Chris and Karen are married and own a three- bedroom home in a large Midwestern city. Their son, Christian, attends college away from home and lives in a fraternity house. Their daughter,

Chris and Karen are married and own a three- bedroom home in a large Midwestern city. Their son, Christian, attends college away from home and lives in a fraternity house. Their daughter,

Chapter3: Tax Formula And Tax Determination; An Overview Of property Transactions

Section: Chapter Questions

Problem 5BCRQ

Related questions

Question

Please solve this

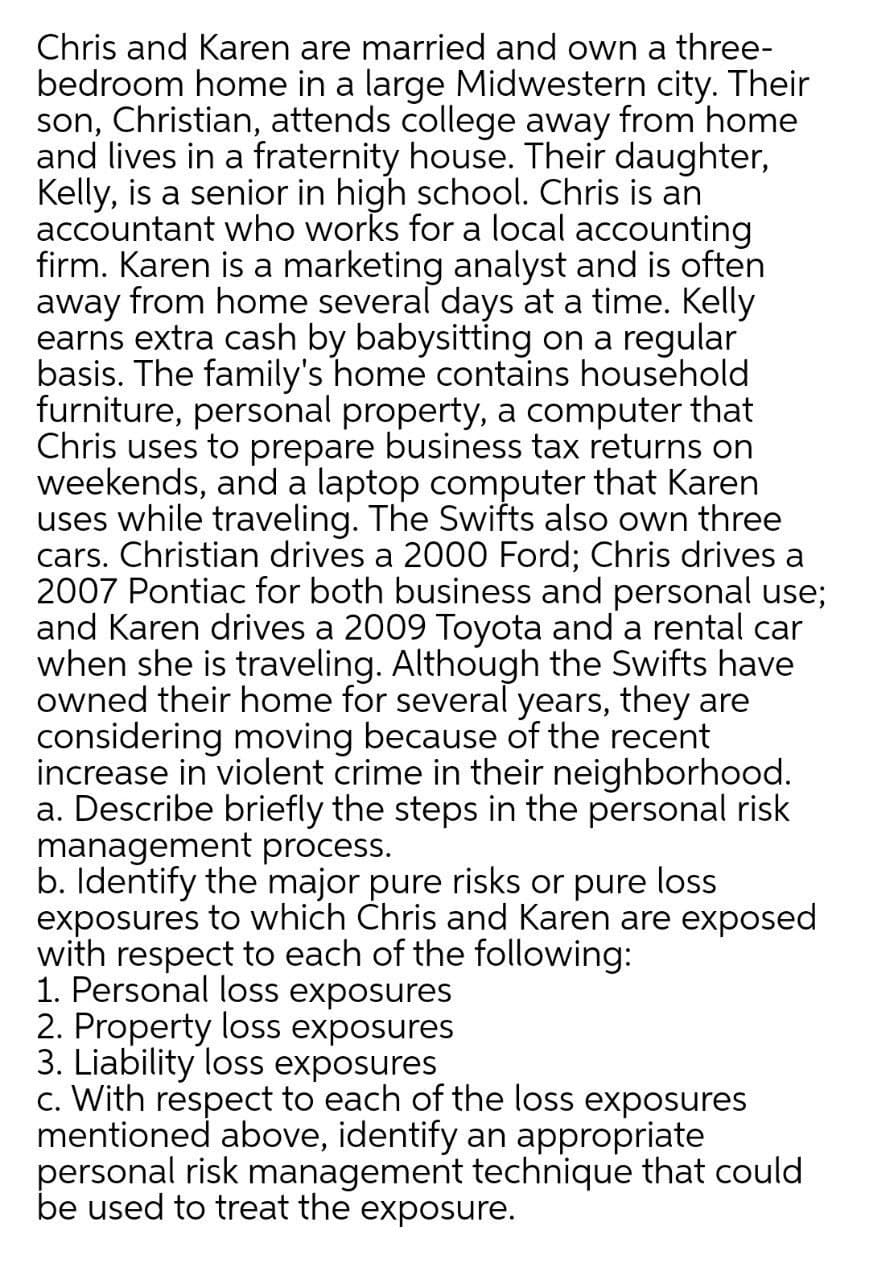

Transcribed Image Text:Chris and Karen are married and own a three-

bedroom home in a large Midwestern city. Their

son, Christian, attends college away from home

and lives in a fraternity house. Their daughter,

Kelly, is a senior in high school. Chris is an

accountant who works for a local accounting

firm. Karen is a marketing analyst and is often

away from home several days at a time. Kelly

earns extra cash by babysitting on a regular

basis. The family's home contains household

furniture, personal property, a computer that

Chris uses to prepare business tax returns on

weekends, and a laptop computer that Karen

uses while traveling. The Swifts also own three

cars. Christian drives a 2000 Ford; Chris drives a

2007 Pontiac for both business and personal use;

and Karen drives a 2009 Toyota and a rental car

when she is traveling. Although the Swifts have

owned their home for several years, they are

considering moving because of the recent

increase in violent crime in their neighborhood.

a. Describe briefly the steps in the personal risk

management process.

b. Identify the major pure risks or pure loss

exposures to which Chris and Karen are exposed

with respect to each of the following:

1. Personal loss exposures

2. Property loss exposures

3. Liability loss exposures

c. With respect to each of the loss exposures

mentioned above, identify an appropriate

personal risk management technique that could

be used to treat the exposure.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT