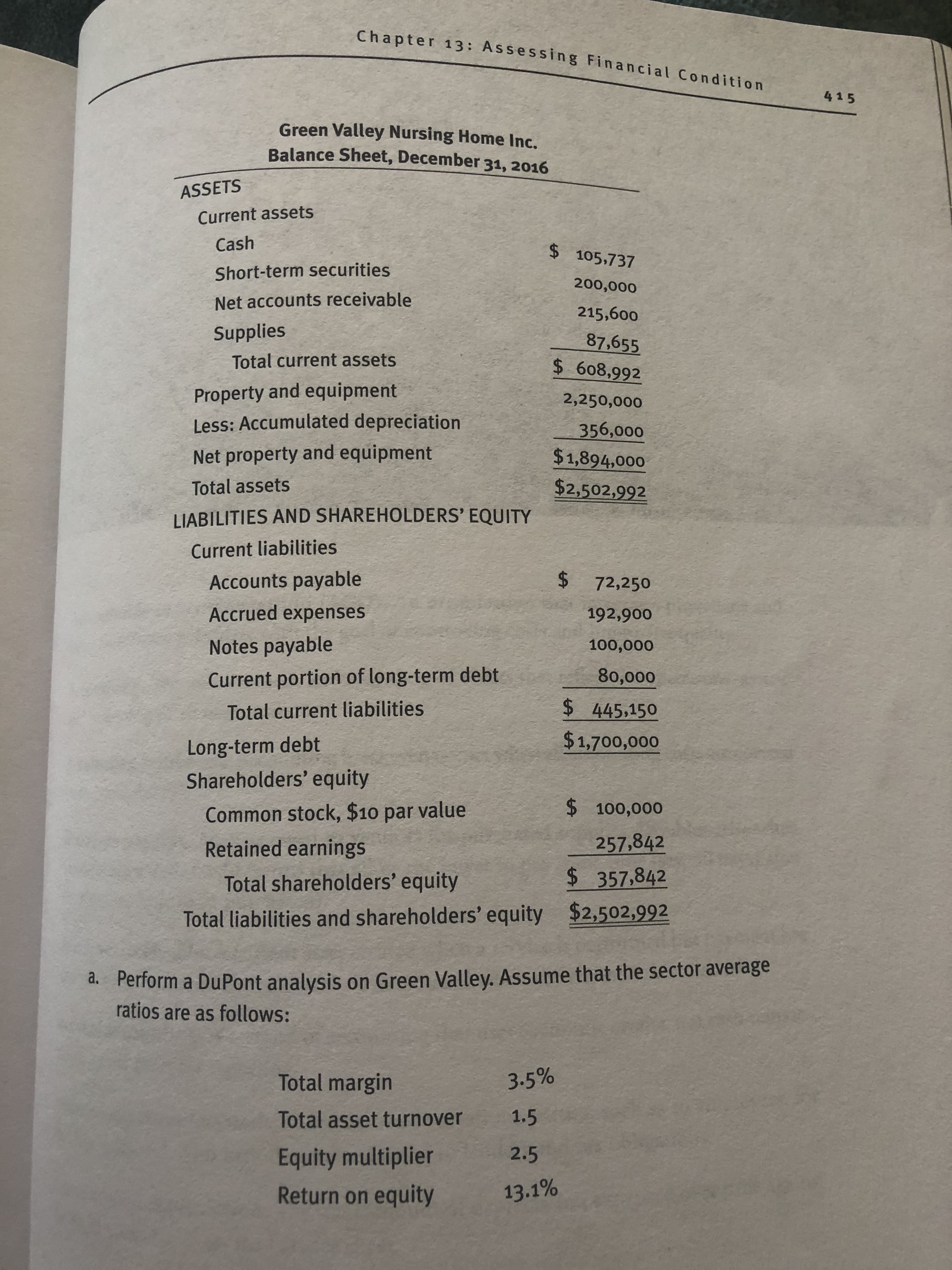

Chapter 13: Assessing Financial Condition 415 Green Valley Nursing Home Inc. Balance Sheet, December 31, 2016 ASSETS Current assets Cash Short-term securities Net accounts receivable Supplies $105,737 200,000 215,600 87,655 $ 608,992 2,250,000 356,000 $1,894,000 $2,502,992 Total current assets Property and equipment Less: Accumulated depreciation Net property and equipment Total assets LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities Accounts payable Accrued expenses Notes payable $ 72,250 192,900 100,000 Current portion of long-term debt80,000 $ 445,150 $1,700,00o Total current liabilities Long-term debt Shareholders' equity $100,000 257,842 $ 357,842 Total liabilities and shareholders' equity $2,502,992 Common stock, $10 par value Retained earnings Total shareholders' equity m a DuPont analysis on Green Valley. Assume that the sector average ratios are as follows: Total margin Total asset turnover Equity multiplier Return on equity 35% 1.5 2.5 13.1%

Chapter 13: Assessing Financial Condition 415 Green Valley Nursing Home Inc. Balance Sheet, December 31, 2016 ASSETS Current assets Cash Short-term securities Net accounts receivable Supplies $105,737 200,000 215,600 87,655 $ 608,992 2,250,000 356,000 $1,894,000 $2,502,992 Total current assets Property and equipment Less: Accumulated depreciation Net property and equipment Total assets LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities Accounts payable Accrued expenses Notes payable $ 72,250 192,900 100,000 Current portion of long-term debt80,000 $ 445,150 $1,700,00o Total current liabilities Long-term debt Shareholders' equity $100,000 257,842 $ 357,842 Total liabilities and shareholders' equity $2,502,992 Common stock, $10 par value Retained earnings Total shareholders' equity m a DuPont analysis on Green Valley. Assume that the sector average ratios are as follows: Total margin Total asset turnover Equity multiplier Return on equity 35% 1.5 2.5 13.1%

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.10P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

perform a DuPont analysis?

Transcribed Image Text:Chapter 13:

Assessing Financial Condition

415

Green Valley Nursing Home Inc.

Balance Sheet, December 31, 2016

ASSETS

Current assets

Cash

Short-term securities

Net accounts receivable

Supplies

$105,737

200,000

215,600

87,655

$ 608,992

2,250,000

356,000

$1,894,000

$2,502,992

Total current assets

Property and equipment

Less: Accumulated depreciation

Net property and equipment

Total assets

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities

Accounts payable

Accrued expenses

Notes payable

$ 72,250

192,900

100,000

Current portion of long-term debt80,000

$ 445,150

$1,700,00o

Total current liabilities

Long-term debt

Shareholders' equity

$100,000

257,842

$ 357,842

Total liabilities and shareholders' equity $2,502,992

Common stock, $10 par value

Retained earnings

Total shareholders' equity

m a DuPont analysis on Green Valley. Assume that the sector average

ratios are as follows:

Total margin

Total asset turnover

Equity multiplier

Return on equity

35%

1.5

2.5

13.1%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 7 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning