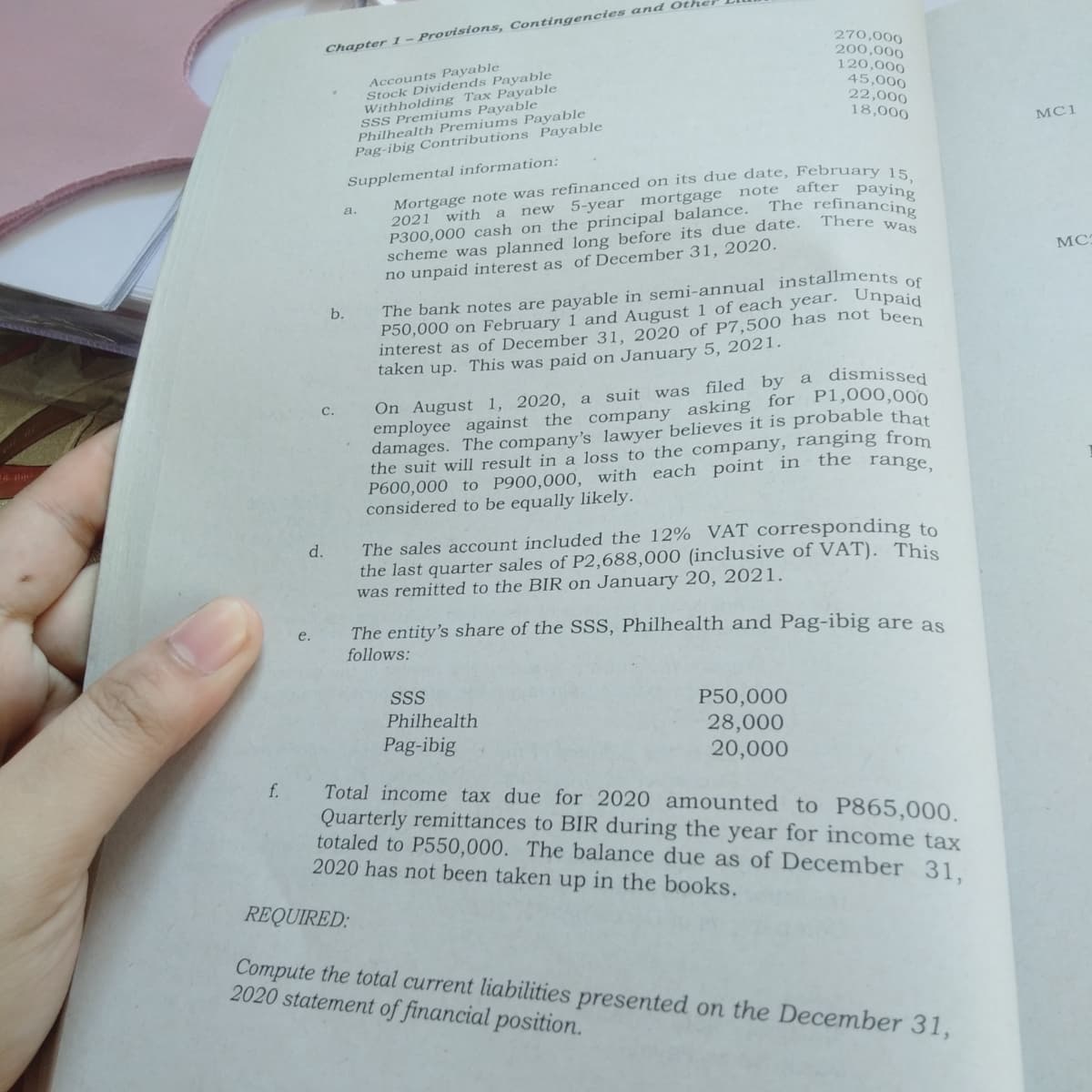

Chapter 1 – Provisions, Accounts Payable Stock Dividends Payable Withholding Tax Payable ssS Premiums Payable Philhealth Premiums Payable Pag-ibig Contributions Payable 270,000 200,000 120,000 45,000 22,000 18,000 MC Mortgage note was refinanced on its due date, February 15, 5-year mortgage note after paying Supplemental information: The refinancing There was a. new P300,000 cash on the principal balance. scheme was planned long before its due date. no unpaid interest as of December 31, 2020. 2021 with a The bank notes are payable in semi-annual installments os P50,000 on February 1 and August1 of each year. Unpaid interest as of December 31, 2020 of P7,500 has not been taken up. This was paid on January 5, 2021. b. suit was filed by a dismissed On August 1, 2020, a employee against the company asking for Pl,000,000 damages. The company's lawyer believes it is probable that the suit will result in a loss to the company, ranging from P600,000 to P900,000, with each point in considered to be equally likely. С. the range, The sales account included the 12% VAT corresponding to the last quarter sales of P2,688,000 (inclusive of VAT). This was remitted to the BIR on January 20, 2021. d. The entity's share of the SSS, Philhealth and Pag-ibig are as e. follows: SSS P50,000 28,000 20,000 Philhealth Pag-ibig Total income tax due for 2020 amounted to P865,000. Quarterly remittances to BIR during the year for income tax totaled to P550,000. The balance due as of December 31. 2020 has not been taken up in the books. f. REQUIRED: Compute the total current liabilities presented on the December 31, 2020 statement of financial position.

Chapter 1 – Provisions, Accounts Payable Stock Dividends Payable Withholding Tax Payable ssS Premiums Payable Philhealth Premiums Payable Pag-ibig Contributions Payable 270,000 200,000 120,000 45,000 22,000 18,000 MC Mortgage note was refinanced on its due date, February 15, 5-year mortgage note after paying Supplemental information: The refinancing There was a. new P300,000 cash on the principal balance. scheme was planned long before its due date. no unpaid interest as of December 31, 2020. 2021 with a The bank notes are payable in semi-annual installments os P50,000 on February 1 and August1 of each year. Unpaid interest as of December 31, 2020 of P7,500 has not been taken up. This was paid on January 5, 2021. b. suit was filed by a dismissed On August 1, 2020, a employee against the company asking for Pl,000,000 damages. The company's lawyer believes it is probable that the suit will result in a loss to the company, ranging from P600,000 to P900,000, with each point in considered to be equally likely. С. the range, The sales account included the 12% VAT corresponding to the last quarter sales of P2,688,000 (inclusive of VAT). This was remitted to the BIR on January 20, 2021. d. The entity's share of the SSS, Philhealth and Pag-ibig are as e. follows: SSS P50,000 28,000 20,000 Philhealth Pag-ibig Total income tax due for 2020 amounted to P865,000. Quarterly remittances to BIR during the year for income tax totaled to P550,000. The balance due as of December 31. 2020 has not been taken up in the books. f. REQUIRED: Compute the total current liabilities presented on the December 31, 2020 statement of financial position.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 12E: On October 1, 2019, Ball Company issued 9% bonds dated October 1, 2019, with a face amount of...

Related questions

Question

Transcribed Image Text:Llon.

COmpu

Containers at December 31, 2020.

ly when

piration

iration,

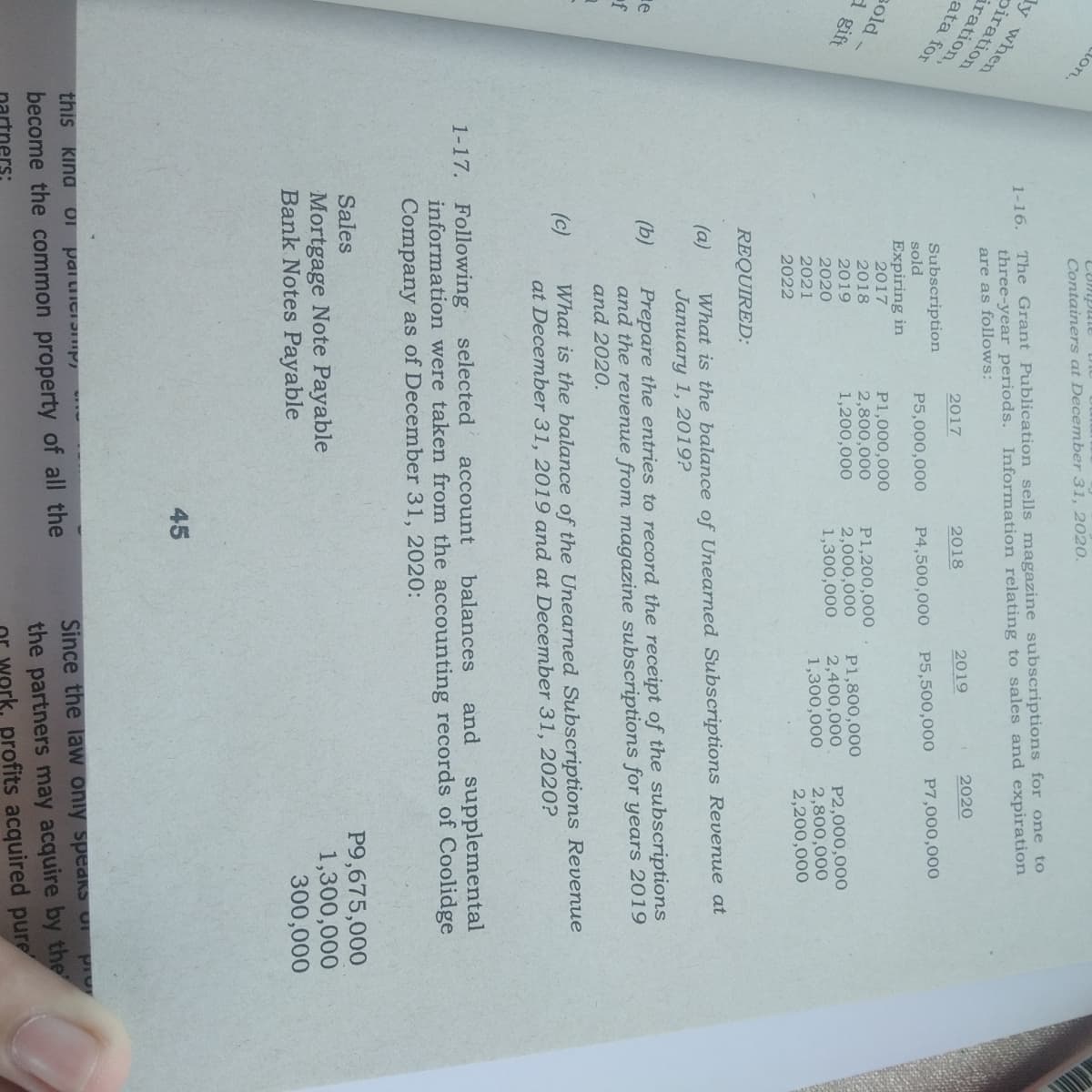

The Grant Publication sells magazine subscriptions for one to

three-year periods. Information relating to sales and expiration

are as follows:

1-16.

2020

2019

2018

2017

ata for

P7,000,000

Subscription

P5,500,000

P5,000,000

P4,500,000

sold

Expiring in

2017

P1,000,000

2,800,000

1,200,000

sold

P1,200,000

2,000,000

1,300,000

P1,800,000

2,400,000

1,300,000

2018

P2,000,000

2,800,000

2,200,000

d gift

2019

2020

2021

2022

REQUIRED:

What is the balance of Unearned Subscriptions Revenue at

January 1, 2019?

(a)

Prepare the entries to record the receipt of the subscriptions

and the revenue from magazine subscriptions for years 2019

and 2020.

(b)

of

What is the balance of the Unearned Subscriptions Revenue

at December 31, 2019 and at December 31, 2020?

(c)

and

supplemental

account

balances

information were taken from the accounting records of Coolidge

Company as of December 31, 2020:

selected

1-17. Following

P9,675,000

1,300,000

300,000

Sales

Mortgage Note Payable

Bank Notes Payable

45

Since the law oniy speaKS U Pr

the partners may acquire by the

work, profits acquired pure

this Kina

become the common property of all the

ers:

Transcribed Image Text:270,000

200,000

120,000

45,000

22,000

18,000

Chapter 1 – Provisions, Contingencies and Ot

Accounts Payable

Stock Dividends Payable

Withholding Tax Payable

SSS Premiums Payable

Philhealth Premiums Payable

Pag-ibig Contributions Payable

MC1

Supplemental information:

note after paying

a.

new 5-year mortgage

2021 with

There was

scheme was planned long before its due date.

no unpaid interest as of December 31, 2020.

МС

The bank notes are payable in semi-annual installments s

P50,000 on February 1 and August 1 of each year. Unpaid

interest as of December 31, 2020 of P7,500 has not been

taken up. This was paid on January 5, 2021.

b.

On August 1, 2020, a suit was filed by a dismissed

employee against the company asking for P1,000,000

damages. The company's lawyer believes it is probable that

the suit will result in a loss to the company, ranging from

P600,000 to P900,000, with each point in the

considered to be equally likely.

С.

range,

The sales account included the 12% VAT corresponding to

the last quarter sales of P2,688,000 (inclusive of VAT). This

was remitted to the BIR on January 20, 2021.

d.

The entity's share of the SSS, Philhealth and Pag-ibig are as

follows:

e.

SSS

P50,000

28,000

20,000

Philhealth

Pag-ibig

f.

Total income tax du

Quarterly remittances to BIR during the year for income tax

totaled to P550,000. The balance due as of December 31.

2020 has not been taken up in the books.

for 2020 amounted to P865,000.

REQUIRED:

Compute the total current liabilities presented on the December 31,

2020 statement of financial position.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning