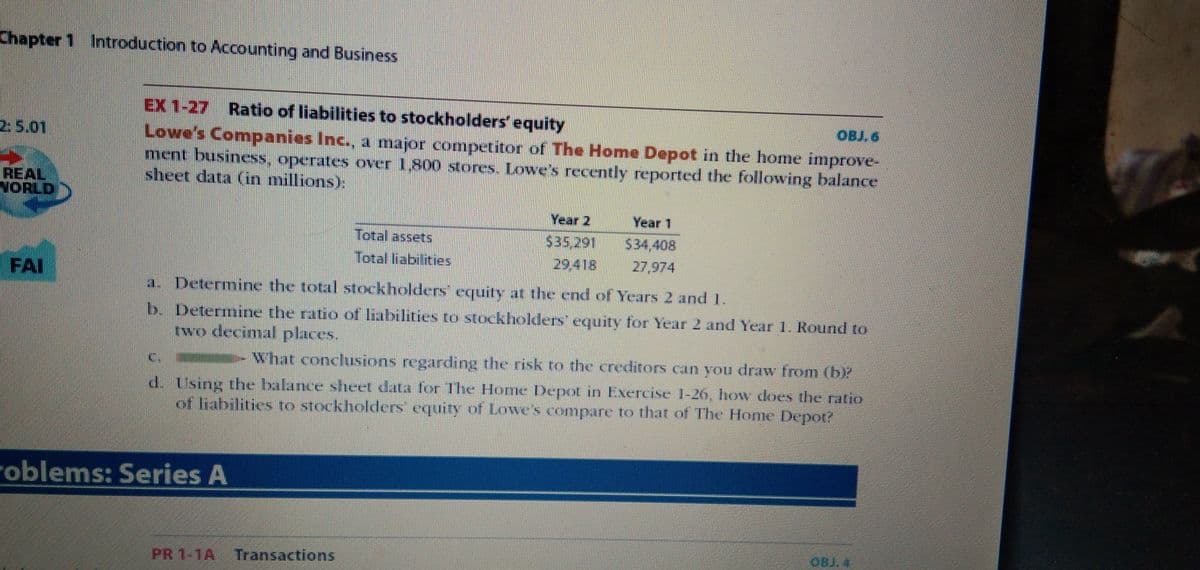

Chapter 1 Introduction to Accounting and Business EX 1-27 Ratio of liabilities to stockholders' equity Lowe's Companies Inc., a major competitor of The Home Depot in the home improve- ment business, operates over 1,800 stores. Lowe's recently reported the following balance sheet data (in millions): OBJ. 6 2: 5.01 REAL VORLD Year 2 Year 1 Total assets $35,291 $34,408 Total liabilities 29,418 27,974 FAI a. Determine the total stockholders' equity at the end of Years 2 and 1. b. Determine the ratio of liabilities to stockholders' equity for Year 2 and Year 1. Round to two decimal places. What conclusions regarding the risk to the creditors can you draw from (b)? C. d. Using the balance sheet data for The Home Depot in Exercise 1-26, how does the ratio of liabilities to stockholders' equity of Lowe's compare to that of The Home Depot? roblems: Series A OBJ, 4 PR 1-1A Transactions

Chapter 1 Introduction to Accounting and Business EX 1-27 Ratio of liabilities to stockholders' equity Lowe's Companies Inc., a major competitor of The Home Depot in the home improve- ment business, operates over 1,800 stores. Lowe's recently reported the following balance sheet data (in millions): OBJ. 6 2: 5.01 REAL VORLD Year 2 Year 1 Total assets $35,291 $34,408 Total liabilities 29,418 27,974 FAI a. Determine the total stockholders' equity at the end of Years 2 and 1. b. Determine the ratio of liabilities to stockholders' equity for Year 2 and Year 1. Round to two decimal places. What conclusions regarding the risk to the creditors can you draw from (b)? C. d. Using the balance sheet data for The Home Depot in Exercise 1-26, how does the ratio of liabilities to stockholders' equity of Lowe's compare to that of The Home Depot? roblems: Series A OBJ, 4 PR 1-1A Transactions

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter1: Introduction To Accounting And Business

Section: Chapter Questions

Problem 1.3ADM: Lowes: Ratio of liabilities to stockholders equity Lowes Companies, Inc., a major competitor to The...

Related questions

Question

Transcribed Image Text:Chapter 1 Introduction to Accounting and Business

EX 1-27 Ratio of liabilities to stockholders' equity

Lowe's Companies Inc., a major competitor of The Home Depot in the home improve-

ment business, operates over 1,800 stores. Lowe's recently reported the following balance

sheet data (in millions):

OBJ. 6

2: 5.01

REAL

VORLD

Year 2

Year 1

Total assets

$35,291

$34,408

Total liabilities

29,418

27,974

FAI

a. Determine the total stockholders' equity at the end of Years 2 and 1.

b. Determine the ratio of liabilities to stockholders' equity for Year 2 and Year 1. Round to

two decimal places.

What conclusions regarding the risk to the creditors can you draw from (b)?

C.

d. Using the balance sheet data for The Home Depot in Exercise 1-26, how does the ratio

of liabilities to stockholders' equity of Lowe's compare to that of The Home Depot?

roblems: Series A

OBJ, 4

PR 1-1A Transactions

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,