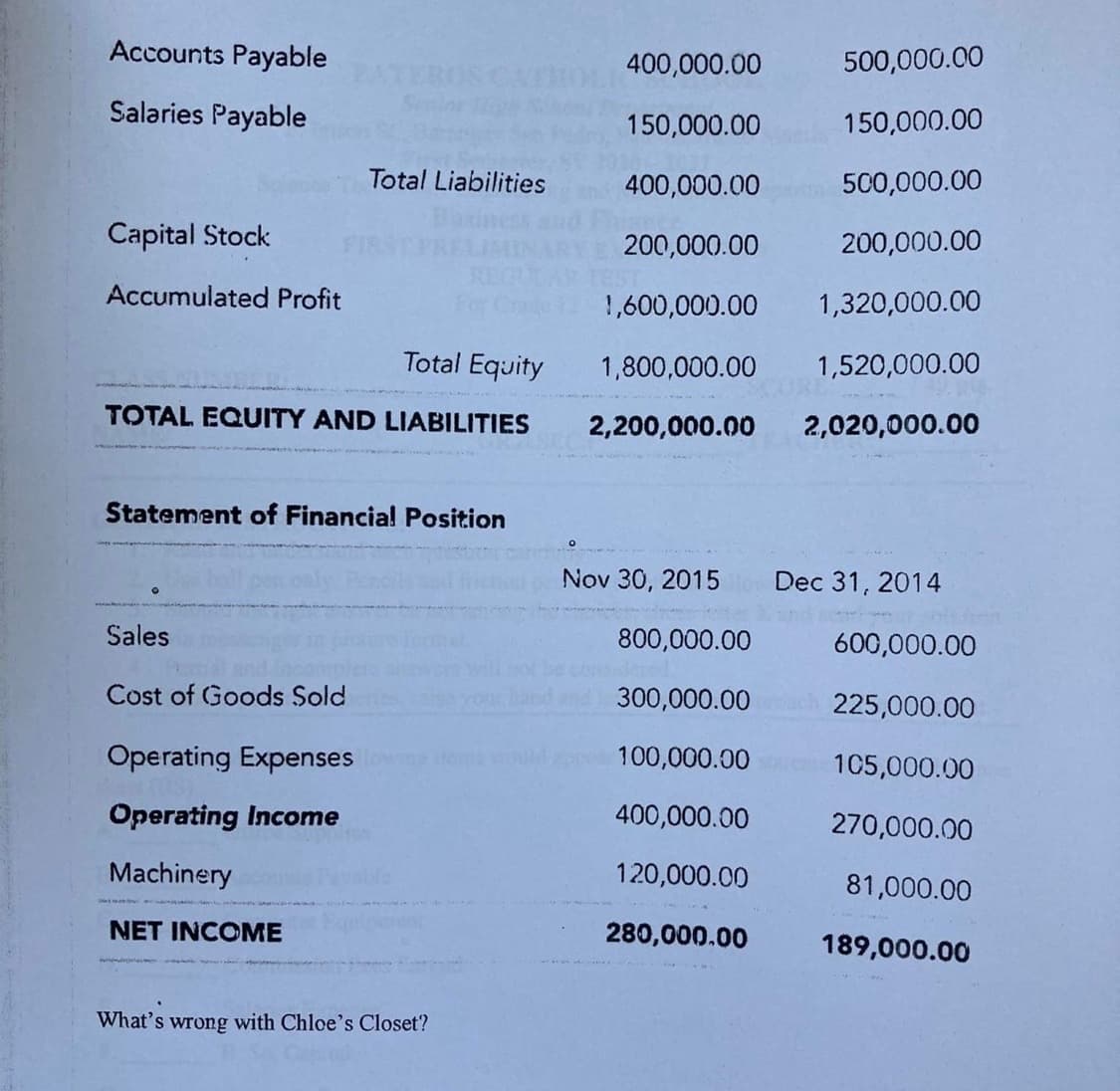

Chloe Mendez owns a clothing company, Chloe's Closet. She has a team of tailors who work for 8 hours every day from Monday to Saturday. Demand for her business is strong but there seems to be something preventing her from meeting the demands of her customers. Chloe sells to both big department stores and small boutique stores under the brand Chloe's Closet. Some brands also ask her to manufacture their own designs. Business for Chloe has been good since it started last 2014. In fact, despite the tough competition from cheaper manufacturers abroad, she still manages to grow her customer base. On December 4, 2015 Chloe received a billing statement from a raw material supplier for an amount of PHP400,000 which will be due in 5 days. She is also scheduled to pay her employees' monthly salary of PHP70,000 the following day. Upon checking her bank account, she only has a PHP67,000 balance. She knew she had exceeded her sales target last October and November so she is wondering why she only has this amount of cash in her bank account. Was her money stolen? Being a CPA, she checked the bank statement and her financial records and found no mistakes. Here is the latest financial statement of Chloe's Closet as of November 30, 2015: Statement of Financial Position Nov 30, 2015 Dec 31, 2014 60,000.00 270,000.00 Cash 740,000.00 500,000.00 Accounts Receivable 600,000.00 400,000.00 Inventory 800,000.00 850,000.00 Machinery 2,200,000.00 2,020,000.00 TOTAL ASSETS

Chloe Mendez owns a clothing company, Chloe's Closet. She has a team of tailors who work for 8 hours every day from Monday to Saturday. Demand for her business is strong but there seems to be something preventing her from meeting the demands of her customers. Chloe sells to both big department stores and small boutique stores under the brand Chloe's Closet. Some brands also ask her to manufacture their own designs. Business for Chloe has been good since it started last 2014. In fact, despite the tough competition from cheaper manufacturers abroad, she still manages to grow her customer base. On December 4, 2015 Chloe received a billing statement from a raw material supplier for an amount of PHP400,000 which will be due in 5 days. She is also scheduled to pay her employees' monthly salary of PHP70,000 the following day. Upon checking her bank account, she only has a PHP67,000 balance. She knew she had exceeded her sales target last October and November so she is wondering why she only has this amount of cash in her bank account. Was her money stolen? Being a CPA, she checked the bank statement and her financial records and found no mistakes. Here is the latest financial statement of Chloe's Closet as of November 30, 2015: Statement of Financial Position Nov 30, 2015 Dec 31, 2014 60,000.00 270,000.00 Cash 740,000.00 500,000.00 Accounts Receivable 600,000.00 400,000.00 Inventory 800,000.00 850,000.00 Machinery 2,200,000.00 2,020,000.00 TOTAL ASSETS

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter18: Pricing And Profitability Analysis

Section: Chapter Questions

Problem 1CE: Ventana Window and Wall Treatments Company provides draperies, shades, and various window...

Related questions

Question

QUESTION:

WHAT’S WRONG WITH CHLOE’S CLOSET?

Transcribed Image Text:Accounts Payable

400,000.00

500,000.00

EROS

Salaries Payable

150,000.00

150,000.00

Total Liabilities

400,000.00

500,000.00

Capital Stock

200,000.00

200,000.00

Accumulated Profit

1,600,000.00

1,320,000.00

Total Equity

1,800,000.00

1,520,000.00

TOTAL EQUITY AND LIABILITIES

2,200,000.00

2,020,000.00

Statement of Financia! Position

Nov 30, 2015

Dec 31, 2014

Sales

800,000.00

600,000.00

Cost of Goods Sold

300,000.00

225,000.00

Operating Expenses

100,000.00

105,000.00

Operating Income

400,000.00

270,000.00

Machinery

120,000.00

81,000.00

NET INCOME

280,000.00

189,000.00

What's wrong with Chloe's Closet?

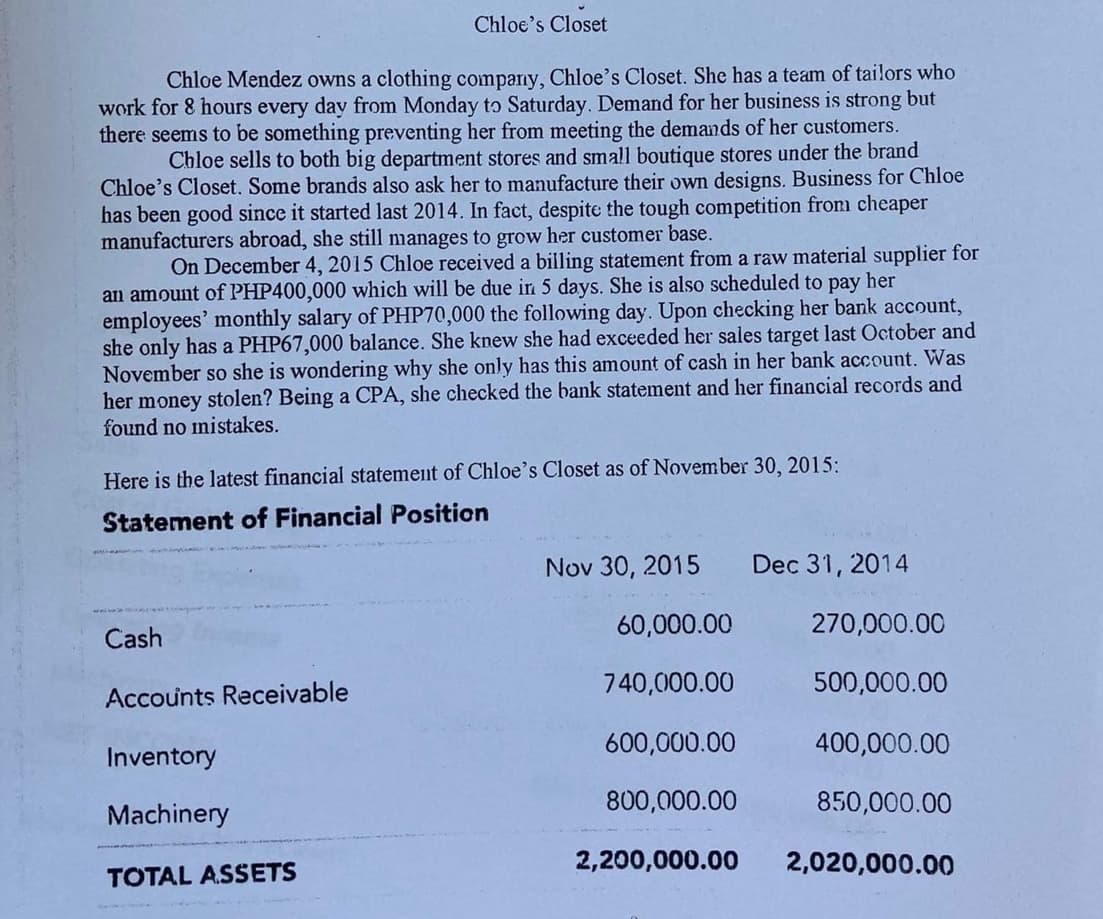

Transcribed Image Text:Chloe's Closet

Chloe Mendez owns a clothing comparny, Chloe's Closet. She has a team of tailors who

work for 8 hours every day from Monday to Saturday. Demand for her business is strong but

there seems to be something preventing her from meeting the demands of her customers.

Chloe sells to both big department stores and small boutique stores under the brand

Chloe's Closet. Some brands also ask her to manufacture their own designs. Business for Chloe

has been good since it started last 2014. In fact, despite the tough competition from cheaper

manufacturers abroad, she still manages to grow her customer base.

On December 4, 2015 Chloe received a billing statement from a raw material supplier for

an amount of PHP400,000 which will be due in 5 days. She is also scheduled to pay her

employees' monthly salary of PHP70,000 the following day. Upon checking her bank account,

she only has a PHP67,000 balance. She knew she had exceeded her sales target last October and

November so she is wondering why she only has this amount of cash in her bank account. Was

her money stolen? Being a CPA, she checked the bank statement and her financial records and

found no mistakes.

Here is the latest financial statement of Chloe's Closet as of November 30, 2015:

Statement of Financial Position

Nov 30, 2015

Dec 31, 2014

60,000.00

270,000.00

Cash

740,000.00

500,000.00

Accounts Receivable

600,000.00

400,000.00

Inventory

800,000.00

850,000.00

Machinery

2,200,000.00

2,020,000.00

TOTAL ASSETS

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College