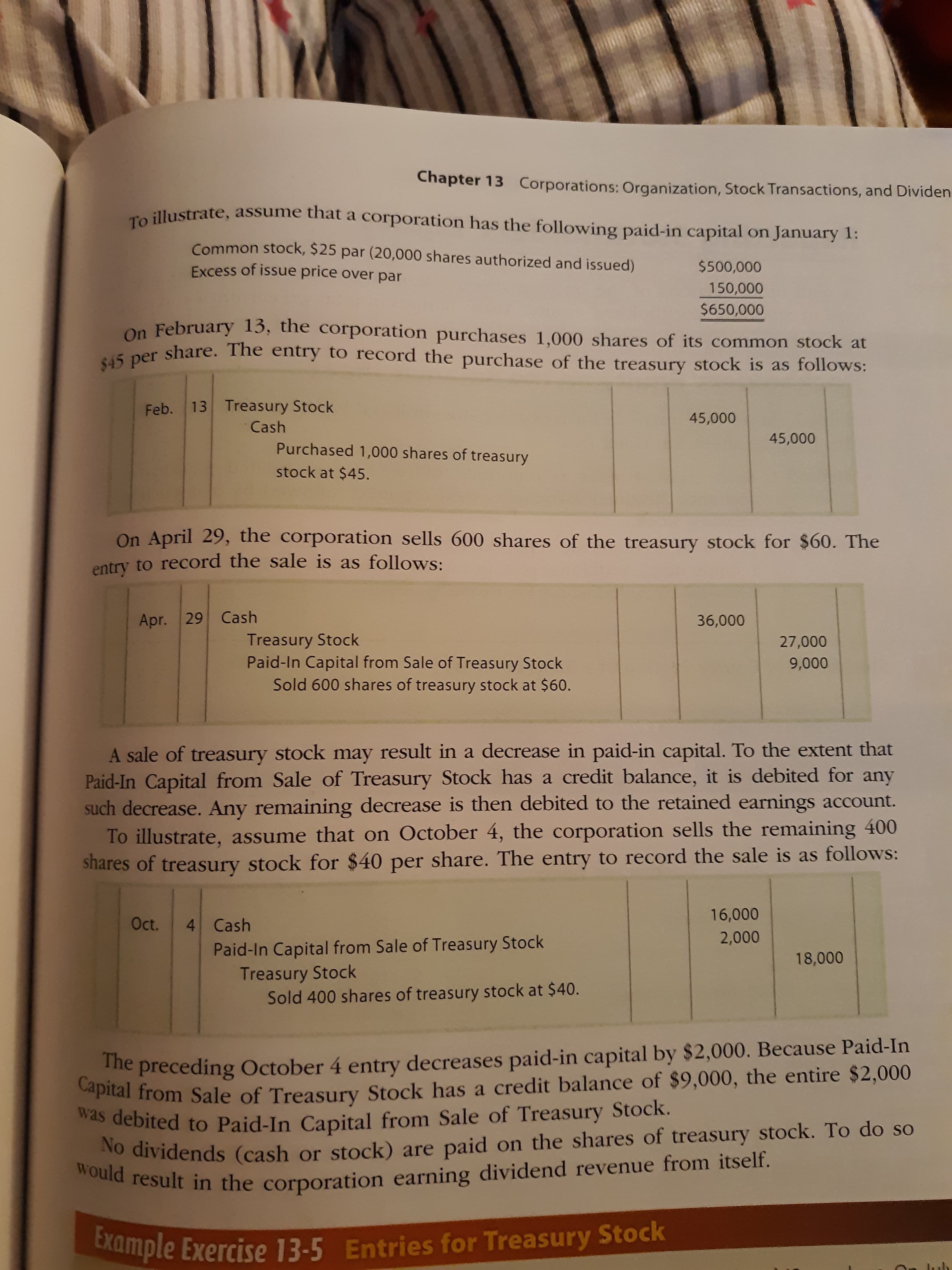

Chapter 13 Corporations: Organization, Stock Transactions, and Dividen To illustrate, assume that a corporation has the following paid-in capital on January 1: Common stock, $25 par (20,000 shares authorized and issued) $500,000 Excess of issue price over par 150,000 $650,000 On February 13, the corporation purchases 1,000 shares of its common stock at VE per share. The entry to record the purchase of the treasury stock is as follows: 13 Treasury Stock Feb. 45,000 Cash 45,000 Purchased 1,000 shares of treasury stock at $45. On April 29, the corporation sells 600 shares of the treasury stock for $60. The entry to record the sale is as follows: Apr. 29 Cash 36,000 Treasury Stock Paid-In Capital from Sale of Treasury Stock Sold 600 shares of treasury stock at $60. 27,000 9,000 A sale of treasury stock may result in a decrease in paid-in capital. To the extent that Paid-In Capital from Sale of Treasury Stock has a credit balance, it is debited for any such decrease. Any remaining decrease is then debited to the retained earnings account. To illustrate, assume that on October 4, the corporation sells the remaining 400 shares of treasury stock for $40 per share. The entry to record the sale is as follows: 16,000 Oct. 4 Cash 2,000 Paid-In Capital from Sale of Treasury Stock Treasury Stock Sold 400 shares of treasury stock at $40. 18,000 preceding October 4 entry decreases paid-in capital by $2,000. Because Paid-In Capital from Sale of Treasury Stock has a credit balance of $9,000, the entire $2,000 as debited to Paid-In Capital from Sale of Treasury Stock. No dividends (cash or stock) are paid on the shares of treasury stock. To do so would result in the corporation earning dividend revenue from itself. Example Exercise 13-5 Entries for Treasury Stock

Chapter 13 Corporations: Organization, Stock Transactions, and Dividen To illustrate, assume that a corporation has the following paid-in capital on January 1: Common stock, $25 par (20,000 shares authorized and issued) $500,000 Excess of issue price over par 150,000 $650,000 On February 13, the corporation purchases 1,000 shares of its common stock at VE per share. The entry to record the purchase of the treasury stock is as follows: 13 Treasury Stock Feb. 45,000 Cash 45,000 Purchased 1,000 shares of treasury stock at $45. On April 29, the corporation sells 600 shares of the treasury stock for $60. The entry to record the sale is as follows: Apr. 29 Cash 36,000 Treasury Stock Paid-In Capital from Sale of Treasury Stock Sold 600 shares of treasury stock at $60. 27,000 9,000 A sale of treasury stock may result in a decrease in paid-in capital. To the extent that Paid-In Capital from Sale of Treasury Stock has a credit balance, it is debited for any such decrease. Any remaining decrease is then debited to the retained earnings account. To illustrate, assume that on October 4, the corporation sells the remaining 400 shares of treasury stock for $40 per share. The entry to record the sale is as follows: 16,000 Oct. 4 Cash 2,000 Paid-In Capital from Sale of Treasury Stock Treasury Stock Sold 400 shares of treasury stock at $40. 18,000 preceding October 4 entry decreases paid-in capital by $2,000. Because Paid-In Capital from Sale of Treasury Stock has a credit balance of $9,000, the entire $2,000 as debited to Paid-In Capital from Sale of Treasury Stock. No dividends (cash or stock) are paid on the shares of treasury stock. To do so would result in the corporation earning dividend revenue from itself. Example Exercise 13-5 Entries for Treasury Stock

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter20: Corporations: Organization And Capital Stock

Section: Chapter Questions

Problem 9SPB: STOCK SUBSCRIPTIONS AND TREASURY STOCK Rogers Hart formed a corporation and had the following...

Related questions

Question

100%

This is an example in my textbook for

Transcribed Image Text:Chapter 13

Corporations: Organization, Stock Transactions, and Dividen

To illustrate, assume that a corporation has the following paid-in capital on January 1:

Common stock, $25 par (20,000 shares authorized and issued)

$500,000

Excess of issue price over par

150,000

$650,000

On February 13, the corporation purchases 1,000 shares of its common stock at

VE per share. The entry to record the purchase of the treasury stock is as follows:

13 Treasury Stock

Feb.

45,000

Cash

45,000

Purchased 1,000 shares of treasury

stock at $45.

On April 29, the corporation sells 600 shares of the treasury stock for $60. The

entry to record the sale is as follows:

Apr. 29 Cash

36,000

Treasury Stock

Paid-In Capital from Sale of Treasury Stock

Sold 600 shares of treasury stock at $60.

27,000

9,000

A sale of treasury stock may result in a decrease in paid-in capital. To the extent that

Paid-In Capital from Sale of Treasury Stock has a credit balance, it is debited for any

such decrease. Any remaining decrease is then debited to the retained earnings account.

To illustrate, assume that on October 4, the corporation sells the remaining 400

shares of treasury stock for $40 per share. The entry to record the sale is as follows:

16,000

Oct.

4 Cash

2,000

Paid-In Capital from Sale of Treasury Stock

Treasury Stock

Sold 400 shares of treasury stock at $40.

18,000

preceding October 4 entry decreases paid-in capital by $2,000. Because Paid-In

Capital from Sale of Treasury Stock has a credit balance of $9,000, the entire $2,000

as debited to Paid-In Capital from Sale of Treasury Stock.

No dividends (cash or stock) are paid on the shares of treasury stock. To do so

would result in the corporation earning dividend revenue from itself.

Example Exercise 13-5

Entries for Treasury Stock

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning