Chapter X + mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/que apter 15, 16, and 17 1 Saved Help Save & Ex Typical Corporation reported a deferred tax liability of $3,800,000 for the year ended December 31, 2023, when the tax rate was 25%. The deferred tax liability was related to a temporary difference of $15,200,000 caused by an installment sale in 2023. The temporary difference is expected to reverse in 2025 when the income deferred from taxation will become taxable. There are no other temporary differences. Assume a new tax law passed in 2024 and the tax rate, which will remain at 25% through December 31, 2024, will become $32,000,000. 48% for tax years beginning after December 31, 2024. Pretax accounting income and taxable income for the year 2024 is Required: Prepare a compound journal entry to record Typical's income tax expense for the year 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. to search 3 View transaction list E Journal entry worksheet Record the income taxes. Note: Enter debits before credits. FA < Prev 33 of 38 Next > Near record 10:22 4/14/2 DOLL F5 F6 F7 FB F9 F10 F11 F12 Priser Insert Delete Calc Backspace

Chapter X + mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/que apter 15, 16, and 17 1 Saved Help Save & Ex Typical Corporation reported a deferred tax liability of $3,800,000 for the year ended December 31, 2023, when the tax rate was 25%. The deferred tax liability was related to a temporary difference of $15,200,000 caused by an installment sale in 2023. The temporary difference is expected to reverse in 2025 when the income deferred from taxation will become taxable. There are no other temporary differences. Assume a new tax law passed in 2024 and the tax rate, which will remain at 25% through December 31, 2024, will become $32,000,000. 48% for tax years beginning after December 31, 2024. Pretax accounting income and taxable income for the year 2024 is Required: Prepare a compound journal entry to record Typical's income tax expense for the year 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. to search 3 View transaction list E Journal entry worksheet Record the income taxes. Note: Enter debits before credits. FA < Prev 33 of 38 Next > Near record 10:22 4/14/2 DOLL F5 F6 F7 FB F9 F10 F11 F12 Priser Insert Delete Calc Backspace

Chapter20: Corporations And Parterships

Section: Chapter Questions

Problem 44P

Related questions

Question

Transcribed Image Text:Chapter X +

mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/que

apter 15, 16, and 17 1

Saved

Help

Save & Ex

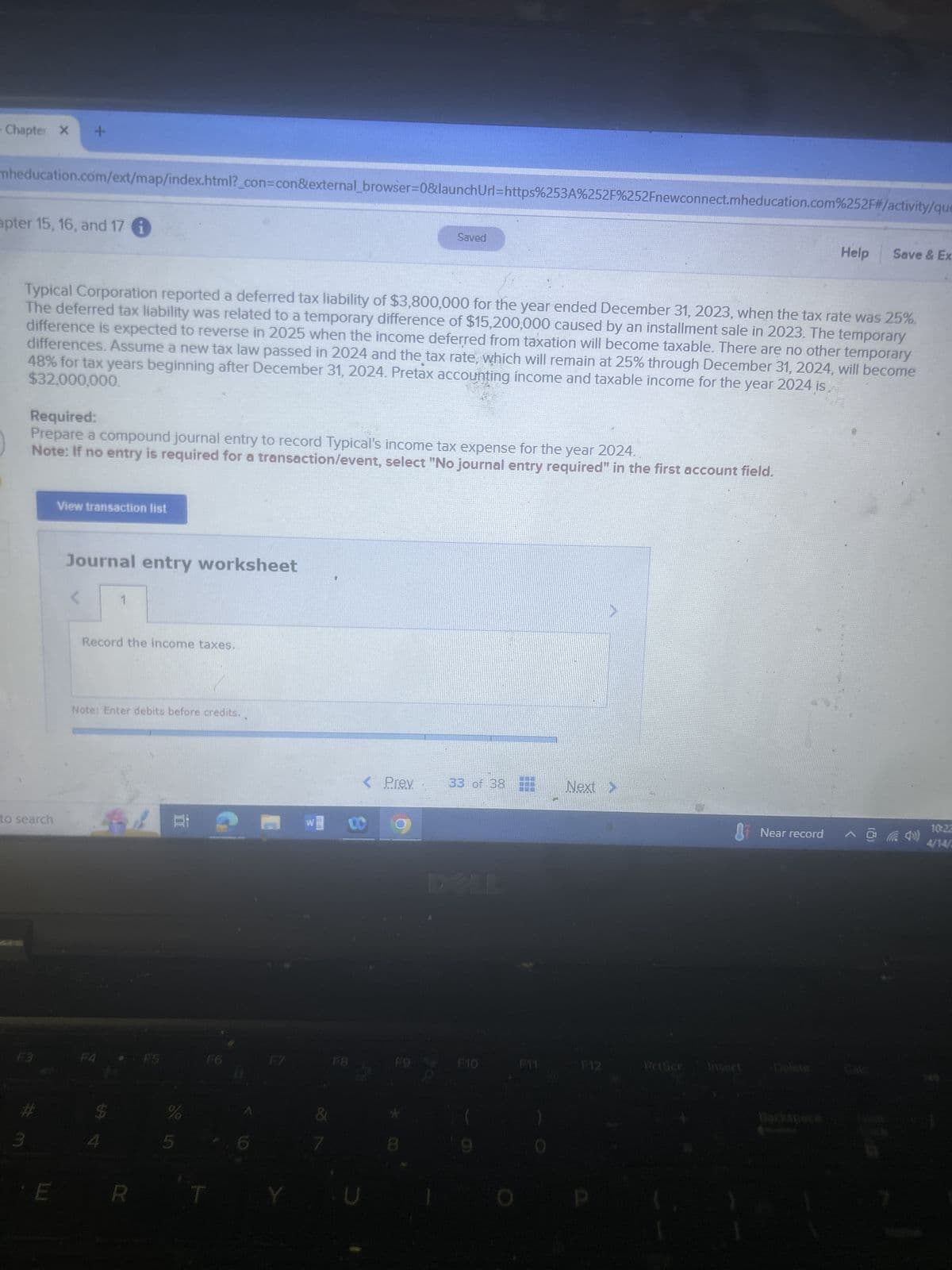

Typical Corporation reported a deferred tax liability of $3,800,000 for the year ended December 31, 2023, when the tax rate was 25%.

The deferred tax liability was related to a temporary difference of $15,200,000 caused by an installment sale in 2023. The temporary

difference is expected to reverse in 2025 when the income deferred from taxation will become taxable. There are no other temporary

differences. Assume a new tax law passed in 2024 and the tax rate, which will remain at 25% through December 31, 2024, will become

$32,000,000.

48% for tax years beginning after December 31, 2024. Pretax accounting income and taxable income for the year 2024 is

Required:

Prepare a compound journal entry to record Typical's income tax expense for the year 2024.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

to search

3

View transaction list

E

Journal entry worksheet

Record the income taxes.

Note: Enter debits before credits.

FA

< Prev

33 of 38

Next >

Near record

10:22

4/14/2

DOLL

F5

F6

F7

FB

F9

F10

F11

F12

Priser

Insert

Delete

Calc

Backspace

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT