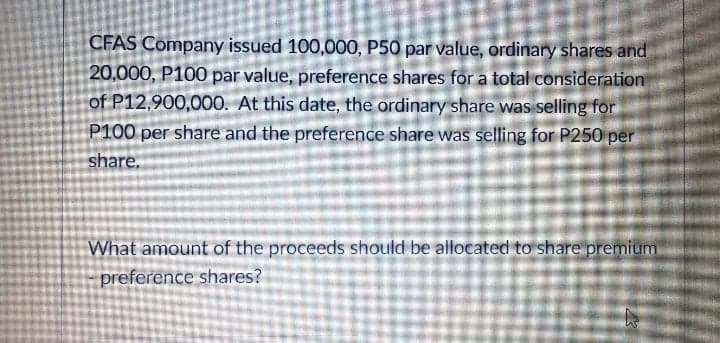

CFAS Company issued 100,000, P50 par value, ordinary shares and 20,000, P100 par value, preference shares for a total consideration of P12,900,000. At this date, the ordinary share was selling for P100 per share and the preference share was selling for P250 per share. What amount of the proceeds should be allocated to share premium preference shares?

Q: A company has the option to invest in project A, project B, or neither (the projects are mutually ex...

A: Decision will be based on NPV as: "Accept the Project with the positive and higher NPV". Net Present...

Q: Emily Rose Company showed the following data: Preference share capital, par value P20, 100,000 share...

A: Shares: Shares are the units owned by company which are classified into two types, common shares or ...

Q: Jam Ltd acquired all the equity in Cab Ltd on 31 December 20X4 for $370 000. At the control date, th...

A: The intercompany sales are to be given effect for the unrealized profit. The intercompany purchase o...

Q: c. Purchased Php2,500 worth of supplies on accounts (on credit) d. Returned defective piece of equip...

A: TRANSACTIONS ASSETS = LIABILITIES + OWNERS EQUITY Balances 89000 9000 80000 ...

Q: For each of the following situations, state the accounting principle or concept that has been applie...

A: The accounting is a process to identify the business transactions, record the transactions and prepa...

Q:

A: Purchase price of Equipment: $4.2million Useful life: 6years. Residual value $341 thousand a) Depr...

Q: a. By what percentage amount did the exchange rate between the yuan and dollar change from January 1...

A: In the international market, exchange rates between currencies hold an important value. The exchange...

Q: Oslo Company prepared the following contribution format income statement based on a sales volume of ...

A: The facts in the given question are as follows: Sales- $30,000 Variable expenses- 16,500 Contributio...

Q: Exclusive Souvenirs Hut does customize, hand-crafted memorabilia for hotels, in which each batch of ...

A: Job costing is customer specific and is used when the products are heterogeneous

Q: Sonya Jared opened a law office on July 1, 2022 On July 31, the balance sheet showed Cash$5.000, Acc...

A: The shareholders' equity statement records the changes that effected the capital of owners such as n...

Q: The following information is obtained from a review of the record keeping process. Analyze the given...

A:

Q: (d) Explain and justify the accounting treatment for share dividends and share splits.

A: Share dividend is the form of dividend in which company issue shares as dividend rather than cash. G...

Q: Which of the following decisions do NOT influence the cash from operating activities slide? Which s...

A: Operating Activities are company core business activities such as manufacturing , distributing , mar...

Q: 9-11. (Individual or component sources of financing for Doosan Babcock: a. A $1,000 par value bond w...

A: Note: Hi! Thank you for the question, As per the honor code, we are allowed to answer three sub-part...

Q: Oslo Company prepared the following contribution format income statement based on a sales volume of ...

A: Information given in the question is as follows: Sales $ 30,000 Variable expenses 16,500 Cont...

Q: Mr. Allen is a 65-year-old Jamaican tax resident. He is the director of a hotel, Allen’s Rest Well R...

A: Mr. Allen is a 65-year-old Jamaican tax resident. He is the director of a hotel, Allen’s Rest Well R...

Q: John's Tree Service depreciation for the month is $500. The adjusting journal entry is: O A. Depreci...

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in...

Q: of Of 10 years, an estimated residual value of $50,000, and were depreciated using straight-line dep...

A: The depreciation expense is charged on fixed assets as reduced value of the fixed asset with usage a...

Q: ABC Company uses a Materials Inventory account to record both direct and indirect materials. ABC cha...

A: Following information was available from the given question: Total materials purchased (including di...

Q: Pls answer this question with solutions. A manufacturer gives warranties at the time of sale to purc...

A: Solution Warranty expenses is the cost that business expects to or has already incurred for the repa...

Q: On April 1, 2028, A Company purchased three units of baking equipment by issuing a four-year, non-in...

A: Solution: Amount of note = P3,200,000 Annual installment = P800,000 As note is non interest bearing ...

Q: Wayne Frederick expects sales of Bison Business Solutions's line of computer workstation furniture t...

A: Total cost of goods sold = Cost of goods sold per unit * Number of units produced Gross margin = Tot...

Q: A donated fixed asset (from a governmental unit) for which the fair value has been determined should...

A: The resources that a firm employs in its commercial activities are referred to as assets. A donated ...

Q: At the beginning of 2019, Norris Company l1ad a deferred tax liability of $6,400, because of the use...

A: Comment-Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the questi...

Q: Show Attemptistory Current Attempt in Progress. Selected transactions for Bonnie Donne Company durin...

A: The T-accounts are prepared to post the journal entries to the specific accounts of the business.

Q: The account "Warranty Liability": Multiple Choice a)has a year-end credit balance equal to the co...

A: A warranty liability is a liability account in which a company notes the amount of the repair or rep...

Q: A company sold 8,000 units of its signature product for the calendar year ended December 31, 2020. E...

A: The provision for warranty is created to record the estimated warranty Expenses for the period. The ...

Q: MD Manufacturing Company is estimating the following raw material purchases for the last four months...

A:

Q: On December 31, 2021, the company exchanged old motor vehicles and RM48,000 for new motor vehicles. ...

A: Since you have posted a question with multiple sub-parts, we will be solving the first three for you...

Q: George Black lives in Manitoba, a non-participating province that has an 7% provincial sales tax Dur...

A: Purchase price = $ 82000 Trade allowance = $ 36000 Provincial sales tax (PST )= 7% The question requ...

Q: ewham Corporation produces and sells two products. In the most recent month, Product R10L had sales ...

A: The breakeven analysis depends on the contribution margin of the product which is calculated by subt...

Q: 7. Copper Mines, Inc (CMI) . purchased property for the purpose of extracting copper ore. CMI paid $...

A:

Q: Solve for maturity value, discount period, bank discount, and proceeds. Assume a bank discount rate ...

A: The note receivable is the assets for the business, which is a promissory note for the payment due f...

Q: Entries for Issuing Bonds and Amortizing Premium by Straight-Line Method Favreau Corporation wholes...

A: Premium on bonds payable = Cash amount - Bonds payable Semiannual amortization period for six years ...

Q: ellco p

A: These are the accounting transactions that are having a monetary impact on the financial statement o...

Q: Discuss the legal effect of incorporation or registration of a Limited Liability Partnership. State ...

A: A limited liability partnership is a separate legal and business entity from its partners. Only afte...

Q: On October 1, 2021, Chrysanthemum Co. purchased equipment by issuing a 9% promissory note with face ...

A: Interest payable on Decemeber 31,2022 = 9% x (1500000-400000) x3/12= 24750

Q: On January 1, 2021, a company issued serial bonds with a face value of 3,000,000 and a stated rate o...

A: Carrying value of the bonds = Present value of principal + Present value of interest payments where,...

Q: Discuss how the lease liability would be measured at lease inception.

A: Lease Liability is the present value of the financial obligation of the lease for the lease payments...

Q: of 9 SASB • requires companies to provide information to replace certain financial statements. -. st...

A: The Sustainability Accounting Standards Board (SASB) is an independent non-profit, whose mission is ...

Q: The audit risk model consists of: AR = IR x R x DR. The detection risk is the dependent variable. Wh...

A: Detection Risk dependent on the level of inherent risk and level of control risk. The relationship b...

Q: Weighted average cost per unit = per unit. Cost Cost of Goods Allocation Cost of Goods Sold Ending I...

A: Sales = (50 units x $120) + (25 units x $125) = $6000 + $3125 = $9125 Cost of Goods Available = (100...

Q: At the begining of 2020, Flynne Company decided to change from the LIFO to the FIFO inventory cost f...

A: Comment- Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the quest...

Q: Use the following excerpts from Fruitcake Company's financial records. Acquired new plant assets $2...

A: Statement of cash flows: It is a financial statement that shows the increase or decrease in the cash...

Q: Abioye Co. produces and distributes semiconductors for use by computer manufacturers. Abioye Co. iss...

A: Bond is issued by the company for raising finance for the business working. It is considered a cheap...

Q: Ivanhoe Leasing Company agrees to lease equipment to Shamrock Corporation on January 1, 2020. The fo...

A: Given, 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimate...

Q: All the following activities are inflows to the company except. a. Decrease in any asset b. Decrease...

A: Cash inflows generally are a result of: Sale of Assets Sale of investments Issue of common stock, e...

Q: high for all financial statements assertions, an auditor should document the auditor’s A B ...

A: An Auditor understanding of its environment, it's entity and then assessing the risk of material in ...

Q: During the month of January, direct materials cost totaled PhP850,000 and direct labor cost was 60% ...

A: Lets understand the basics. Prime cost is a cost which are directly related to the production of the...

Q: ABD Company's direct labor cost is 30% of its conversion cost. If the manufacturing overhead cost fo...

A: The conversion cost include direct labor and manufacturing overhead. If direct labor represents 30% ...

Step by step

Solved in 2 steps

- Alert Companys shareholders equity prior to any of the following events is as follows: The company is considering the following alternative items: 1. An 8% stock dividend on the common stock when it is selling for 30 per share. 2. A 30% stock dividend on the common stock when it is selling for 32 per share. 3. A special stock dividend to common shareholders consisting of 1 share of preferred stock for every 100 shares of common stock. The preferred stock and common stock are selling for 123 and 31 per share, respectively. 4. A 2-for-1 stock split on the common stock, reducing the par value to 5 per share (assume the same date for declaration and issuance). The market price is 30 per share on the common stock. 5. A property dividend to common shareholders consisting of 100 bonds issued by West Company. These bonds are carried on the Alert Company books as an available-for sale investment at a fair value of 48,000 (which is also its cost); it has a current value of 54,000. 6. A cash dividend, consisting of a normal dividend and a liquidating dividend, on both the preferred and the common stock. The 10% preferred dividend includes a 2% liquidating dividend, and the 2.30 per share common dividend includes a 0.30 per share liquidating dividend (separate liquidating dividend contra accounts should be used). Required: For each of the preceding alternative items: 1. Record (a) the journal entry at the date of declaration and (b) the journal entry at the date of issuance. 2. Compute the balances in the shareholders equity accounts immediately after the issuance (any gains or losses are to be reflected in the retained earnings balance; ignore income taxes).Ball Company issued 50,000 shares of its P100 par ordinary and 80,000 shares of its P50 convertible preference for a total amount of P12,500,000. At the date of issue, the ordinary shares had a market value of P120 per share and the preference shares are selling at P75 per share. What is the amount credited to share premium from preference shares? Please provide solution.Ball Company issued 50,000 shares of its P100 par ordinary and 80,000 shares of its P50 convertible preference for a total amount of P12,500,000. At the date of issue, the ordinary shares had a market value of P120 per share and the preference shares are selling at P75 per share. What is the amount credited to share premium from preference shares?

- On March 1, 2019, Mall Co. issued 60,000, P50 par value, ordinary shares and 20,000, P100 par value, preference shares for a total consideration of P7,500,000. At this date, the ordinary share was selling for P100 per share and the preference share was selling for P150 per share. What amount of the proceeds should be allocated to the preference shares?Victory Company issued 8,000 ordinary shares with P200 par value and 20,000 preference shares with P200 par value for a total consideration of P7,500,000. At the date of issue, the ordinary share was selling for P360 and the preference share was selling for P270. What is the share premium from the issuance of ordinary shares?A company issued 20,000 shares of its P70 par value ordinary share capital and 8,000 of its P80 par value preference share capital for a total amount of 1,800,000. At this date, the company’s ordinary share capital was selling P 80 per share and the preference share capital was selling for P100 per share. What amount of the proceeds should be allocated to the preference share capital?

- At the beginning of the current year, Ria Company issued 10,000 ordinary shares P20 par value and 20,000 convertible preference shares of P20 par value for a total of P800,000. At this date, the ordinary share was selling for P36, and the convertible preferences share was selling for P27.What amount of the proceeds should be allocated the convertible preference shares?ABC Co. issued 20,000 shares of its P10 par value ordinary share and 40,000 shares of its P10 par value convertible preference share for a total amount of P1,800,000. At this date, Hallway’s ordinary share was selling P20 per share and convertible preference share was selling for P30 per share. What amount of the proceeds should be allocated to the ordinary share? * P400,000 P450,000 P600,000 P1,350,000 answer not givenVenus Company issued 20,000 shares of its P70 par value ordinary shares and 8.000 shares of its P80 par value preference share capital for a total of P1,800.000. At this date, the company's ordinary shares were selling at P80 per share and the preference was selling at P100 per share. (1) What amount of the proceeds should be allocated to the preference shares?*

- PAPAYA Corporation is authorized to issue ₱1,000,000 share capitaldividend into 10,000 shares with ₱100 par. If 2,000 shares were sold oncash basis at ₱150/share, by how much did the corporation's assetincrease? Choices: ₱ 200,000₱ 100,000₱ 400,000₱ 300,000At the beginning of the current year, Riza Company issued 10,000 ordinary shares of P20. Par value and 20,000 convertible preference shares of P20 par value for a total of P800,000.At this date, the ordinary share was selling for P36, and the convertible preference share was selling for P27. What is the share premium from the issuance of preference shares? a. 360,000 b. 200,000 c. 320,000 d. 400,000 What is the share premium from the issuance of preference shares? a. 180,000 b. 100,00 c. 80,000 d. – 0 –During 20B, Glaiza company had the following two classes of share capital issued and outstanding for the entire year: Ordinary share capital, 300,000 shares, P10 par, P3,000,000; Preference share capital, 3,000 shares, P100 par, 12% convertible Share for share into ordinary share, P300,000. Glaiza's net income for 20B was P2,700,000, and its income tax rate is 30%. In the computation of basic earnings per share, what is the amount to be used as earnings? Choices A. 2,736,000 B. 2,664,000 C. 1,836,000 d. 2,700,000