%24 S. Required information [The following information applies to the questions displayed below.] The following transactions apply to Jova Company for Year 1, the first year of operation: 1. Issued $15,500 of common stock for cash. 2. Recognized $64,500 of service revenue earned on account. 3. Collected $57,600 from accounts receivable. 4. Paid operating expenses of $36,000. 5. Adjusted accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for uncollectible accounts and estimates that uncollectible accounts expense will be 2 percent of sales on account. The following transactions apply to Jova for Year 2: 1. Recognized $72,000 of service revenue on account. 2. Collected $65,600 from accounts receivable. Determined that $890 of the accounts receivable were uncollectible and wrote them off. 4. Collected $300 of an account that had previously been written off. 5. Paid $48,400 cash for operating expenses. 6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectible accounts expense will be 1.0 percent of sales on account. Required Complete the following requirements for Year 1 and Year 2. Complete all requirements for Year 1 prior to beginning the requirements for Year 2. 1 of 5 Next > search 70°F fg SuI prt sc AA 144 & $4 5. R. 33 H. sned B. alt ctrl L5 %24 Show less A Req C1 Req C2 Organize the transaction data in accounts under an accounting equation for Year 1. (Enter any decreases to account balances with a minus sign. If there is no effect on the Accounts Titles for Retained Earnings, leave the cell blank. Not all cells will require entry.) JOVA COMPANY Accounting Equation for the Year 1 Assets Equity Accounting Titles for Retained Earnings Event = Liabilities + Common Retained NRV Accounts Receivable Cash Stock Earnings 1. 15,500 + 15,500 2. 64,500 = 64,500 Service revenue (57,600) 3. 4. + 009 (36,000) Operating expenses (1,290) Uncollectible accounts expense 5. Bal. 37,100 + 27,210 = 006 +0 + 00 < Req C1 Req C2 > 1 of 5 ...... < xeN e to search O 70°F SUI prt sc delete 61 AA KA 原S & %23 backspace 3. 7. 33 H. pause WIN alt

%24 S. Required information [The following information applies to the questions displayed below.] The following transactions apply to Jova Company for Year 1, the first year of operation: 1. Issued $15,500 of common stock for cash. 2. Recognized $64,500 of service revenue earned on account. 3. Collected $57,600 from accounts receivable. 4. Paid operating expenses of $36,000. 5. Adjusted accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for uncollectible accounts and estimates that uncollectible accounts expense will be 2 percent of sales on account. The following transactions apply to Jova for Year 2: 1. Recognized $72,000 of service revenue on account. 2. Collected $65,600 from accounts receivable. Determined that $890 of the accounts receivable were uncollectible and wrote them off. 4. Collected $300 of an account that had previously been written off. 5. Paid $48,400 cash for operating expenses. 6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectible accounts expense will be 1.0 percent of sales on account. Required Complete the following requirements for Year 1 and Year 2. Complete all requirements for Year 1 prior to beginning the requirements for Year 2. 1 of 5 Next > search 70°F fg SuI prt sc AA 144 & $4 5. R. 33 H. sned B. alt ctrl L5 %24 Show less A Req C1 Req C2 Organize the transaction data in accounts under an accounting equation for Year 1. (Enter any decreases to account balances with a minus sign. If there is no effect on the Accounts Titles for Retained Earnings, leave the cell blank. Not all cells will require entry.) JOVA COMPANY Accounting Equation for the Year 1 Assets Equity Accounting Titles for Retained Earnings Event = Liabilities + Common Retained NRV Accounts Receivable Cash Stock Earnings 1. 15,500 + 15,500 2. 64,500 = 64,500 Service revenue (57,600) 3. 4. + 009 (36,000) Operating expenses (1,290) Uncollectible accounts expense 5. Bal. 37,100 + 27,210 = 006 +0 + 00 < Req C1 Req C2 > 1 of 5 ...... < xeN e to search O 70°F SUI prt sc delete 61 AA KA 原S & %23 backspace 3. 7. 33 H. pause WIN alt

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter6: Cash And Internal Control

Section: Chapter Questions

Problem 6.1DC

Related questions

Question

It's not incomplete

![%24

S.

Required information

[The following information applies to the questions displayed below.]

The following transactions apply to Jova Company for Year 1, the first year of operation:

1. Issued $15,500 of common stock for cash.

2. Recognized $64,500 of service revenue earned on account.

3. Collected $57,600 from accounts receivable.

4. Paid operating expenses of $36,000.

5. Adjusted accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for

uncollectible accounts and estimates that uncollectible accounts expense will be 2 percent of sales on account.

The following transactions apply to Jova for Year 2:

1. Recognized $72,000 of service revenue on account.

2. Collected $65,600 from accounts receivable.

Determined that $890 of the accounts receivable were uncollectible and wrote them off.

4. Collected $300 of an account that had previously been written off.

5. Paid $48,400 cash for operating expenses.

6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectible accounts

expense will be 1.0 percent of sales on account.

Required

Complete the following requirements for Year 1 and Year 2. Complete all requirements for Year 1 prior to beginning the

requirements for Year 2.

1 of 5

Next >

search

70°F

fg

SuI

prt sc

AA

144

&

$4

5.

R.

33

H.

sned

B.

alt

ctrl](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F585e4a80-646c-4418-ada9-cb992a2ce44b%2F999de3a8-2cea-466a-b266-1971bd882460%2Fd7h6cu5.jpeg&w=3840&q=75)

Transcribed Image Text:%24

S.

Required information

[The following information applies to the questions displayed below.]

The following transactions apply to Jova Company for Year 1, the first year of operation:

1. Issued $15,500 of common stock for cash.

2. Recognized $64,500 of service revenue earned on account.

3. Collected $57,600 from accounts receivable.

4. Paid operating expenses of $36,000.

5. Adjusted accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for

uncollectible accounts and estimates that uncollectible accounts expense will be 2 percent of sales on account.

The following transactions apply to Jova for Year 2:

1. Recognized $72,000 of service revenue on account.

2. Collected $65,600 from accounts receivable.

Determined that $890 of the accounts receivable were uncollectible and wrote them off.

4. Collected $300 of an account that had previously been written off.

5. Paid $48,400 cash for operating expenses.

6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectible accounts

expense will be 1.0 percent of sales on account.

Required

Complete the following requirements for Year 1 and Year 2. Complete all requirements for Year 1 prior to beginning the

requirements for Year 2.

1 of 5

Next >

search

70°F

fg

SuI

prt sc

AA

144

&

$4

5.

R.

33

H.

sned

B.

alt

ctrl

Transcribed Image Text:L5

%24

Show less A

Req C1

Req C2

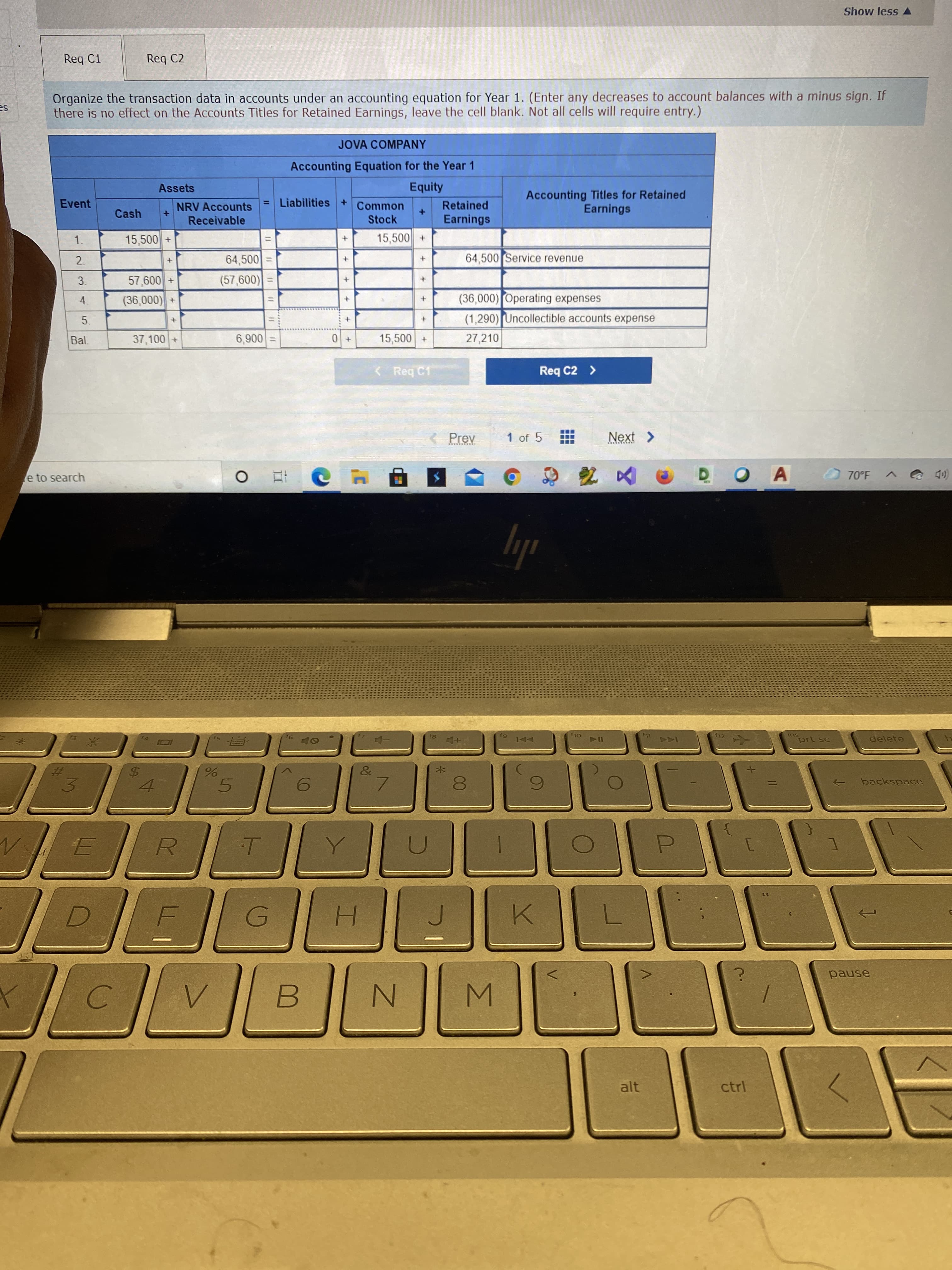

Organize the transaction data in accounts under an accounting equation for Year 1. (Enter any decreases to account balances with a minus sign. If

there is no effect on the Accounts Titles for Retained Earnings, leave the cell blank. Not all cells will require entry.)

JOVA COMPANY

Accounting Equation for the Year 1

Assets

Equity

Accounting Titles for Retained

Earnings

Event

= Liabilities +

Common

Retained

NRV Accounts

Receivable

Cash

Stock

Earnings

1.

15,500 +

15,500

2.

64,500 =

64,500 Service revenue

(57,600)

3.

4.

+ 009

(36,000) Operating expenses

(1,290) Uncollectible accounts expense

5.

Bal.

37,100 +

27,210

= 006

+0

+ 00

< Req C1

Req C2 >

1 of 5

......

< xeN

e to search

O 70°F

SUI

prt sc

delete

61

AA

KA

原S

&

%23

backspace

3.

7.

33

H.

pause

WIN

alt

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning