rate.