Data table Activity Setup Machine maintenance Total indirect manufacturing costs Direct labor hours Number of setups Number of machine hours Print Cost $ 58,000 Number of setups 30,000 Number of machine hours $ 88,000 Allocation Base Lo-Gain 1,200 40 3,000 Done Hi-Gain 3,800 40 2,000 Total 5,000 80 5,000

Data table Activity Setup Machine maintenance Total indirect manufacturing costs Direct labor hours Number of setups Number of machine hours Print Cost $ 58,000 Number of setups 30,000 Number of machine hours $ 88,000 Allocation Base Lo-Gain 1,200 40 3,000 Done Hi-Gain 3,800 40 2,000 Total 5,000 80 5,000

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter4: Activity-based Costing

Section: Chapter Questions

Problem 3CE: Lansing. Inc., provided the following data for its two producing departments: Machine hours are used...

Related questions

Question

I attached the data as well please do it

Thanks

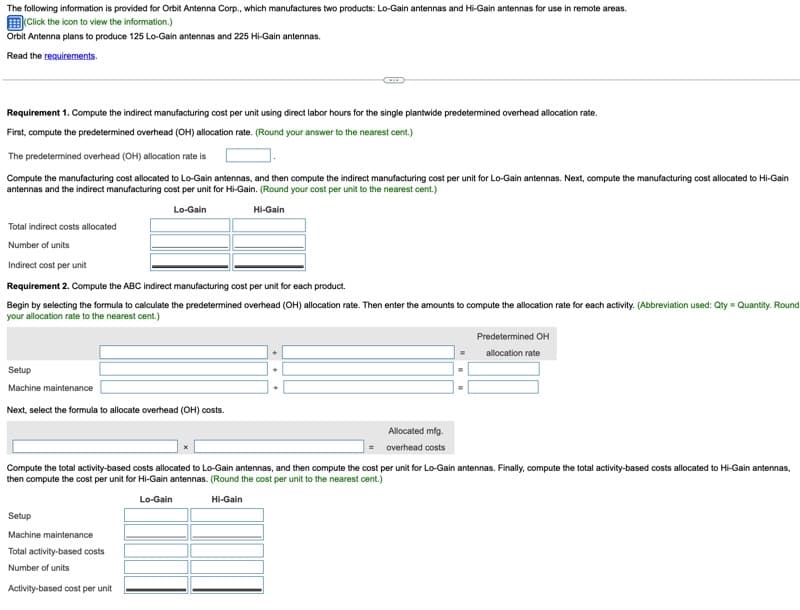

Transcribed Image Text:The following information is provided for Orbit Antenna Corp., which manufactures two products: Lo-Gain antennas and Hi-Gain antennas for use in remote areas.

(Click the icon to view the information.)

Orbit Antenna plans to produce 125 Lo-Gain antennas and 225 Hi-Gain antennas.

Read the requirements.

Requirement 1. Compute the indirect manufacturing cost per unit using direct labor hours for the single plantwide predetermined overhead allocation rate.

First, compute the predetermined overhead (OH) allocation rate. (Round your answer to the nearest cent.)

The predetermined overhead (OH) allocation rate is

Compute the manufacturing cost allocated to Lo-Gain antennas, and then compute the indirect manufacturing cost per unit for Lo-Gain antennas. Next, compute the manufacturing cost allocated to Hi-Gain

antennas and the indirect manufacturing cost per unit for Hi-Gain. (Round your cost per unit to the nearest cent.)

Lo-Gain

Hi-Gain

Total indirect costs allocated

Number of units

Indirect cost per unit

Requirement 2. Compute the ABC indirect manufacturing cost per unit for each product.

Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter the amounts to compute the allocation rate for each activity. (Abbreviation used: Qty = Quantity. Round

your allocation rate to the nearest cent.)

Setup

Machine maintenance

Next, select the formula to allocate overhead (OH) costs.

+

Setup

Machine maintenance

Total activity-based costs

Number of units

Activity-based cost per unit

Allocated mfg.

overhead costs

Predetermined OH

allocation rate

=

Compute the total activity-based costs allocated to Lo-Gain antennas, and then compute the cost per unit for Lo-Gain antennas. Finally, compute the total activity-based costs allocated to Hi-Gain antennas,

then compute the cost per unit for Hi-Gain antennas. (Round the cost per unit to the nearest cent.)

Lo-Gain

Hi-Gain

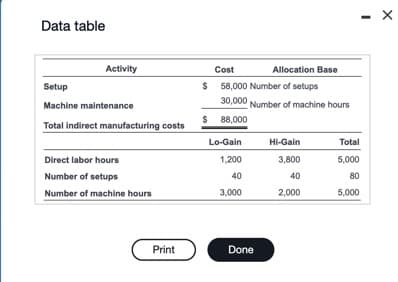

Transcribed Image Text:Data table

Activity

Setup

Machine maintenance

Total indirect manufacturing costs

Direct labor hours

Number of setups

Number of machine hours

Print

Cost

$ 58,000 Number of setups

30,000 Number of machine hours

$ 88,000

Lo-Gain

1,200

40

3,000

Allocation Base

Done

Hi-Gain

3,800

40

2,000

-

Total

5,000

80

5,000

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning