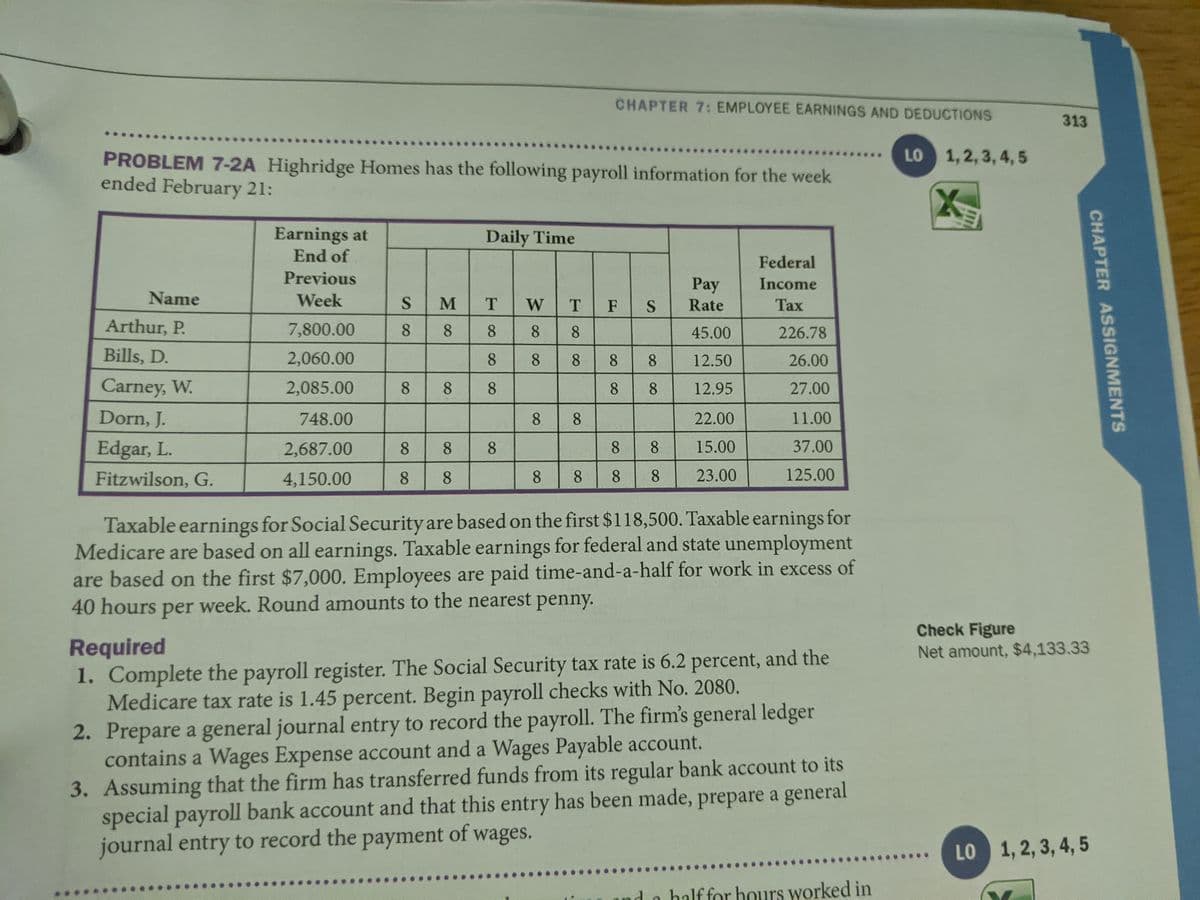

CHAPTER 7: EMPLOYEE EARNINGS AND DEDUCTIONS LO 1,2,3, 4,5 PROBLEM 7-2A Highridge Homes has the following payroll information for the week ended February 21: Earnings at End of Daily Time Federal Previous Pay Income Name Week S M W Rate Тах Arthur, P. 7,800.00 8. 8 8. 8. 8 45.00 226.78 Bills, D. 2,060.00 8. 8. 8. 8. 8 12.50 26.00 Carney, W. 2,085.00 8 8 8. 8. 8 12.95 27.00 Dorn, J. 748.00 8 8 22.00 11.00 Edgar, L. 2,687.00 8. 8. 8. 8 8 15.00 37.00 Fitzwilson, G. 4,150.00 8 8 8. 8. 23.00 125.00 Taxable earnings for Social Security are based on the first $118,500. Taxable earnings for Medicare are based on all earnings. Taxable earnings for federal and state unemployment are based on the first $7,000. Employees are paid time-and-a-half for work in excess of 40 hours per week. Round amounts to the nearest penny. Check Figure Net amount, $4, Required 1. Complete the payroll register. The Social Security tax rate is 6.2 percent, and the Medicare tax rate is 1.45 percent. Begin payroll checks with No. 2080. 2. Prepare a general journal entry to record the payroll. The firm's general ledger contains a Wages Expense account and a Wages Payable account. 3. Assuming that the firm has transferred funds from its regular bank account to its special payroll bank account and that this entry has been made, prepare a general journal entry to record the payment of wages.

CHAPTER 7: EMPLOYEE EARNINGS AND DEDUCTIONS LO 1,2,3, 4,5 PROBLEM 7-2A Highridge Homes has the following payroll information for the week ended February 21: Earnings at End of Daily Time Federal Previous Pay Income Name Week S M W Rate Тах Arthur, P. 7,800.00 8. 8 8. 8. 8 45.00 226.78 Bills, D. 2,060.00 8. 8. 8. 8. 8 12.50 26.00 Carney, W. 2,085.00 8 8 8. 8. 8 12.95 27.00 Dorn, J. 748.00 8 8 22.00 11.00 Edgar, L. 2,687.00 8. 8. 8. 8 8 15.00 37.00 Fitzwilson, G. 4,150.00 8 8 8. 8. 23.00 125.00 Taxable earnings for Social Security are based on the first $118,500. Taxable earnings for Medicare are based on all earnings. Taxable earnings for federal and state unemployment are based on the first $7,000. Employees are paid time-and-a-half for work in excess of 40 hours per week. Round amounts to the nearest penny. Check Figure Net amount, $4, Required 1. Complete the payroll register. The Social Security tax rate is 6.2 percent, and the Medicare tax rate is 1.45 percent. Begin payroll checks with No. 2080. 2. Prepare a general journal entry to record the payroll. The firm's general ledger contains a Wages Expense account and a Wages Payable account. 3. Assuming that the firm has transferred funds from its regular bank account to its special payroll bank account and that this entry has been made, prepare a general journal entry to record the payment of wages.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 10.12EX: Payroll entries The payroll register for D. Salah Company for the week ended May 18 indicated the...

Related questions

Question

Needing some help.

Transcribed Image Text:CHAPTER 7: EMPLOYEE EARNINGS AND DEDUCTIONS

313

LO 1,2, 3, 4, 5

PROBLEM 7-2A Highridge Homes has the following payroll information for the week

ended February 21:

*.

Earnings at

End of

Daily Time

Federal

Previous

Pay

Income

Name

Week

W

F

Rate

Tax

Arthur, P.

7,800.00

8.

8.

8.

8.

8.

45.00

226.78

Bills, D.

2,060.00

8.

8.

8

8.

8.

12.50

26.00

Carney, W.

2,085.00

8

8.

8.

8.

8.

12.95

27.00

Dorn, J.

748.00

8.

8.

22.00

11.00

Edgar, L.

2,687.00

8.

8.

8.

8.

8.

15.00

37.00

Fitzwilson, G.

4,150.00

8

8.

8.

8.

8.

23.00

125.00

Taxable earnings for Social Security are based on the first $118,500. Taxable earnings for

Medicare are based on all earnings. Taxable earnings for federal and state unemployment

are based on the first $7,000. Employees are paid time-and-a-half for work in excess of

40 hours week. Round amounts to the nearest penny.

per

Check Figure

Net amount, $4,133.33

Required

1. Complete the payroll register. The Social Security tax rate is 6.2 percent, and the

Medicare tax rate is 1.45 percent. Begin payroll checks with No. 2080.

2. Prepare a general journal entry to record the payroll. The firm's general ledger

contains a Wages Expense account and a Wages Payable account.

3. Assuming that the firm has transferred funds from its regular bank account to its

special payroll bank account and that this entry has been made, prepare a general

journal entry to record the payment of wages.

LO 1, 2, 3, 4, 5

d o half for hours worked in

CHAPTER ASSIGNMENTS

8.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning