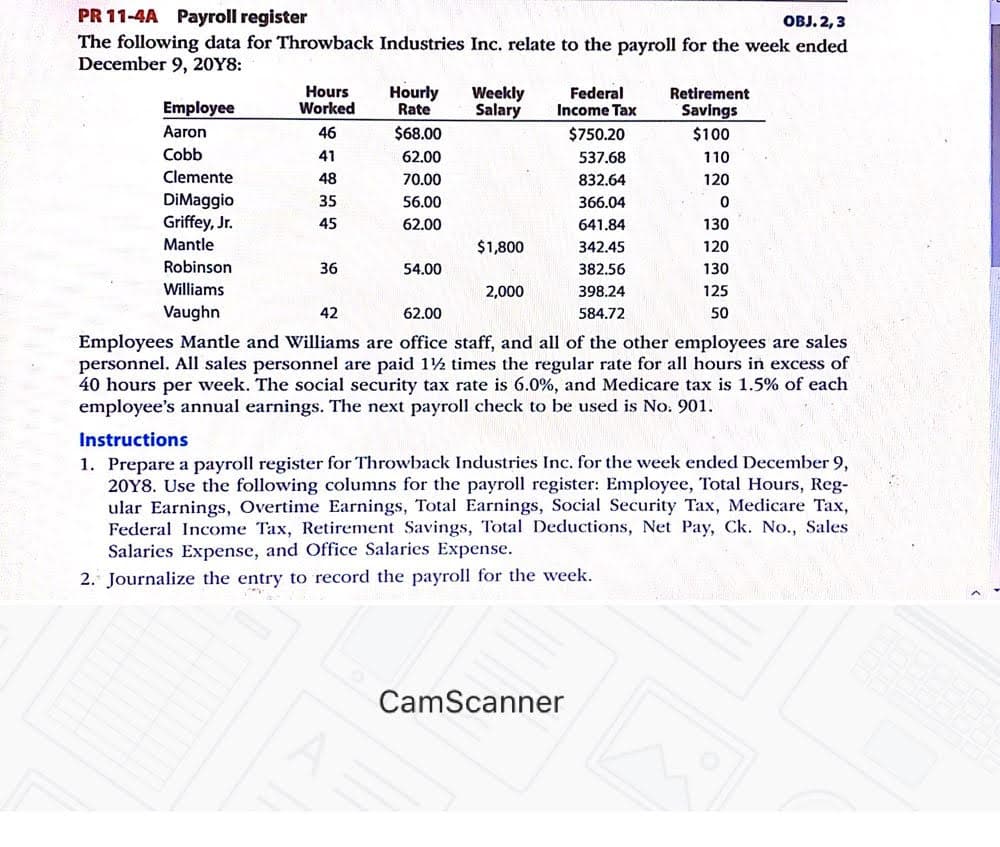

PR 11-4A Payroll register OBJ. 2,3 The following data for Throwback Industries Inc. relate to the payroll for the week ended December 9, 20Y8: Hours Worked Hourly Rate Weekly Salary Federal Income Tax Retirement Employee Savings Aaron 46 $68.00 $750.20 $100 Cobb 41 62.00 537.68 110 Clemente 48 70.00 832.64 120 DiMaggio Griffey, Jr. 35 56.00 366.04 45 62.00 641.84 130 Mantle $1,800 342.45 120 Robinson 36 54.00 382.56 130 Williams 2,000 398.24 125 Vaughn 42 62.00 584.72 50 Employees Mantle and Williams are office staff, and all of the other employees are sales personnel. All sales personnel are paid 12 times the regular rate for all hours in excess of 40 hours per week. The social security tax rate is 6.0%, and Medicare tax is 1.5% of each employee's annual earnings. The next payroll check to be used is No. 901. Instructions 1. Prepare a payroll register for Throwback Industries Inc. for the week ended December 9, 20Y8. Use the following columns for the payroll register: Employee, Total Hours, Reg- ular Earnings, Overtime Earnings, Total Earnings, Social Security Tax, Medicare Tax, Federal Income Tax, Retirement Savings, Total Deductions, Net Pay, Ck. No., Sales Salaries Expense, and Office Salaries Expense. 2. Journalize the entry to record the payroll for the week.

PR 11-4A Payroll register OBJ. 2,3 The following data for Throwback Industries Inc. relate to the payroll for the week ended December 9, 20Y8: Hours Worked Hourly Rate Weekly Salary Federal Income Tax Retirement Employee Savings Aaron 46 $68.00 $750.20 $100 Cobb 41 62.00 537.68 110 Clemente 48 70.00 832.64 120 DiMaggio Griffey, Jr. 35 56.00 366.04 45 62.00 641.84 130 Mantle $1,800 342.45 120 Robinson 36 54.00 382.56 130 Williams 2,000 398.24 125 Vaughn 42 62.00 584.72 50 Employees Mantle and Williams are office staff, and all of the other employees are sales personnel. All sales personnel are paid 12 times the regular rate for all hours in excess of 40 hours per week. The social security tax rate is 6.0%, and Medicare tax is 1.5% of each employee's annual earnings. The next payroll check to be used is No. 901. Instructions 1. Prepare a payroll register for Throwback Industries Inc. for the week ended December 9, 20Y8. Use the following columns for the payroll register: Employee, Total Hours, Reg- ular Earnings, Overtime Earnings, Total Earnings, Social Security Tax, Medicare Tax, Federal Income Tax, Retirement Savings, Total Deductions, Net Pay, Ck. No., Sales Salaries Expense, and Office Salaries Expense. 2. Journalize the entry to record the payroll for the week.

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter11: Current Liabilities And Payroll

Section: Chapter Questions

Problem 11.4BPR

Related questions

Question

Transcribed Image Text:PR 11-4A Payroll register

OBJ. 2,3

The following data for Throwback Industries Inc. relate to the payroll for the week ended

December 9, 20Y8:

Hours

Worked

Hourly

Rate

Weekly

Salary

Federal

Income Tax

Retirement

Employee

Savings

Aaron

46

$68.00

$750.20

$100

Cobb

41

62.00

537.68

110

Clemente

48

70.00

832.64

120

DiMaggio

Griffey, Jr.

35

56.00

366.04

45

62.00

641.84

130

Mantle

$1,800

342.45

120

Robinson

36

54.00

382.56

130

Williams

2,000

398.24

125

Vaughn

42

62.00

584.72

50

Employees Mantle and Williams are office staff, and all of the other employees are sales

personnel. All sales personnel are paid 12 times the regular rate for all hours in excess of

40 hours per week. The social security tax rate is 6.0%, and Medicare tax is 1.5% of each

employee's annual earnings. The next payroll check to be used is No. 901.

Instructions

1. Prepare a payroll register for Throwback Industries Inc. for the week ended December 9,

20Y8. Use the following columns for the payroll register: Employee, Total Hours, Reg-

ular Earnings, Overtime Earnings, Total Earnings, Social Security Tax, Medicare Tax,

Federal Income Tax, Retirement Savings, Total Deductions, Net Pay, Ck. No., Sales

Salaries Expense, and Office Salaries Expense.

2. Journalize the entry to record the payroll for the week.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning