For each of the following situations, state the accounting principle or concept that has been applied or violated AND provide an explanation. (a) Hong Kong Entertainment Company has organized two concerts in March and May 2021. Tickets were sold in advance in December 2020. from both concerts were recorded as revenue earned in the company's Income Statement for the year ended March 31, 2021. All the money received (i) Accounting Principle / Concept Applied OR Violated (ii) Explanation: John was the only owner of ABC Company. John purchased a birthday gift to his son who was six years old. He asked the accountant of the company to pay for it and record it as the entertainment expense of ABC Company. (b)

For each of the following situations, state the accounting principle or concept that has been applied or violated AND provide an explanation. (a) Hong Kong Entertainment Company has organized two concerts in March and May 2021. Tickets were sold in advance in December 2020. from both concerts were recorded as revenue earned in the company's Income Statement for the year ended March 31, 2021. All the money received (i) Accounting Principle / Concept Applied OR Violated (ii) Explanation: John was the only owner of ABC Company. John purchased a birthday gift to his son who was six years old. He asked the accountant of the company to pay for it and record it as the entertainment expense of ABC Company. (b)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter3: Accrual Accounting

Section: Chapter Questions

Problem 2MCQ: In December 2019, Swanstrom Inc. receives a cash payment of $3,500 for services performed in...

Related questions

Question

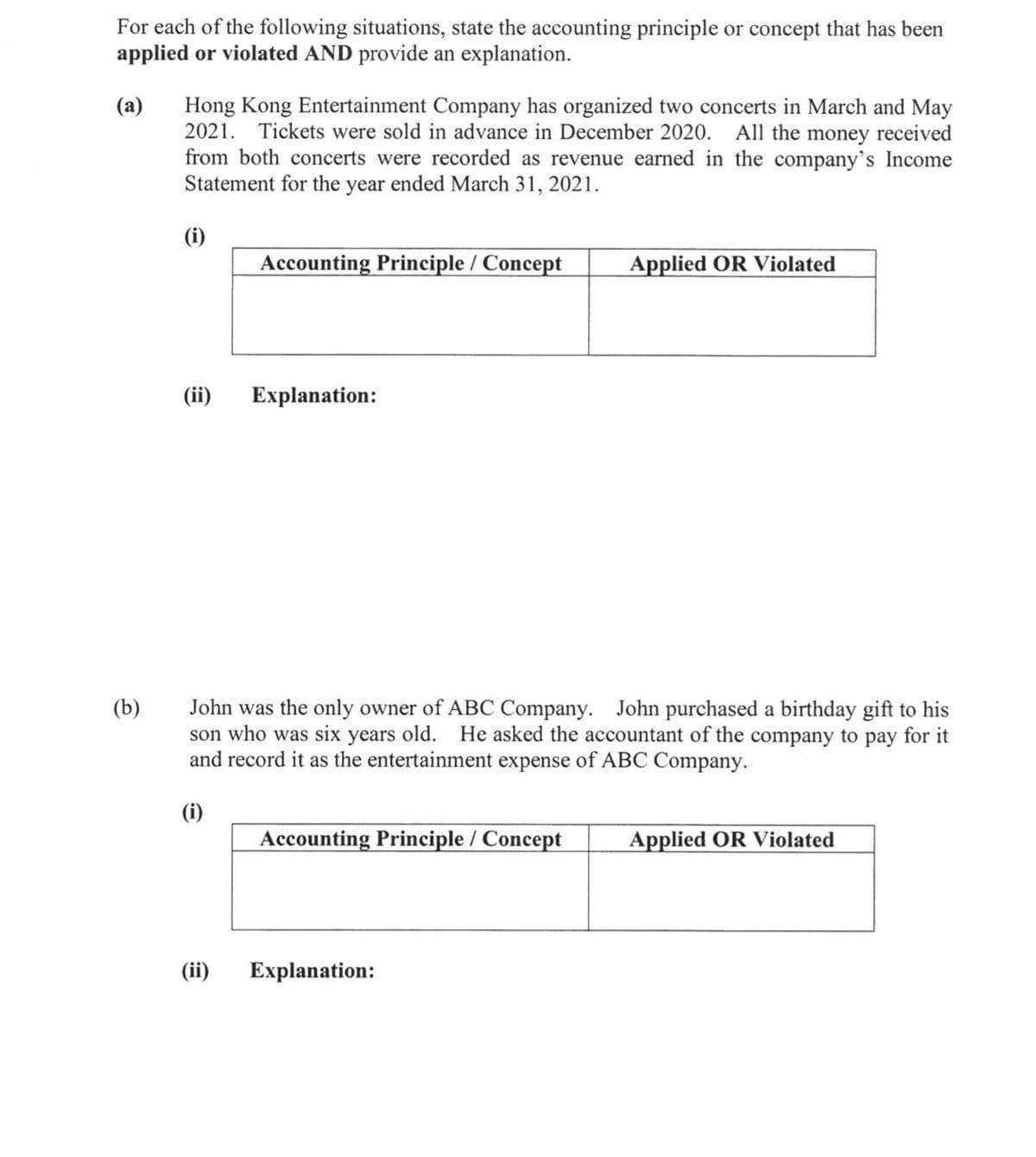

Transcribed Image Text:For each of the following situations, state the accounting principle or concept that has been

applied or violated AND provide an explanation.

Hong Kong Entertainment Company has organized two concerts in March and May

2021. Tickets were sold in advance in December 2020. All the money received

from both concerts were recorded as revenue earned in the company's Income

Statement for the year ended March 31, 2021.

(a)

(i)

Accounting Principle / Concept

Applied OR Violated

(ii)

Explanation:

John was the only owner of ABC Company. John purchased a birthday gift to his

son who was six years old. He asked the accountant of the company to pay for it

and record it as the entertainment expense of ABC Company.

(b)

(i)

Accounting Principle / Concept

Applied OR Violated

(ii)

Explanation:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning