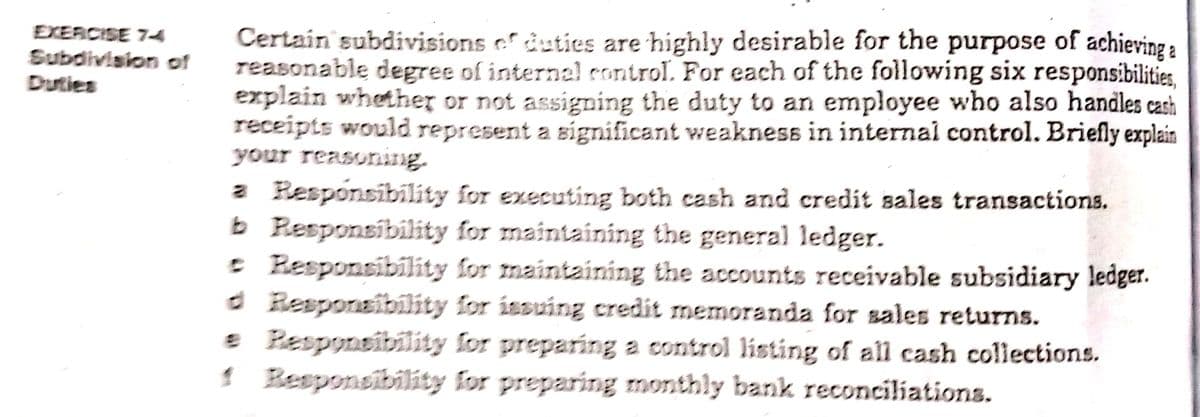

Certain subdivisions e duties are highly desirable for the purpose of achieving a reasonable degree of internal rntrol. For each of the following six responsibilities, explain whether or not assigning the duty to an employee who also handles cash receipts would represent a significant weakness in internal control. Briefly explain your reasornang. a Besponsibility for executing both cash and credit sales transactions. b Responsibility for maintaining the general ledger. : Responsibility for maintaining the accounts receivable subsidiary ledger.

Certain subdivisions e duties are highly desirable for the purpose of achieving a reasonable degree of internal rntrol. For each of the following six responsibilities, explain whether or not assigning the duty to an employee who also handles cash receipts would represent a significant weakness in internal control. Briefly explain your reasornang. a Besponsibility for executing both cash and credit sales transactions. b Responsibility for maintaining the general ledger. : Responsibility for maintaining the accounts receivable subsidiary ledger.

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter10: Auditing Cash, Marketable Securities, And Complex Financial Instruments

Section: Chapter Questions

Problem 11RQSC

Related questions

Question

Transcribed Image Text:EXERCISE 74

Subdivision of

Certain subdivisions ef duties are highly desirable for the purpose of achieving a

reasonable degree of internal control. For each of the following six responsibilities,

explain whether or not assignming the duty to an employee who also handles cash

receipts would represent a significant weakness in internal control. Briefly explain

your reasuning.

Duties

2 Besponsibility for executing both cash and credit sales transactions.

b Responsibility for maintaining the general ledger.

e Responsibillity for maintaining the accounts receivable subsidiary ledger.

d Besponsibility for issuing credit memoranda for sales returns.

e Pesponsibility for preparing a control listing of all cash collections.

1 Besponsibility for preparing monthly bank reconciliations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning