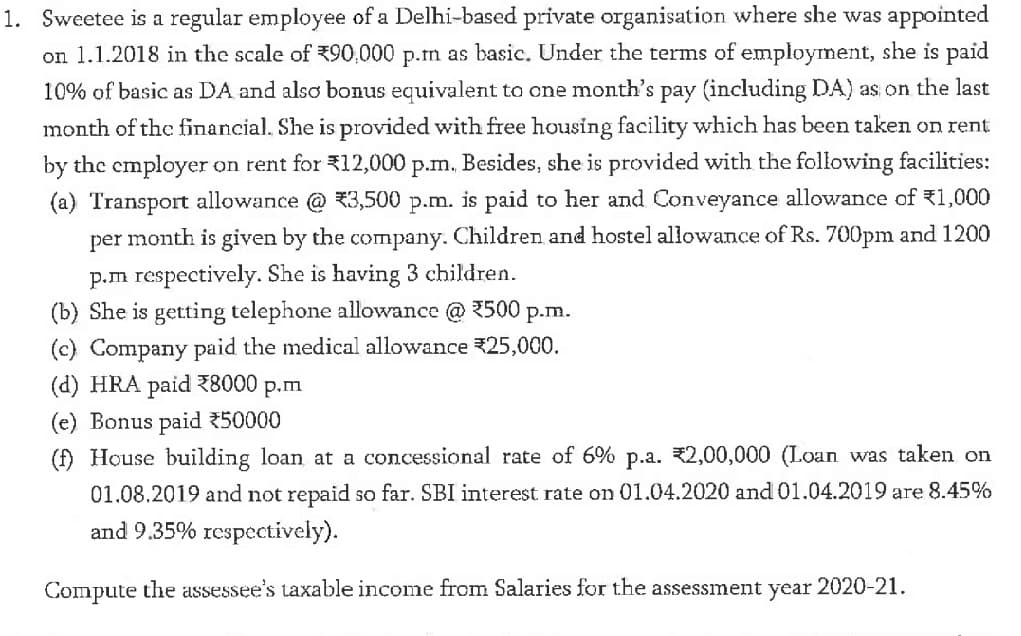

Sweetee is a regular employee of a Delhi-based private organisatión where she was appointea on 1.1.2018 in the scale of 90,000 p.m as basic. Under the terms of employment, she is paid 10% of basic as DA and alsơ bonus equivalent to one month's pay (including DA) as on the last month of the financial. She is provided with free housing facility which has been taken on rent by the employer on rent for 12,000 p.m. Besides, she is provided with the following facilities: (a) Transport allowance @ 3,500 p.m. is paid to her and Conveyance allowance of 1,000 per month is given by the company. Children and hostel allowance of Rs. 700pm and 1200 p.m respectively. She is having 3 children. (b) She is getting telephone allowance @ 3500 p.m. (c) Company paid the medical allowance 25,000. (d) HRA paid Z8000 p.m

Sweetee is a regular employee of a Delhi-based private organisatión where she was appointea on 1.1.2018 in the scale of 90,000 p.m as basic. Under the terms of employment, she is paid 10% of basic as DA and alsơ bonus equivalent to one month's pay (including DA) as on the last month of the financial. She is provided with free housing facility which has been taken on rent by the employer on rent for 12,000 p.m. Besides, she is provided with the following facilities: (a) Transport allowance @ 3,500 p.m. is paid to her and Conveyance allowance of 1,000 per month is given by the company. Children and hostel allowance of Rs. 700pm and 1200 p.m respectively. She is having 3 children. (b) She is getting telephone allowance @ 3500 p.m. (c) Company paid the medical allowance 25,000. (d) HRA paid Z8000 p.m

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter7: Employee Earnings And Deductions

Section: Chapter Questions

Problem 5PA

Related questions

Question

Transcribed Image Text:1. Sweetee is a regular employee of a Delhi-based private organisation where she was appointed

on 1.1.2018 in the scale of 390,000 p.m as basic. Under the terms of employment, she is paid

10% of basic as DA and also bonus equivalent to one month's pay (including DA) as on the last

month of the financial. She is provided with free housing facility which has been taken on rent

by the employer on rent for 312,000 p.m. Besides, she is provided with the following facilities:

(a) Transport allowance @ 3,500 p.m. is paid to her and Conveyance allowance of 1,000

per month is given by the company. Children and hostel allowance of Rs. 700pm and 1200

p.m respectively. She is having 3 children.

(b) She is getting telephone allowance @ 2500 p.m.

(c) Company paid the medical allowance 25,000.

(d) HRA paid Z8000

P.m

(e) Bonus paid 50000

(f) House building loan at a concessional rate of 6% p.a. 2,00,000 (Loan was taken on

01.08.2019 and not repaid so far. SBI interest rate on 01.04.2020 and 01.04.2019 are 8.45%

and 9.35% respectively).

Compute the assessee's taxable income from Salaries for the assessment year 2020-21.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning