Ch 08 Tableau-3 Log In to Canvas MyEagle 8 Tableau-3 i Tableau DA 8-3: Mini-Case, Analyzing straight-line, units-of-prod uction, and double-declining-balance LO P1 1 The company founder hires us as consultants and asks that we oversee the accounting for new equipment purchased on January 1. The founder wants to know the implications of different depreciation methods and estimates for the company's financial statements. Those statements will be used to attract financing from new investors and creditors. At the end of the equipment's first year in operation, we are given the following Tableau Dashboard. ts Purchase Price & Estimated Salvage Value Estimated Useful Life of Assets еВook Truck Equipment Building 20 Print $70,000 eferences 16 $60,000 $50,000 12 $40,000 $30,000 8 $20,000 4 $10,000 $0 0 Purchase Salvage Purchase Salvage Purchase Salvage Price Value Price Building Truck Value Price Equipment Value Actual & Estimated Units-of-Production Year 1 Production Actual Year 2 Production Estimated Year 2 Production: 55,000 units Year 3 Production Estimated Year 4 Production Estimated 0 25,000 50,000 75,000 100,000 125,000 Total Units to be Produced ableau k- raw Years Ch 08 Tableau-3 Log In to Canvas MyEagle ableau-3i Actual & Estimated Units-of-Production Actual Year 1 Production Estimated Year 2 Production Estimated Year 3 Production es Estimated Year 4 Production 125,000 100,000 75,000 50,000 25,000 0 Total Units to be Produced k- - ableau 1(a). Determine the equipment's first-year depreciation under the straight-line method. 1(b). Determine the equipment's first-year depreciation under the units-of-production method. Note: Actual units produced for Year 1 were equal to the units estimated to be produced for Year 1 1(c). Determine the equipment's first-year depreciation under the double-declining-balance method. 2. Which method in part 1 results in the highest net income in the first year? 3. If the company anticipates that its use of assets will vary greatly from one year to the next based on usage, which method would we recommend the company use? 4. The founder is concerned that a depreciation method might result in more total depreciation expense over the useful life of an asset than another method. Which method would result in the highest amount of depreciation over an asset's useful life? Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 1C Required 2 Required 4 Required 3 Determine the equipment's first-year depreciation under the straight-line method. Straight-Line Method Annual Depreciation Expense Choose Numerator: Choose Denominator: / Depreciation expense / II II

Ch 08 Tableau-3 Log In to Canvas MyEagle 8 Tableau-3 i Tableau DA 8-3: Mini-Case, Analyzing straight-line, units-of-prod uction, and double-declining-balance LO P1 1 The company founder hires us as consultants and asks that we oversee the accounting for new equipment purchased on January 1. The founder wants to know the implications of different depreciation methods and estimates for the company's financial statements. Those statements will be used to attract financing from new investors and creditors. At the end of the equipment's first year in operation, we are given the following Tableau Dashboard. ts Purchase Price & Estimated Salvage Value Estimated Useful Life of Assets еВook Truck Equipment Building 20 Print $70,000 eferences 16 $60,000 $50,000 12 $40,000 $30,000 8 $20,000 4 $10,000 $0 0 Purchase Salvage Purchase Salvage Purchase Salvage Price Value Price Building Truck Value Price Equipment Value Actual & Estimated Units-of-Production Year 1 Production Actual Year 2 Production Estimated Year 2 Production: 55,000 units Year 3 Production Estimated Year 4 Production Estimated 0 25,000 50,000 75,000 100,000 125,000 Total Units to be Produced ableau k- raw Years Ch 08 Tableau-3 Log In to Canvas MyEagle ableau-3i Actual & Estimated Units-of-Production Actual Year 1 Production Estimated Year 2 Production Estimated Year 3 Production es Estimated Year 4 Production 125,000 100,000 75,000 50,000 25,000 0 Total Units to be Produced k- - ableau 1(a). Determine the equipment's first-year depreciation under the straight-line method. 1(b). Determine the equipment's first-year depreciation under the units-of-production method. Note: Actual units produced for Year 1 were equal to the units estimated to be produced for Year 1 1(c). Determine the equipment's first-year depreciation under the double-declining-balance method. 2. Which method in part 1 results in the highest net income in the first year? 3. If the company anticipates that its use of assets will vary greatly from one year to the next based on usage, which method would we recommend the company use? 4. The founder is concerned that a depreciation method might result in more total depreciation expense over the useful life of an asset than another method. Which method would result in the highest amount of depreciation over an asset's useful life? Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 1C Required 2 Required 4 Required 3 Determine the equipment's first-year depreciation under the straight-line method. Straight-Line Method Annual Depreciation Expense Choose Numerator: Choose Denominator: / Depreciation expense / II II

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter9: Fixed Assets And Intangible Assets

Section: Chapter Questions

Problem 9.3CP: Effect of depreciation on net income Tuttle Construction Co. specializes in building replicas of...

Related questions

Question

Can someone help me solve this

Transcribed Image Text:Ch 08 Tableau-3

Log In to Canvas

MyEagle

8 Tableau-3 i

Tableau DA 8-3: Mini-Case, Analyzing straight-line, units-of-prod uction, and double-declining-balance

LO P1

1

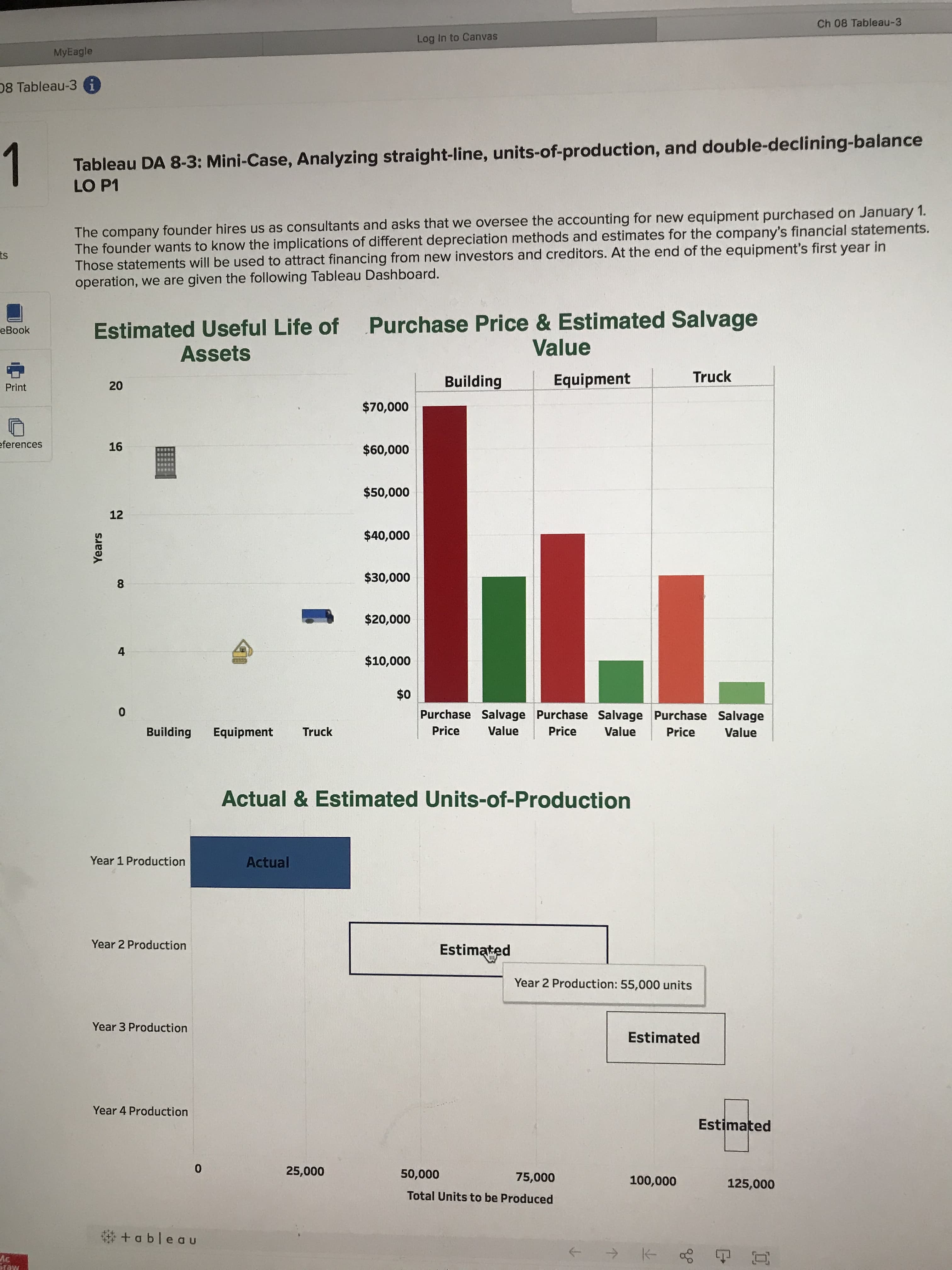

The company founder hires us as consultants and asks that we oversee the accounting for new equipment purchased on January 1.

The founder wants to know the implications of different depreciation methods and estimates for the company's financial statements.

Those statements will be used to attract financing from new investors and creditors. At the end of the equipment's first year in

operation, we are given the following Tableau Dashboard.

ts

Purchase Price & Estimated Salvage

Value

Estimated Useful Life of

Assets

еВook

Truck

Equipment

Building

20

Print

$70,000

eferences

16

$60,000

$50,000

12

$40,000

$30,000

8

$20,000

4

$10,000

$0

0

Purchase Salvage Purchase Salvage Purchase Salvage

Price

Value

Price

Building

Truck

Value

Price

Equipment

Value

Actual & Estimated Units-of-Production

Year 1 Production

Actual

Year 2 Production

Estimated

Year 2 Production: 55,000 units

Year 3 Production

Estimated

Year 4 Production

Estimated

0

25,000

50,000

75,000

100,000

125,000

Total Units to be Produced

ableau

k-

raw

Years

Transcribed Image Text:Ch 08 Tableau-3

Log In to Canvas

MyEagle

ableau-3i

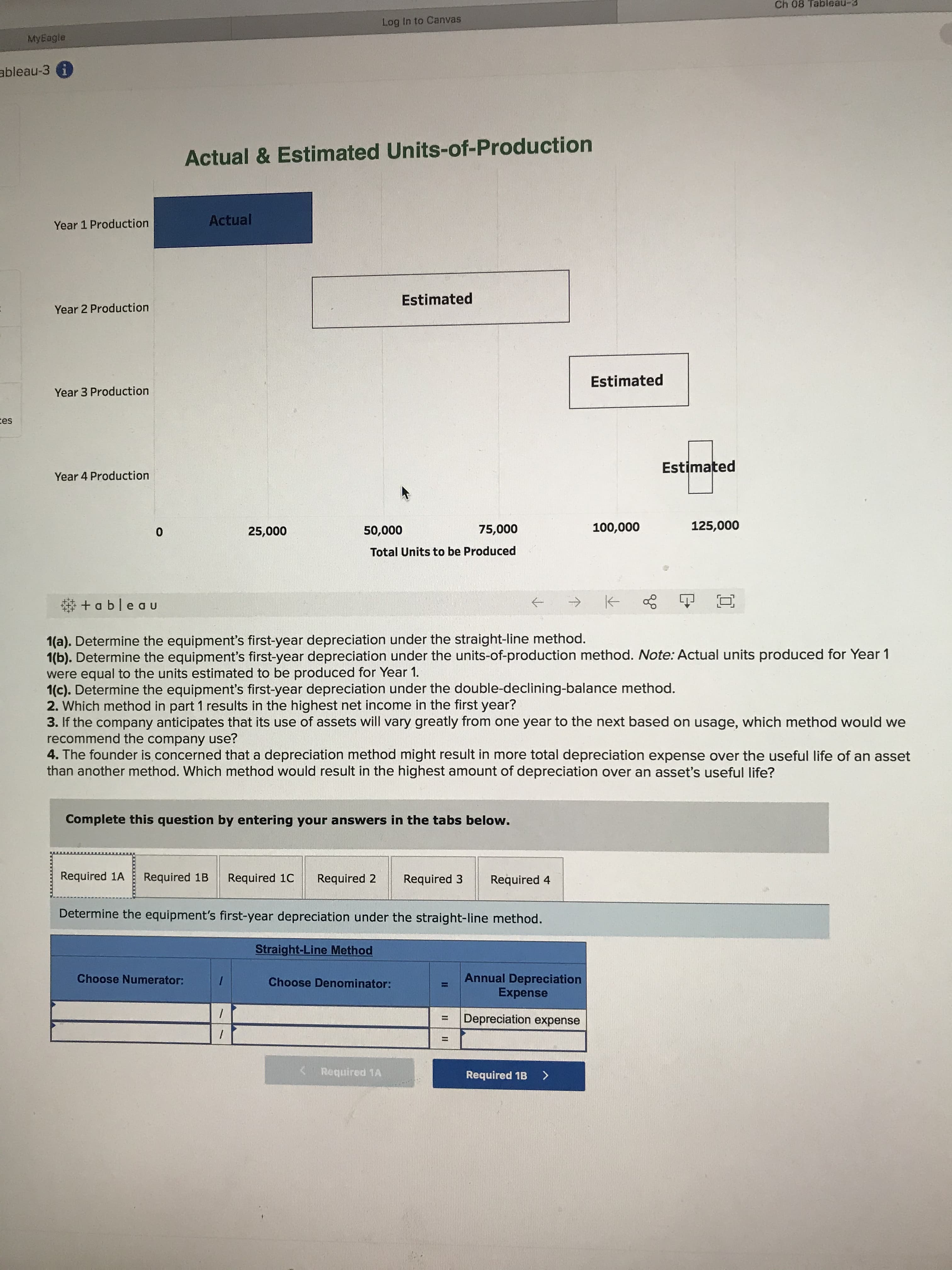

Actual & Estimated Units-of-Production

Actual

Year 1 Production

Estimated

Year 2 Production

Estimated

Year 3 Production

es

Estimated

Year 4 Production

125,000

100,000

75,000

50,000

25,000

0

Total Units to be Produced

k-

-

ableau

1(a). Determine the equipment's first-year depreciation under the straight-line method.

1(b). Determine the equipment's first-year depreciation under the units-of-production method. Note: Actual units produced for Year 1

were equal to the units estimated to be produced for Year 1

1(c). Determine the equipment's first-year depreciation under the double-declining-balance method.

2. Which method in part 1 results in the highest net income in the first year?

3. If the company anticipates that its use of assets will vary greatly from one year to the next based on usage, which method would we

recommend the company use?

4. The founder is concerned that a depreciation method might result in more total depreciation expense over the useful life of an asset

than another method. Which method would result in the highest amount of depreciation over an asset's useful life?

Complete this question by entering your answers in the tabs below.

Required 1A

Required 1B

Required 1C

Required 2

Required 4

Required 3

Determine the equipment's first-year depreciation under the straight-line method.

Straight-Line Method

Annual Depreciation

Expense

Choose Numerator:

Choose Denominator:

/

Depreciation expense

/

<Required 1A

Required 1B >

II

II

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,