Change the estimated total amount of the allocation base to 82,000 machine-hours, but keep everything the same as in Requirement 2. The data area of your worksheet should now look like this: A 1 Chapter 3: Applying Excel 2 Data 4 Allocation base Machine-hours Estimated manufacturing overhead cost $ 713,400 6 Estimated total amount of the allocation base 82,000 machine-hours 7 Actual manufacturing overhead cost $ 695,900 8 Actual total amount of the allocation base 86,000 machine-hours (a) By how much is the manufacturing overhead underapplied or overapplied? manufacturing overhead

Change the estimated total amount of the allocation base to 82,000 machine-hours, but keep everything the same as in Requirement 2. The data area of your worksheet should now look like this: A 1 Chapter 3: Applying Excel 2 Data 4 Allocation base Machine-hours Estimated manufacturing overhead cost $ 713,400 6 Estimated total amount of the allocation base 82,000 machine-hours 7 Actual manufacturing overhead cost $ 695,900 8 Actual total amount of the allocation base 86,000 machine-hours (a) By how much is the manufacturing overhead underapplied or overapplied? manufacturing overhead

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter4: Accounting For Factory Overhead

Section: Chapter Questions

Problem 4P: Using the data in P4-2 and Microsoft Excel: 1. Separate the variable and fixed elements. 2....

Related questions

Question

Info in image "ACC PT1" can be used for image "ACC PT2"

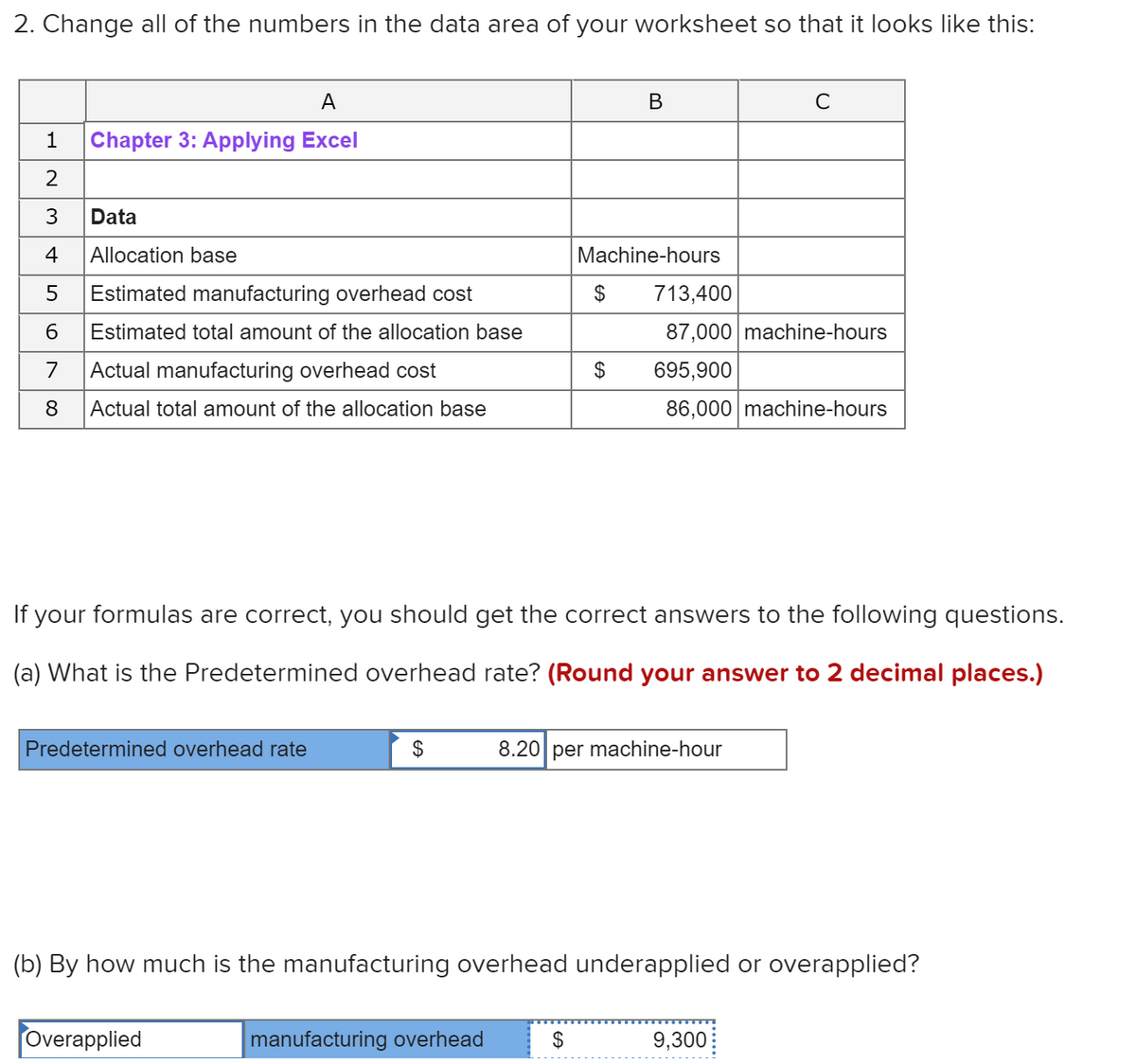

Transcribed Image Text:2. Change all of the numbers in the data area of your worksheet so that it looks like this:

A

C

1

Chapter 3: Applying Excel

3

Data

4

Allocation base

Machine-hours

Estimated manufacturing overhead cost

2$

713,400

6.

Estimated total amount of the allocation base

87,000 machine-hours

7

Actual manufacturing overhead cost

2$

695,900

8

Actual total amount of the allocation base

86,000 machine-hours

If your formulas are correct, you should get the correct answers to the following questions.

(a) What is the Predetermined overhead rate? (Round your answer to 2 decimal places.)

Predetermined overhead rate

$

8.20 per machine-hour

(b) By how much is the manufacturing overhead underapplied or overapplied?

Overapplied

manufacturing overhead

$

9,300

%24

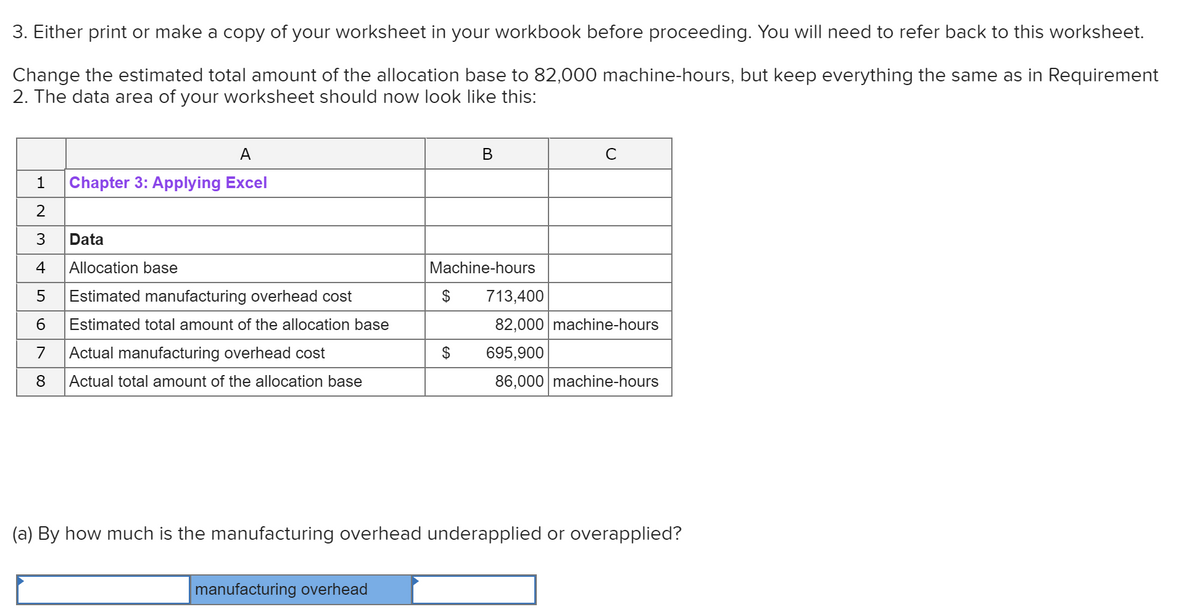

Transcribed Image Text:3. Either print or make a copy of your worksheet in your workbook before proceeding. You will need to refer back to this worksheet.

Change the estimated total amount of the allocation base to 82,000 machine-hours, but keep everything the same as in Requirement

2. The data area of your worksheet should now look like this:

A

C

1

Chapter 3: Applying Excel

2

3

Data

4

Allocation base

Machine-hours

Estimated manufacturing overhead cost

$

713,400

Estimated total amount of the allocation base

82,000 machine-hours

7

Actual manufacturing overhead cost

$

695,900

8

Actual total amount of the allocation base

86,000 machine-hours

(a) By how much is the manufacturing overhead underapplied or overapplied?

manufacturing overhead

Expert Solution

Step 1

Manufacturing overhead: It is the indirect cost incurred as a part of manufacturing the products. These costs are not directly related to the units manufactured. So they are allocated to the manufactured units based on estimated cost drivers.

Pre-determined overhead allocate rate: It the rate of allocating the expected overheads to the actual units or hours for a specific accounting period.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning