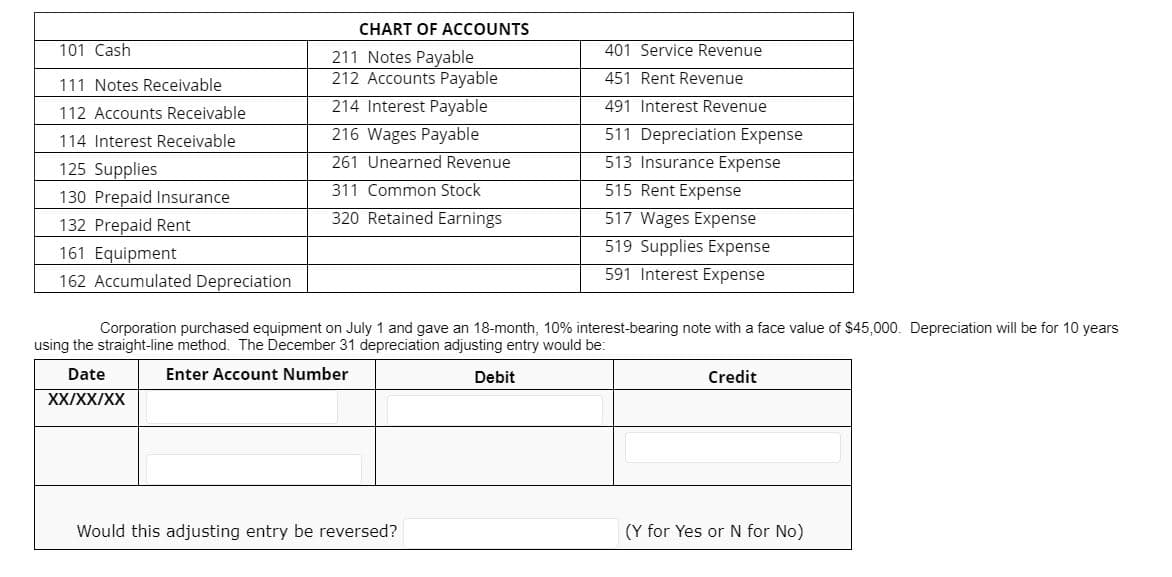

CHART OF ACCOUNTS 101 Cash 401 Service Revenue 211 Notes Payable 212 Accounts Payable 451 Rent Revenue 111 Notes Receivable 112 Accounts Receivable 214 Interest Payable 491 Interest Revenue 216 Wages Payable 511 Depreciation Expense 513 Insurance Expense 515 Rent Expense 114 Interest Receivable 261 Unearned Revenue 125 Supplies 311 Common Stock 130 Prepaid Insurance 132 Prepaid Rent 320 Retained Earnings 517 Wages Expense 519 Supplies Expense 591 Interest Expense 161 Equipment 162 Accumulated Depreciation Corporation purchased equipment on July 1 and gave an 18-month, 10% interest-bearing note with a face value of $45,000. Depreciation will be for 10 years using the straight-line method. The December 31 depreciation adjusting entry would be: Date Enter Account Number Debit Credit XX/XX/XX Would this adjusting entry be reversed? (Y for Yes or N for No)

CHART OF ACCOUNTS 101 Cash 401 Service Revenue 211 Notes Payable 212 Accounts Payable 451 Rent Revenue 111 Notes Receivable 112 Accounts Receivable 214 Interest Payable 491 Interest Revenue 216 Wages Payable 511 Depreciation Expense 513 Insurance Expense 515 Rent Expense 114 Interest Receivable 261 Unearned Revenue 125 Supplies 311 Common Stock 130 Prepaid Insurance 132 Prepaid Rent 320 Retained Earnings 517 Wages Expense 519 Supplies Expense 591 Interest Expense 161 Equipment 162 Accumulated Depreciation Corporation purchased equipment on July 1 and gave an 18-month, 10% interest-bearing note with a face value of $45,000. Depreciation will be for 10 years using the straight-line method. The December 31 depreciation adjusting entry would be: Date Enter Account Number Debit Credit XX/XX/XX Would this adjusting entry be reversed? (Y for Yes or N for No)

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter3: Journalizing Transactions

Section: Chapter Questions

Problem 4.1AP

Related questions

Topic Video

Question

Transcribed Image Text:CHART OF ACCOUNTS

101 Cash

401 Service Revenue

211 Notes Payable

212 Accounts Payable

451 Rent Revenue

111 Notes Receivable

214 Interest Payable

491 Interest Revenue

112 Accounts Receivable

114 Interest Receivable

216 Wages Payable

511 Depreciation Expense

125 Supplies

261 Unearned Revenue

513 Insurance Expense

130 Prepaid Insurance

311 Common Stock

515 Rent Expense

320 Retained Earnings

517 Wages Expense

519 Supplies Expense

132 Prepaid Rent

161 Equipment

162 Accumulated Depreciation

591 Interest Expense

Corporation purchased equipment on July 1 and gave an 18-month, 10% interest-bearing note with a face value of $45,000. Depreciation will be for 10 years

using the straight-line method. The December 31 depreciation adjusting entry would be:

Date

Enter Account Number

Debit

Credit

XX/XX/XX

Would this adjusting entry be reversed?

(Y for Yes or N for No)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College