Catherine is employed in ABC Corporation. She received the basic wage for 2015 in the total amount of ₱234,000, inclusive of the 13th month pay. In the same year, she also received overtime pay of ₱40,000 and night-shift differential of ₱25,000. The monthly nontaxable deductions would be SSS (₱ 720.00), Philhealth (₱ 247.50), and HDMF (₱ 100.00). 1. Compute for the withholding tax due.

Catherine is employed in ABC Corporation. She received the basic wage for 2015 in the total amount of ₱234,000, inclusive of the 13th month pay. In the same year, she also received overtime pay of ₱40,000 and night-shift differential of ₱25,000. The monthly nontaxable deductions would be SSS (₱ 720.00), Philhealth (₱ 247.50), and HDMF (₱ 100.00). 1. Compute for the withholding tax due.

Chapter24: Multistate Corporate Taxation

Section: Chapter Questions

Problem 1BCRQ

Related questions

Question

Catherine is employed in ABC Corporation. She received the basic wage for 2015 in the total amount of

₱234,000, inclusive of the 13th month pay. In the same year, she also received overtime pay of ₱40,000

and night-shift differential of ₱25,000. The monthly nontaxable deductions would be SSS (₱ 720.00),

Philhealth (₱ 247.50), and HDMF (₱ 100.00).

1. Compute for the withholding tax due.

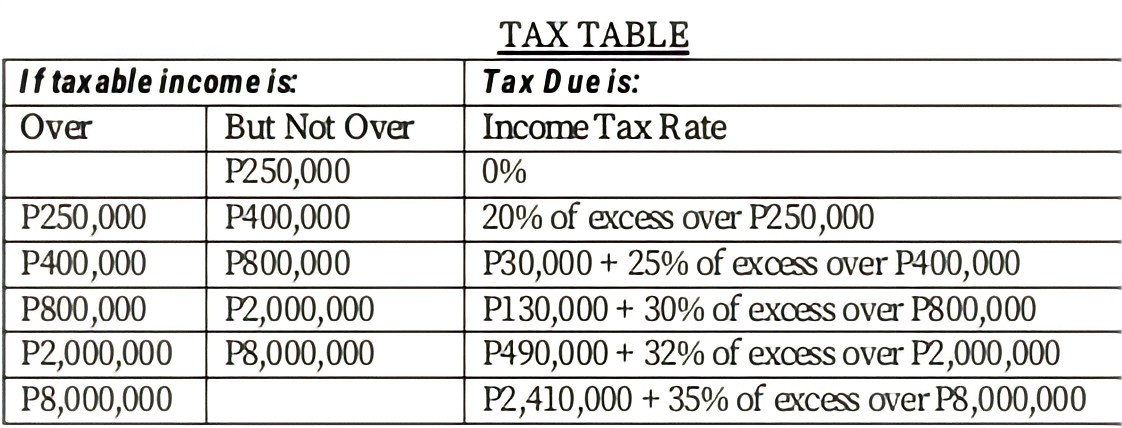

Transcribed Image Text:TAX TABLE

If taxable income is:

ТаxDueis:

Over

But Not Over

Income Tax R ate

P250,000

P400,000

P800,000

Р2,000,000

P8,000,000

0%

20% of exces over P250,000

P250,000

P400,000

P800,000

P2,000,000

P8,000,000

P30,000 + 25% of excess over P400,000

P130,000 + 30% of excess over P800,000

P490,000 + 32% of excess over P2,000,000

P2,410,000 + 35% of excess over P8,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you