Credit Accounts Cash Accounts Receivable Allowance for uncollectible Accounts Inventory Land Accounts Payable Notes Payable (6x, due in 3 years) Debit $ 23, 100 40, 000 $ 4, s00 37,000 72,100 28,900 37,000 63,000 39,000 Comnon Stack Retained tarnings Totals $172,400 $172, 400

Credit Accounts Cash Accounts Receivable Allowance for uncollectible Accounts Inventory Land Accounts Payable Notes Payable (6x, due in 3 years) Debit $ 23, 100 40, 000 $ 4, s00 37,000 72,100 28,900 37,000 63,000 39,000 Comnon Stack Retained tarnings Totals $172,400 $172, 400

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 15P: Comprehensive Receivables Problem Blackmon Corporations December 31, 2018, balance sheet disclosed...

Related questions

Question

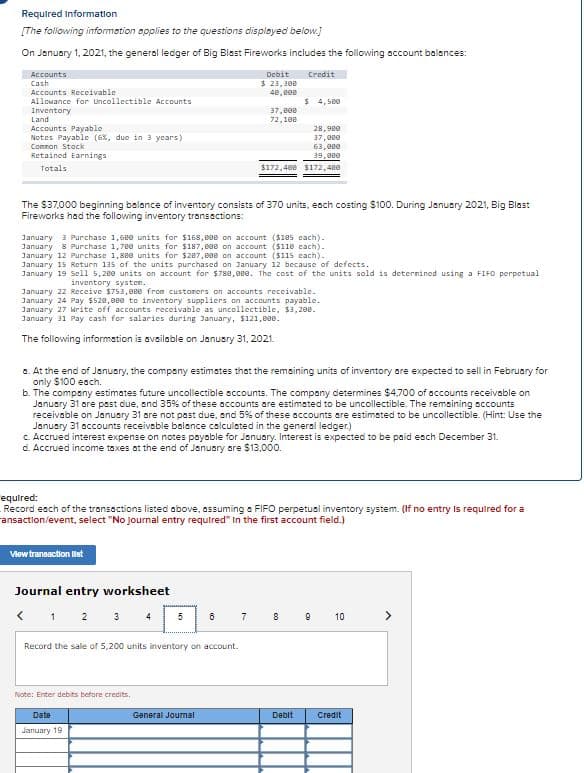

Transcribed Image Text:Required Information

[The following information opplies to the questions displayed below.)

On January 1, 2021, the general ledger of Big Blest Fireworks includes the following account balances:

Accounts

Debit

Credit

Cash

Accounts Receivable

Allowance for Lncollectible Accounts

$ 23,300

48, B00

$ 4, 5e0

Inventory

Land

Accounts Payable

Notes Payable (6%, due in 3 years)

37, e00

72,100

28,980

37,eee

63, 8ee

39, 8ee

Common Stock

Retained Earnings

Totals

$172,408 $172,480

The $37,000 beginning belance of inventory consists of 370 units, each costing $100. During January 2021, Big Blast

Fireworks had the following inventory transections:

January 3 Purchase 1,68e units for S168, 800 on account ($105 cach).

January 8 Purchase 1,78e units for $187, e00 on account ($118 cach).

January 12 Purchase 1, see units for $287,890 on account ($115 cach).

January 15 Return 135 of the units purchased on January 12 because of defects.

January 19 Sell 5,200 units on account for $788,0ee. The cost of the units sold is deternined using a FIFO perpetual

inventory systen.

January 22 Receive $753, eee from custoners on accounts receivable.

January 24 Pay $528, 0ee to inventory suppliers on accounts payable.

January 27 rite off accounts receivable as uncollectible, $3,200.

January 31 Pay cash for salaries during January, $121,808.

The following information is available on Janusry 31, 2021.

a. At the end of January, the company estimates that the remaining units of inventory are expected to sell in February for

only $100 each.

b. The company estimates future uncollectible sccounts. The company determines $4,700 of accounts receivable on

January 31 ore psst due, and 35% of these accounts are estimated to be uncollectible. The remsining accounts

receivable on January 31 are not past due, and 5%% of these accounts are estimated to be uncollectible. (Hint: Use the

January 31 accounts receiveble bolance calculated in the general ledger.)

Accrued interest expense on notes payable for January. Interest is expected to be paid esch December 31.

d. Accrued income taxes ot the end of January are $13,000.

equired:

Record esch of the transoctions listed above, assuming a FIFO perpetual inventory system. (If no entry is required for a

ansaction/event, select "No Journal entry requtred" In the first account field.)

Viewtraneaction lst

Journal entry worksheet

< 1 2 3 4

5

7

8

10

>

Record the sale of 5,200 units inventory on account.

Note: Enter debits before credits,

Date

General Jourmal

Debit

Credit

January 19

co

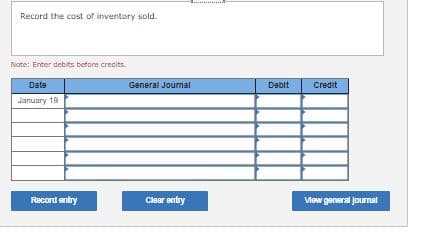

Transcribed Image Text:Record the cost of inventory sold.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

January 19

Racord entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT