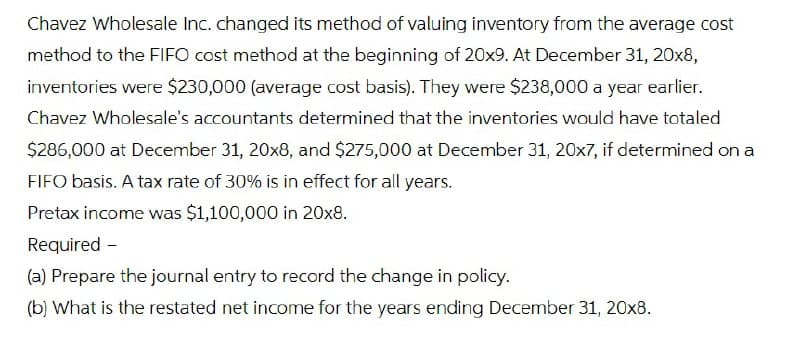

Chavez Wholesale Inc. changed its method of valuing inventory from the average cost method to the FIFO cost method at the beginning of 20x9. At December 31, 20x8, inventories were $230,000 (average cost basis). They were $238,000 a year earlier. Chavez Wholesale's accountants determined that the inventories would have totaled $286,000 at December 31, 20x8, and $275,000 at December 31, 20x7, if determined on a FIFO basis. A tax rate of 30% is in effect for all years. Pretax income was $1,100,000 in 20x8. Required - (a) Prepare the journal entry to record the change in policy. (b) What is the restated net income for the years ending December 31, 20x8.

Chavez Wholesale Inc. changed its method of valuing inventory from the average cost method to the FIFO cost method at the beginning of 20x9. At December 31, 20x8, inventories were $230,000 (average cost basis). They were $238,000 a year earlier. Chavez Wholesale's accountants determined that the inventories would have totaled $286,000 at December 31, 20x8, and $275,000 at December 31, 20x7, if determined on a FIFO basis. A tax rate of 30% is in effect for all years. Pretax income was $1,100,000 in 20x8. Required - (a) Prepare the journal entry to record the change in policy. (b) What is the restated net income for the years ending December 31, 20x8.

Chapter10: Inventory

Section: Chapter Questions

Problem 2TP: Assume your company uses the periodic inventory costing method, and the inventory count left out an...

Related questions

Question

Transcribed Image Text:Chavez Wholesale Inc. changed its method of valuing inventory from the average cost

method to the FIFO cost method at the beginning of 20x9. At December 31, 20x8,

inventories were $230,000 (average cost basis). They were $238,000 a year earlier.

Chavez Wholesale's accountants determined that the inventories would have totaled

$286,000 at December 31, 20x8, and $275,000 at December 31, 20x7, if determined on a

FIFO basis. A tax rate of 30% is in effect for all years.

Pretax income was $1,100,000 in 20x8.

Required -

(a) Prepare the journal entry to record the change in policy.

(b) What is the restated net income for the years ending December 31, 20x8.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning