Christian Company provided the following data for the current year: Sales Sales salaries Advertising Indirect labor Delivery expense Freight in Depreciation- machinery Factory taxes Purchases Direct labor Factory supplies expense Office supplies expense Office salaries 8,000,000 520,000 120,000 600,000 160,000 80,000 50,000 130,000 1,600,000 1,480,000 120,000 30,000 800,000 480,000 100,000 150,000 220,000 170,000 Factory superintendence Doubtful accounts Factory maintenance Factory heat, light and power Income tax expense Inventory balances at the end of the fiscal period as compared with balances at the beginning of the fiscal period were as follows: Finished goods Goods in process Raw materials 200,000 decrease 90,000 decrease 100,000 increase Required: Prepare an income statement for the current year supported by a schedule of cost goods manufaatunO

Christian Company provided the following data for the current year: Sales Sales salaries Advertising Indirect labor Delivery expense Freight in Depreciation- machinery Factory taxes Purchases Direct labor Factory supplies expense Office supplies expense Office salaries 8,000,000 520,000 120,000 600,000 160,000 80,000 50,000 130,000 1,600,000 1,480,000 120,000 30,000 800,000 480,000 100,000 150,000 220,000 170,000 Factory superintendence Doubtful accounts Factory maintenance Factory heat, light and power Income tax expense Inventory balances at the end of the fiscal period as compared with balances at the beginning of the fiscal period were as follows: Finished goods Goods in process Raw materials 200,000 decrease 90,000 decrease 100,000 increase Required: Prepare an income statement for the current year supported by a schedule of cost goods manufaatunO

Chapter22: S Corporations

Section: Chapter Questions

Problem 16CE

Related questions

Concept explainers

Mortgages

A mortgage is a formal agreement in which a bank or other financial institution lends cash at interest in return for assuming the title to the debtor's property, on the condition that the obligation is paid in full.

Mortgage

The term "mortgage" is a type of loan that a borrower takes to maintain his house or any form of assets and he agrees to return the amount in a particular period of time to the lender usually in a series of regular equally monthly, quarterly, or half-yearly payments.

Question

answer with explanation/solution

Transcribed Image Text:Christian Company provided the following data for the

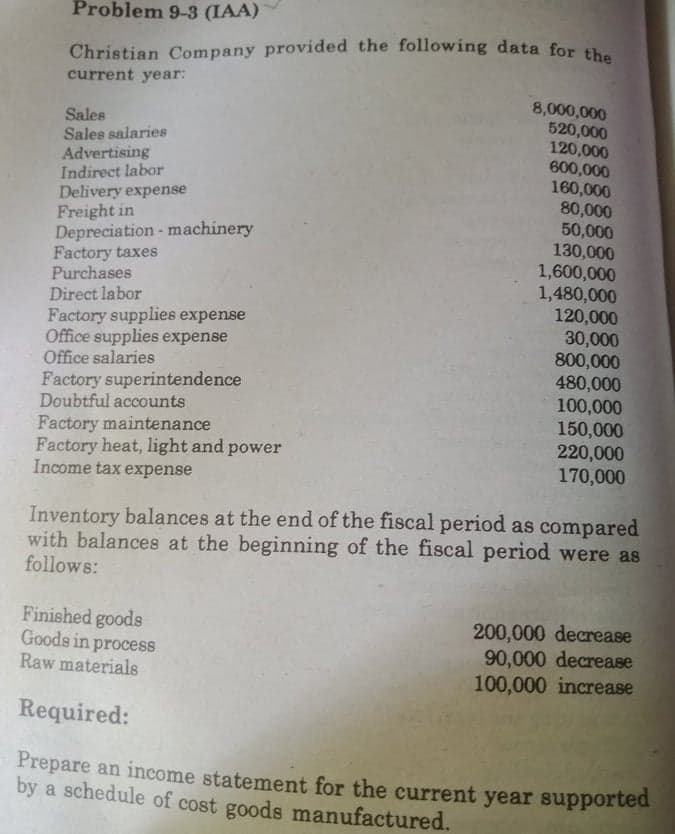

Problem 9-3 (IAA)

Christian Company provided the following data for the

current year:

Sales

Sales salaries

Advertising

Indirect labor

Delivery expense

Freight in

Depreciation - machinery

Factory taxes

Purchases

Direct labor

8,000,000

520,000

120,000

600,000

160,000

80,000

50,000

130,000

1,600,000

1,480,000

120,000

30,000

800,000

480,000

100,000

150,000

220,000

170,000

Factory supplies expense

Office supplies expense

Office salaries

Factory superintendence

Doubtful accounts

Factory maintenance

Factory heat, light and power

Income tax expense

Inventory balances at the end of the fiscal period as compared

with balances at the beginning of the fiscal period were as

follows:

Finished goods

Goods in process

Raw materials

200,000 decrease

90,000 decrease

100,000 increase

Required:

Prepare an income statement for the current year supported

by a schedule of cost goods manufactured.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you