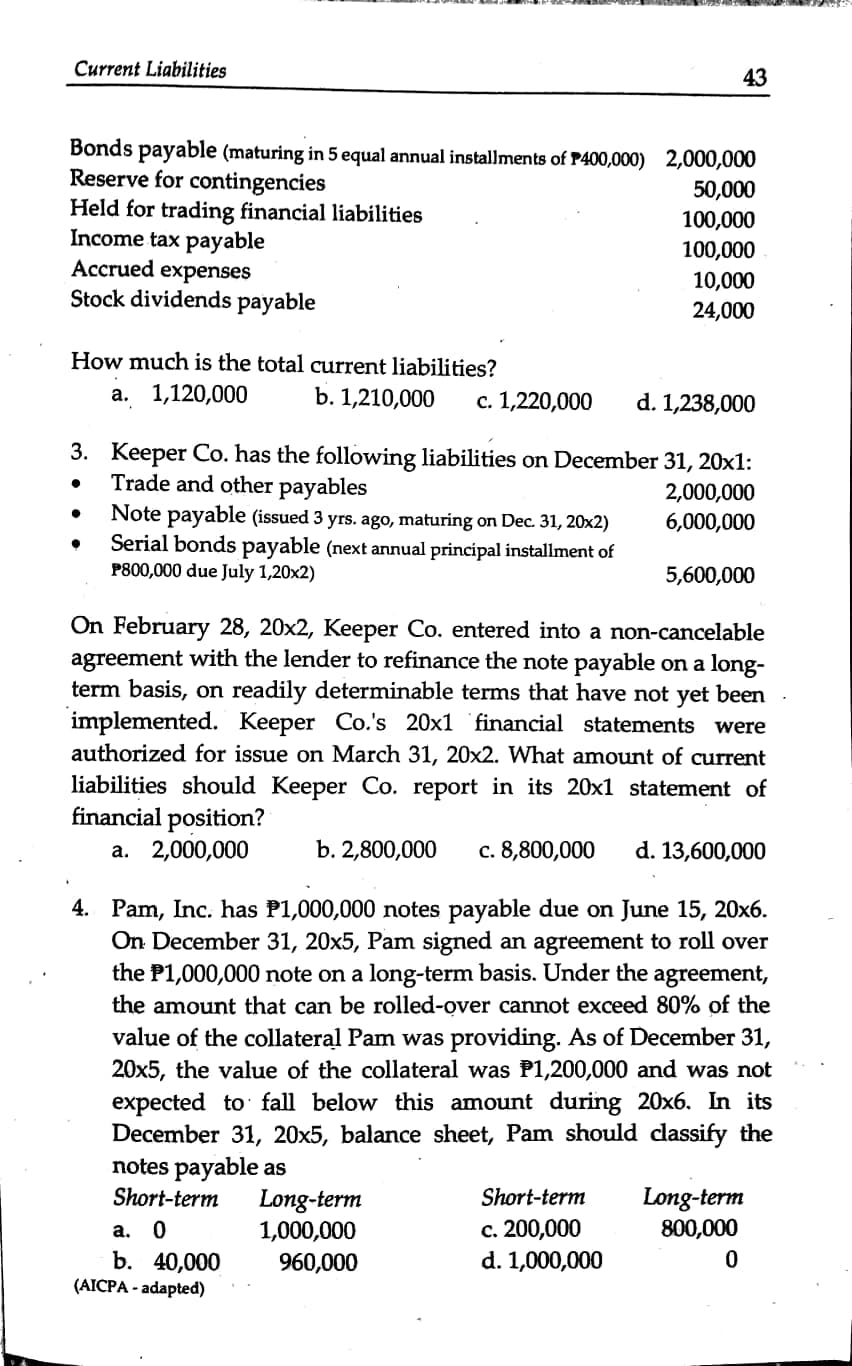

Bonds payable (maturing in 5 equal annual installments of P400,000) 2,000,000 Reserve for contingencies Held for trading financial liabilities Income tax payable Accrued expenses Stock dividends payable 50,000 100,000 100,000 10,000 24,000 How much is the total current liabilities? а. 1,120,000 b. 1,210,000 c. 1,220,000 d. 1,238,000

Bonds payable (maturing in 5 equal annual installments of P400,000) 2,000,000 Reserve for contingencies Held for trading financial liabilities Income tax payable Accrued expenses Stock dividends payable 50,000 100,000 100,000 10,000 24,000 How much is the total current liabilities? а. 1,120,000 b. 1,210,000 c. 1,220,000 d. 1,238,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter4: The Balance Sheet And The Statement Of Shareholders' Equity

Section: Chapter Questions

Problem 16P: Ratios Analyses: McCormick Refer to the information for McCormick above. Additional information for...

Related questions

Question

multiple choice

Transcribed Image Text:Current Liabilities

43

Bonds payable (maturing in 5 equal annual installments of P400,000) 2,000,000

Reserve for contingencies

Held for trading financial liabilities

Income tax payable

Accrued expenses

Stock dividends payable

50,000

100,000

100,000

10,000

24,000

How much is the total current liabilities?

а. 1,120,000

b. 1,210,000

c. 1,220,000

d. 1,238,000

3. Keeper Co. has the following liabilities on December 31, 20x1:

Trade and other payables

Note payable (issued 3 yrs. ago, maturing on Dec. 31, 20x2)

Serial bonds payable (next annual principal installment of

P800,000 due July 1,20x2)

2,000,000

6,000,000

5,600,000

On February 28, 20x2, Keeper Co. entered into a non-cancelable

agreement with the lender to refinance the note payable on a long-

term basis, on readily determinable terms that have not yet been

implemented. Keeper Co.'s 20x1 financial statements were

authorized for issue on March 31, 20x2. What amount of current

liabilities should Keeper Co. report in its 20x1 statement of

financial position?

а. 2,000,000

b. 2,800,000

c. 8,800,000

d. 13,600,000

4. Pam, Inc. has P1,000,000 notes payable due on June 15, 20x6.

On December 31, 20x5, Pam signed an agreement to roll over

the P1,000,000 note on a long-term basis. Under the agreement,

the amount that can be rolled-over cannot exceed 80% of the

value of the collateral Pam was providing. As of December 31,

20x5, the value of the collateral was P1,200,000 and was not

expected to fall below this amount during 20x6. In its

December 31, 20x5, balance sheet, Pam should classify the

notes payable as

Short-term

Short-term

Long-term

1,000,000

Long-term

800,000

c. 200,000

d. 1,000,000

а. 0

b. 40,000

(AICPA - adapted)

960,000

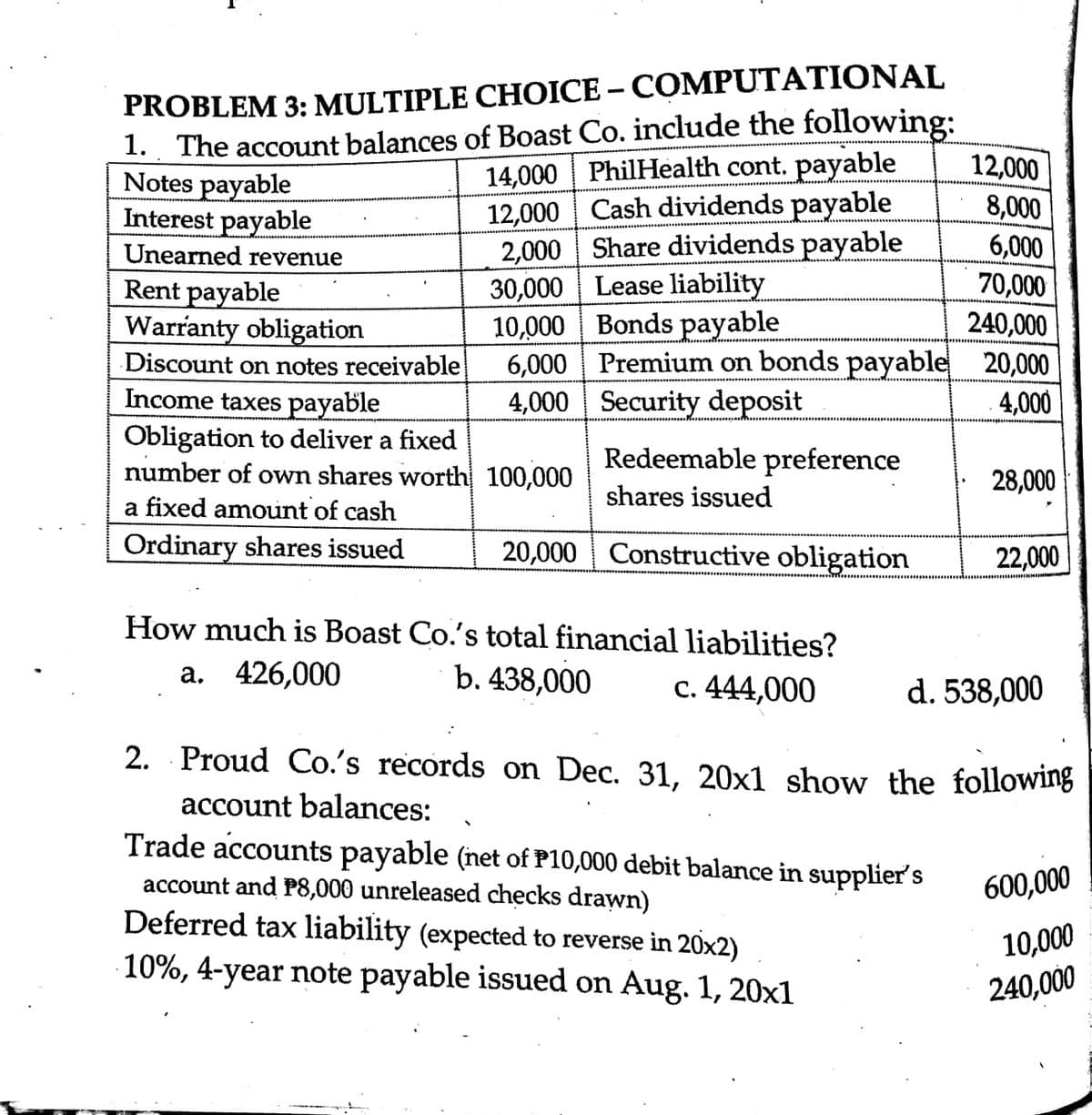

Transcribed Image Text:PROBLEM 3: MULTIPLE CHOICE – COMPUTATIONAL

1. The account balances of Boast Co. include the following:

Notes payable

Interest payable

14,000 PhilHealth cont. payable

12,000 Cash dividends payable

2,000 Share dividends payable

30,000 Lease liability

10,000 Bonds payable

6,000 Premium on bonds payable 20,000

4,000 Security deposit

12,000

8,000

6,000

70,000

240,000

Unearned revenue

Rent payable

Warranty obligation

Discount on notes receivable

Income taxes payable

Obligation to deliver a fixed

number of own shares worth 100,000

a fixed amount of cash

Ordinary shares issued

4,000

Redeemable preference

28,000

shares issued

20,000 Constructive obligation

22,000

How much is Boast Co.'s total financial liabilities?

а. 426,000

b. 438,000

c. 444,000

d. 538,000

2. Proud Co.'s records on Dec. 31, 20x1 show the following

account balances:

Trade accounts payable (net of P10,000 debit balance in supplier's

account and P8,000 unreleased checks drawn)

Deferred tax liability (expected to reverse in 20x2)

10%, 4-year note payable issued on Aug. 1, 20x1

600,000

10,000

240,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning