Helene and Pauline are twin sisters who live in Louisiana and Mississippi, respectively. Helene is married to Frank, and Pauline is married to Richard. Frank and Richard are killed in an auto accident in 2020 while returning from a sporting event. Helene and Frank jointly owned some farmland in Louisiana, a community property state (value of $940,000, cost of $450,000). Pauline and Richard jointly owned some farmland in Mississippi, a common law state (value of $940,000, cost of $450,000). Assume that all of Frank's and Richard's property passes to their surviving wives. Louisiana is a community property state and Mississippi is a common law state.

Helene and Pauline are twin sisters who live in Louisiana and Mississippi, respectively. Helene is married to Frank, and Pauline is married to Richard. Frank and Richard are killed in an auto accident in 2020 while returning from a sporting event. Helene and Frank jointly owned some farmland in Louisiana, a community property state (value of $940,000, cost of $450,000). Pauline and Richard jointly owned some farmland in Mississippi, a common law state (value of $940,000, cost of $450,000). Assume that all of Frank's and Richard's property passes to their surviving wives. Louisiana is a community property state and Mississippi is a common law state.

Chapter15: Property Transactions: Nontaxable Exchanges

Section: Chapter Questions

Problem 7DQ

Related questions

Question

100%

Helene and Pauline are twin sisters who live in Louisiana and Mississippi, respectively. Helene is married to Frank, and Pauline is married to Richard. Frank and Richard are killed in an auto accident in 2020 while returning from a sporting event.

Helene and Frank jointly owned some farmland in Louisiana, a community property state (value of $940,000, cost of $450,000). Pauline and Richard jointly owned some farmland in Mississippi, a common law state (value of $940,000, cost of $450,000). Assume that all of Frank's and Richard's property passes to their surviving wives.

Louisiana is a community property state and Mississippi is a common law state.

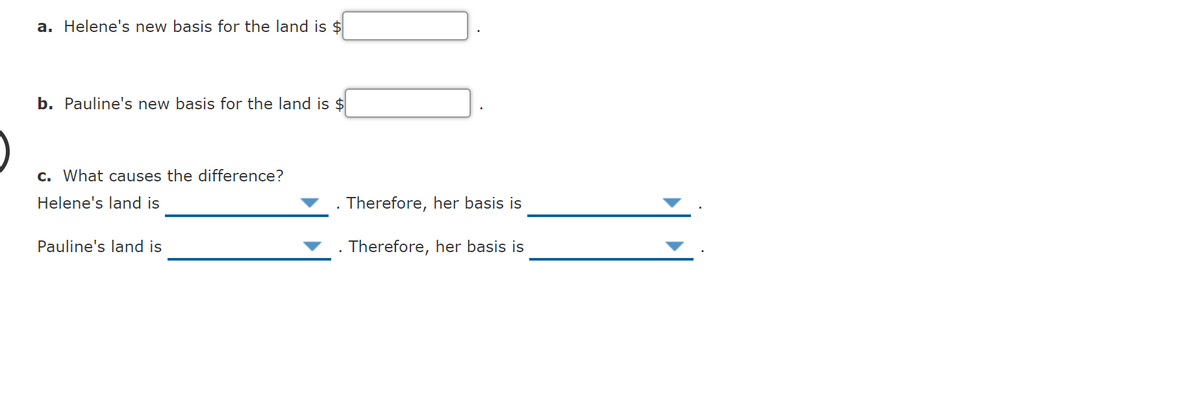

Transcribed Image Text:a. Helene's new basis for the land is $

b. Pauline's new basis for the land is $

c. What causes the difference?

Helene's land is

Therefore, her basis is

Pauline's land is

Therefore, her basis is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT