Check my work foreseeable future. Company B pays corporate taxes at investment. Suppose the opportunity cost of capital is 10 e of 21% and can claim 100% bonus depreciation on the gnore inflation. a. Calculate project NPV for each company. (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) NPV ed Company A Company B k ces b. What is the IRR of the after-tax cash flows for each company? (Do not round intermediate calculations. Enter your answers as a percent rounded to 1 decimal places.) IRR Company A Company B

Check my work foreseeable future. Company B pays corporate taxes at investment. Suppose the opportunity cost of capital is 10 e of 21% and can claim 100% bonus depreciation on the gnore inflation. a. Calculate project NPV for each company. (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) NPV ed Company A Company B k ces b. What is the IRR of the after-tax cash flows for each company? (Do not round intermediate calculations. Enter your answers as a percent rounded to 1 decimal places.) IRR Company A Company B

Chapter5: Operating Activities: Purchases And Cash Payments

Section: Chapter Questions

Problem 3.4C

Related questions

Question

Transcribed Image Text:O Mon 28 Mar 9:10

O Queştion x C The Presi X C The Presi X C The Pres X C The Pres x fn FINA306 x m https://lm x +

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser%3D0&launchUrl=https%253A%... ☆ *

Ch 6 HW i

1

Saved

Help

Save & Exit

Submit

Check my work

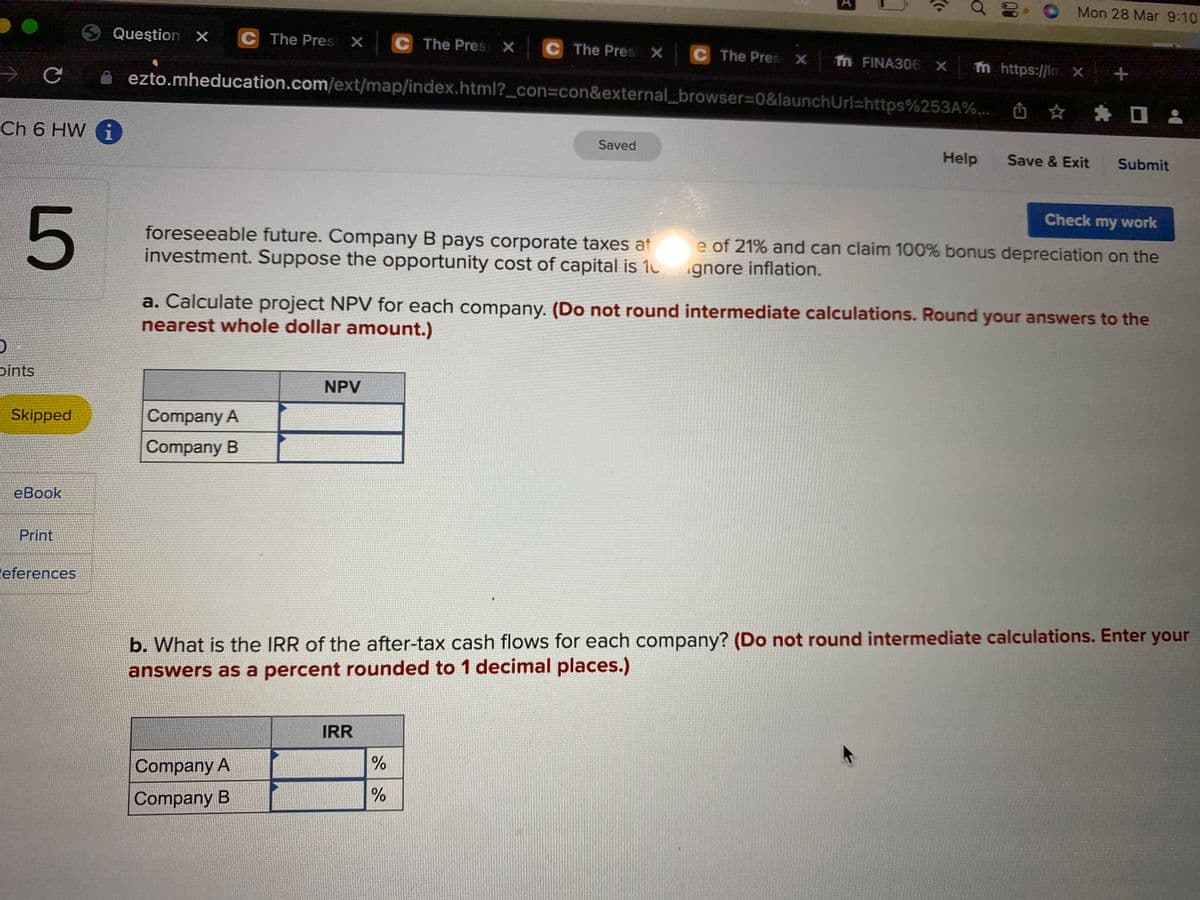

foreseeable future. Company B pays corporate taxes at

investment. Suppose the opportunity cost of capital is 10

e of 21% and can claim 100% bonus depreciation on the

gnore inflation.

a. Calculate project NPV for each company. (Do not round intermediate calculations. Round your answers to the

nearest whole dollar amount.)

pints

NPV

Skipped

Company A

Company B

еВook

Print

eferences

b. What is the IRR of the after-tax cash flows for each company? (Do not round intermediate calculations. Enter your

answers as a percent rounded to 1 decimal places.)

IRR

Company A

Company B

00

LO

Transcribed Image Text:Tab

Window

Help

A

Mon 28 Mar 9:1

Queştion X

C The Presi X

C The Presi X

C The Presi X

C The Presi X

Tm FINA306 X

m https://Im X +

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser%3D0&launchUrl=https%253A%... ☆ * O

キ口2

Saved

Help

Save & Exit

Submit

Check my work

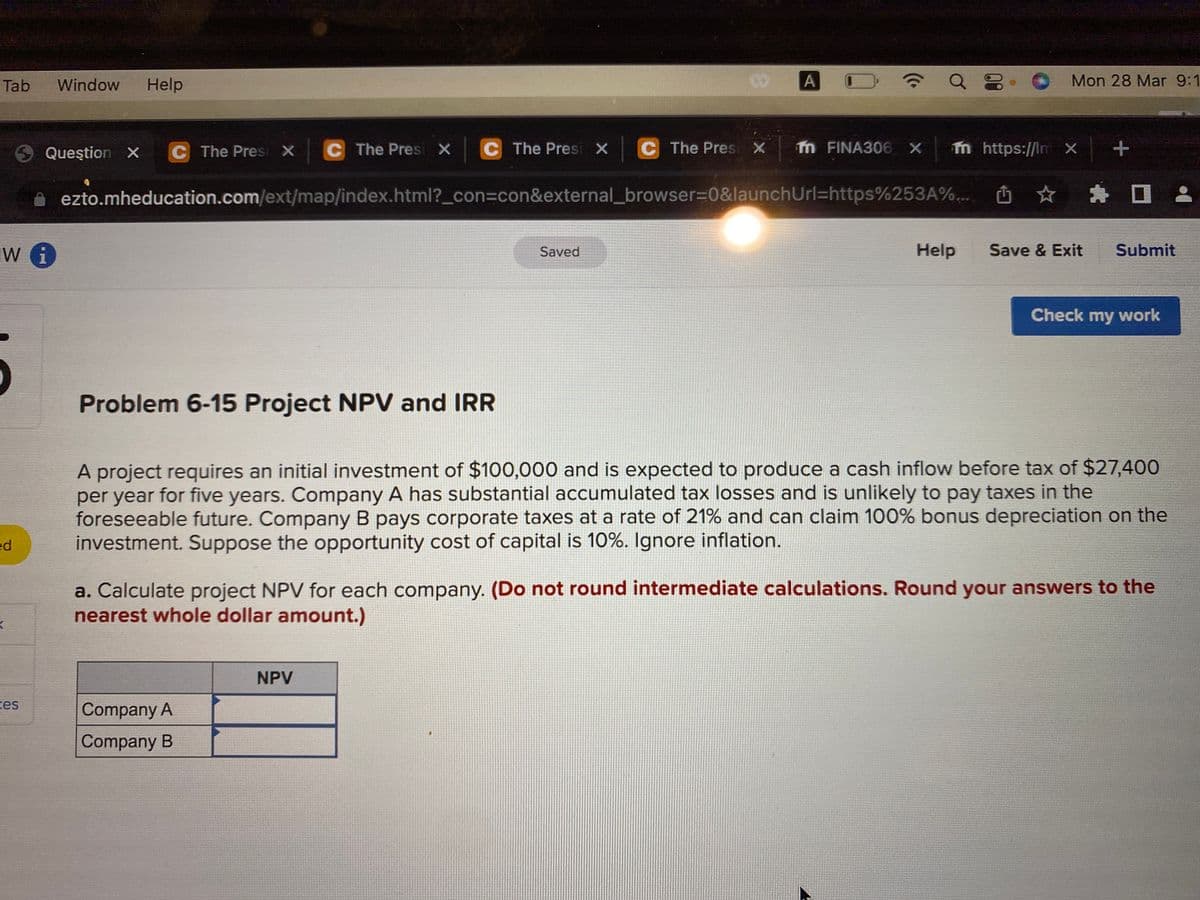

Problem 6-15 Project NPV and IRR

A project requires an initial investment of $100,000 and is expected to produce a cash inflow before tax of $27,400

per year for five years. Company A has substantial accumulated tax losses and is unlikely to pay taxes in the

foreseeable future. Company B pays corporate taxes at a rate of 21% and can claim 100% bonus depreciation on the

investment. Suppose the opportunity cost of capital is 10%. Ignore inflation.

ed

a. Calculate project NPV for each company. (Do not round intermediate calculations. Round your answers to the

nearest whole dollar amount.)

NPV

ces

Company A

Company B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning