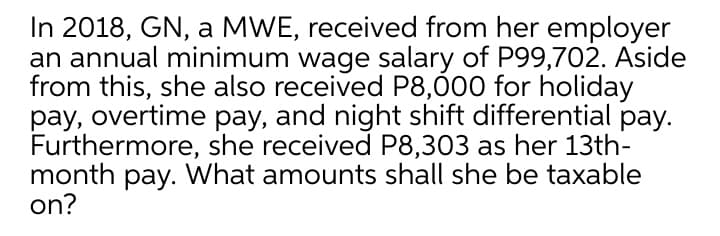

In 2018, GN, a MWE, received from her employer an annual minimum wage salary of P99,702. Aside from this, she also received P8,00 for holiday pay, overtime pay, and night shift differential pay. Furthermore, she received P8,303 as her 13th- month pay. What amounts shall she be taxable on?

In 2018, GN, a MWE, received from her employer an annual minimum wage salary of P99,702. Aside from this, she also received P8,00 for holiday pay, overtime pay, and night shift differential pay. Furthermore, she received P8,303 as her 13th- month pay. What amounts shall she be taxable on?

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 6DQ

Related questions

Question

Transcribed Image Text:In 2018, GN, a MWE, received from her employer

an annual minimum wage salary of P99,702. Aside

from this, she also received P8,00 for holiday

pay, overtime pay, and night shift differential pay.

Furthermore, she received P8,303 as her 13th-

month pay. What amounts shall she be taxable

on?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT