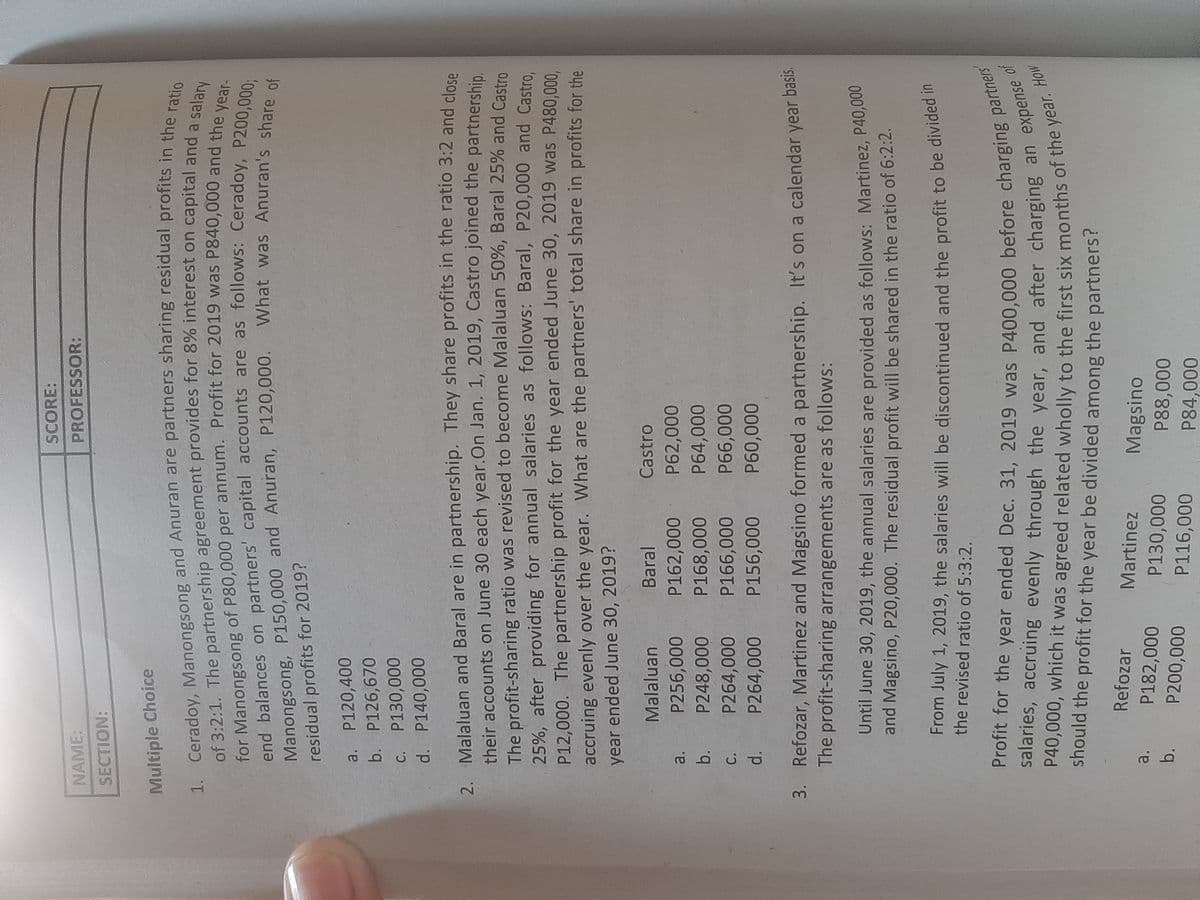

Ceradoy, Ma of 3:2:1. The for Manongs end balance Manongsong residual prof a. P120,40 b. P126,67 C. P130,00 d. P140,00

Ceradoy, Ma of 3:2:1. The for Manongs end balance Manongsong residual prof a. P120,40 b. P126,67 C. P130,00 d. P140,00

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter12: Accounting For Partnerships And Limited Liability Companies

Section: Chapter Questions

Problem 9E

Related questions

Question

Transcribed Image Text:P118,000

C.

000'86

P132,000

d.

P180,000

P88,000

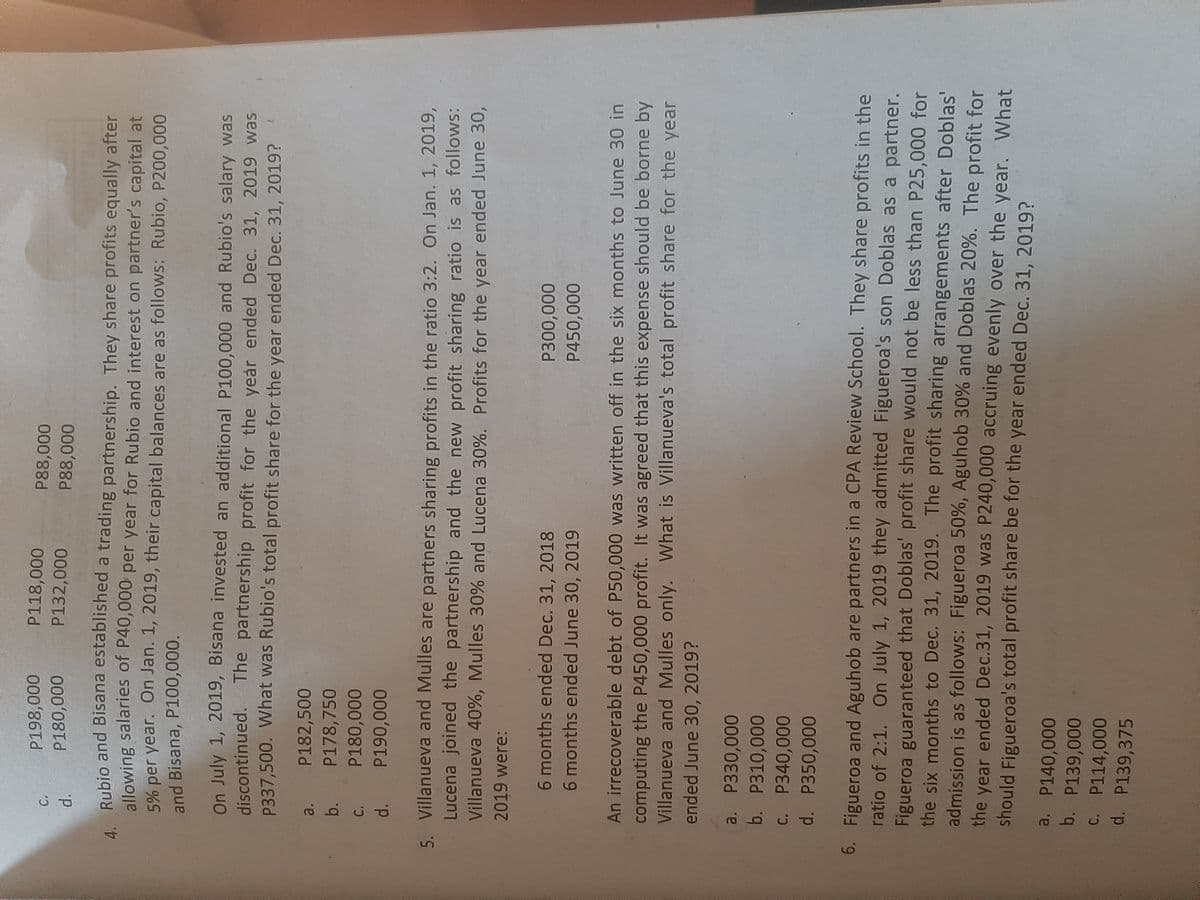

Rubio and Bisana established a trading partnership. They share profits equally after

allowing salaries of P40,000 per year for Rubio and interest on partner's capital at

5% per year. On Jan. 1, 2019, their capital balances are as follows: Rubio, P200,000

and Bisana, P100,000.

On July 1, 2019, Bisana invested an additional P100,000 and Rubio's salary was

discontinued. The partnership profit for the year ended Dec. 31, 2019 was

P337,500. What was Rubio's total profit share for the year ended Dec. 31, 2019?

P182,500

b. P178,750

P180,000

C.

d. P190,000

5. Villanueva and Mulles are partners sharing profits in the ratio 3:2. On Jan. 1, 2019,

Lucena joined the partnership and the new profit sharing ratio

Villanueva 40%, Mulles 30% and Lucena 30%. Profits for the year ended June 30,

as follows:

2019 were:

6 months ended Dec. 31, 2018

6 months ended June 30, 2019

P450,000

000'00

An irrecoverable debt of P50,000 was written off in the six months to June 30 in

computing the P450,000 profit. It was agreed that this expense should be borne by

Villanueva and Mulles only. What is Villanueva's total profit share for the year

ended June 30, 2019?

a. P330,000

b. P310,000

C. P340,000

d. P350,000

6. Figueroa and Aguhob are partners in a CPA Review School. They share profits in the

ratio of 2:1. On July 1, 2019 they admitted Figueroa's son Doblas as a partner.

Figueroa guaranteed that Doblas' profit share would not be less than P25,000 for

the six months to Dec. 31, 2019. The profit sharing arrangements after Doblas'

admission is as follows: Figueroa 50%, Aguhob 30% and Doblas 20%. The profit for

the year ended Dec.31, 2019 was P240,000 accruing evenly over the year. What

should Figueroa's total profit share be for the year ended Dec. 31, 2019?

a. P140,000

b. P139,000

C. P114,000

d. P139,375

Transcribed Image Text:SCORE:

NAME:

PROFESSOR:

SECTION:

Multiple Choice

for Manongsong of P80,000 per annum. Profit for 2019 was P840,000 and the

end balances on partners' capital accountsS are as follows: Ceradoy, P200

Manongsong, P150,000 and Anuran, P120,000.

residual profits for 2019?

ve

a. P120,400

b. P126,670

C. P130,000

d. P140,000

2. Malaluan and Baral are in partnership. They share profits in the ratio 3:2 and close

their accounts on June 30 each year.On Jan. 1, 2019, Castro joined the partnershin

The profit-sharing ratio was revised to become Malaluan 50%, Baral 25% and Castro

25%, after providing for annual salaries as follows: Baral, P20,000 and Castro

P12,000. The partnership profit for the year ended June 30, 2019 was P480,000.

accruing evenly over the year. What are the partners' total share in profits for the

year ended June 30, 2019?

Malaluan

Baral

Castro

a.

P162,000

000's

000

b.

d. P264,000 P156,000

3. Refozar, Martinez and Magsino formed a partnership. It's on a calendar year basis.

The profit-sharing arrangements are as follows:

Until June 30, 2019, the annual salaries are provided as follows: Martinez, P40,000

and Magsino, P20,000. The residual profit will be shared in the ratio of 6:2:2.

the revised ratio of 5:3:2.

salaries, accruing evenly through the year, and after charging

should the profit for the year be divided among the partners?

Refozar

Martinez

a.

P182,000

Magsino

b.

P130,000

000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning