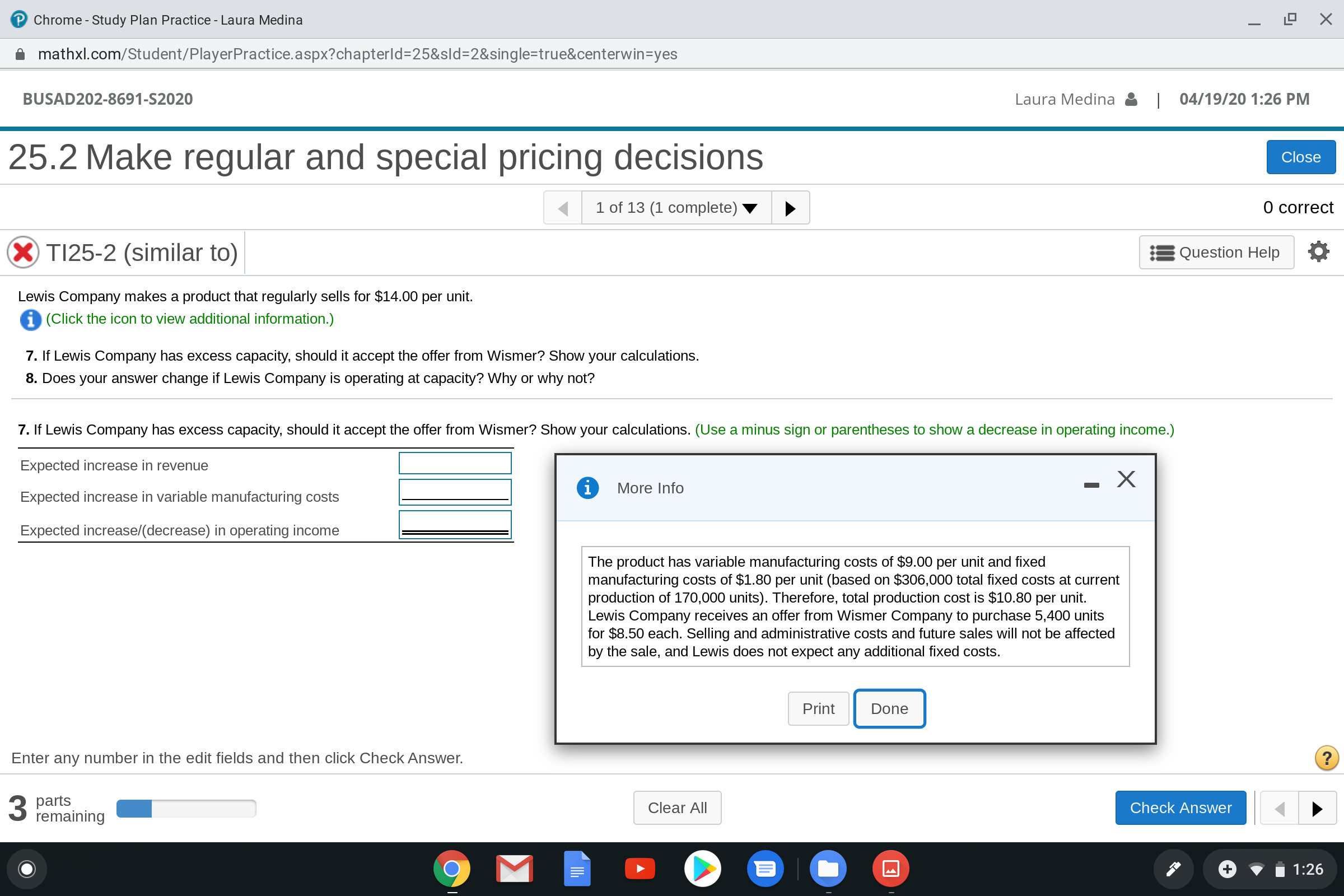

Chrome - Study Plan Practice - Laura Medina mathxl.com/Student/PlayerPractice.aspx?chapterld=25&sld=2&single=true¢erwin=yes BUSAD202-8691-S2020 Laura Medina | 04/19/20 1:26 PM 25.2 Make regular and special pricing decisions Close 1 of 13 (1 complete) O correct X TI25-2 (similar to) Question Help Lewis Company makes a product that regularly sells for $14.00 per unit. i (Click the icon to view additional information.) 7. If Lewis Company has excess capacity, should it accept the offer from Wismer? Show your calculations. 8. Does your answer change if Lewis Company is operating at capacity? Why or why not? 7. If Lewis Company has excess capacity, should it accept the offer from Wismer? Show your calculations. (Use a minus sign or parentheses to show a decrease in operating income.) Expected increase in revenue More Info Expected increase in variable manufacturing costs Expected increase/(decrease) in operating income The product has variable manufacturing costs of $9.00 per unit and fixed manufacturing costs of $1.80 per unit (based on $306,000 total fixed costs at current production of 170,000 units). Therefore, total production cost is $10.80 per unit. Lewis Company receives an offer from Wismer Company to purchase 5,400 units for $8.50 each. Selling and administrative costs and future sales will not be affected by the sale, and Lewis does not expect any additional fixed costs. Print Done Enter any number in the edit fields and then click Check Answer. 3 parts remaining Clear All Check Answer 1:26 Chrome - Study Plan Practice - Laura Medina mathxl.com/Student/PlayerPractice.aspx?chapterld=25&sld=2&single=true¢erwin=yes BUSAD202-8691-S2020 Laura Medina | 04/19/20 1:26 PM 25.2 Make regular and special pricing decisions Close 1 of 13 (1 complete) O correct X TI25-2 (similar to) Question Help Lewis Company makes a product that regularly sells for $14.00 per unit. i (Click the icon to view additional information.) 7. If Lewis Company has excess capacity, should it accept the offer from Wismer? Show your calculations. 8. Does your answer change if Lewis Company is operating at capacity? Why or why not? 7. If Lewis Company has excess capacity, should it accept the offer from Wismer? Show your calculations. (Use a minus sign or parentheses to show a decrease in operating income.) Expected increase in revenue More Info Expected increase in variable manufacturing costs Expected increase/(decrease) in operating income The product has variable manufacturing costs of $9.00 per unit and fixed manufacturing costs of $1.80 per unit (based on $306,000 total fixed costs at current production of 170,000 units). Therefore, total production cost is $10.80 per unit. Lewis Company receives an offer from Wismer Company to purchase 5,400 units for $8.50 each. Selling and administrative costs and future sales will not be affected by the sale, and Lewis does not expect any additional fixed costs. Print Done Enter any number in the edit fields and then click Check Answer. 3 parts remaining Clear All Check Answer 1:26

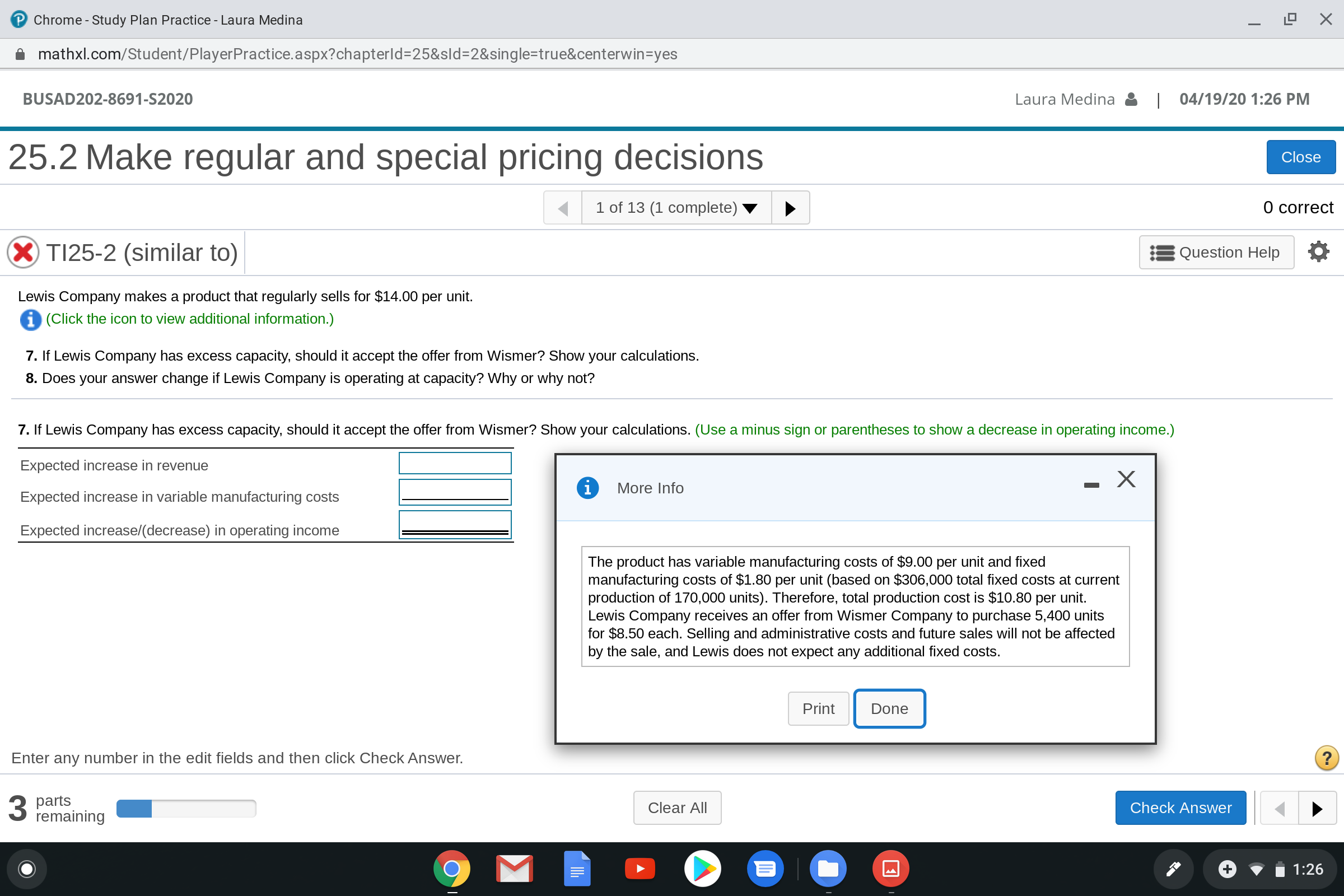

Chrome - Study Plan Practice - Laura Medina mathxl.com/Student/PlayerPractice.aspx?chapterld=25&sld=2&single=true¢erwin=yes BUSAD202-8691-S2020 Laura Medina | 04/19/20 1:26 PM 25.2 Make regular and special pricing decisions Close 1 of 13 (1 complete) O correct X TI25-2 (similar to) Question Help Lewis Company makes a product that regularly sells for $14.00 per unit. i (Click the icon to view additional information.) 7. If Lewis Company has excess capacity, should it accept the offer from Wismer? Show your calculations. 8. Does your answer change if Lewis Company is operating at capacity? Why or why not? 7. If Lewis Company has excess capacity, should it accept the offer from Wismer? Show your calculations. (Use a minus sign or parentheses to show a decrease in operating income.) Expected increase in revenue More Info Expected increase in variable manufacturing costs Expected increase/(decrease) in operating income The product has variable manufacturing costs of $9.00 per unit and fixed manufacturing costs of $1.80 per unit (based on $306,000 total fixed costs at current production of 170,000 units). Therefore, total production cost is $10.80 per unit. Lewis Company receives an offer from Wismer Company to purchase 5,400 units for $8.50 each. Selling and administrative costs and future sales will not be affected by the sale, and Lewis does not expect any additional fixed costs. Print Done Enter any number in the edit fields and then click Check Answer. 3 parts remaining Clear All Check Answer 1:26 Chrome - Study Plan Practice - Laura Medina mathxl.com/Student/PlayerPractice.aspx?chapterld=25&sld=2&single=true¢erwin=yes BUSAD202-8691-S2020 Laura Medina | 04/19/20 1:26 PM 25.2 Make regular and special pricing decisions Close 1 of 13 (1 complete) O correct X TI25-2 (similar to) Question Help Lewis Company makes a product that regularly sells for $14.00 per unit. i (Click the icon to view additional information.) 7. If Lewis Company has excess capacity, should it accept the offer from Wismer? Show your calculations. 8. Does your answer change if Lewis Company is operating at capacity? Why or why not? 7. If Lewis Company has excess capacity, should it accept the offer from Wismer? Show your calculations. (Use a minus sign or parentheses to show a decrease in operating income.) Expected increase in revenue More Info Expected increase in variable manufacturing costs Expected increase/(decrease) in operating income The product has variable manufacturing costs of $9.00 per unit and fixed manufacturing costs of $1.80 per unit (based on $306,000 total fixed costs at current production of 170,000 units). Therefore, total production cost is $10.80 per unit. Lewis Company receives an offer from Wismer Company to purchase 5,400 units for $8.50 each. Selling and administrative costs and future sales will not be affected by the sale, and Lewis does not expect any additional fixed costs. Print Done Enter any number in the edit fields and then click Check Answer. 3 parts remaining Clear All Check Answer 1:26

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter7: Inventory Cost Flow Assumptions (fifolifo)

Section: Chapter Questions

Problem 8R: Reset the November 20 purchase to 150 units, including column G. To test your formulas, suppose that...

Related questions

Question

Can you work step by step and explain how you worked it out.

Transcribed Image Text:Chrome - Study Plan Practice - Laura Medina

mathxl.com/Student/PlayerPractice.aspx?chapterld=25&sld=2&single=true¢erwin=yes

BUSAD202-8691-S2020

Laura Medina

| 04/19/20 1:26 PM

25.2 Make regular and special pricing decisions

Close

1 of 13 (1 complete)

O correct

X TI25-2 (similar to)

Question Help

Lewis Company makes a product that regularly sells for $14.00 per unit.

i (Click the icon to view additional information.)

7. If Lewis Company has excess capacity, should it accept the offer from Wismer? Show your calculations.

8. Does your answer change if Lewis Company is operating at capacity? Why or why not?

7. If Lewis Company has excess capacity, should it accept the offer from Wismer? Show your calculations. (Use a minus sign or parentheses to show a decrease in operating income.)

Expected increase in revenue

More Info

Expected increase in variable manufacturing costs

Expected increase/(decrease) in operating income

The product has variable manufacturing costs of $9.00 per unit and fixed

manufacturing costs of $1.80 per unit (based on $306,000 total fixed costs at current

production of 170,000 units). Therefore, total production cost is $10.80 per unit.

Lewis Company receives an offer from Wismer Company to purchase 5,400 units

for $8.50 each. Selling and administrative costs and future sales will not be affected

by the sale, and Lewis does not expect any additional fixed costs.

Print

Done

Enter any number in the edit fields and then click Check Answer.

3 parts

remaining

Clear All

Check Answer

1:26

Transcribed Image Text:Chrome - Study Plan Practice - Laura Medina

mathxl.com/Student/PlayerPractice.aspx?chapterld=25&sld=2&single=true¢erwin=yes

BUSAD202-8691-S2020

Laura Medina

| 04/19/20 1:26 PM

25.2 Make regular and special pricing decisions

Close

1 of 13 (1 complete)

O correct

X TI25-2 (similar to)

Question Help

Lewis Company makes a product that regularly sells for $14.00 per unit.

i (Click the icon to view additional information.)

7. If Lewis Company has excess capacity, should it accept the offer from Wismer? Show your calculations.

8. Does your answer change if Lewis Company is operating at capacity? Why or why not?

7. If Lewis Company has excess capacity, should it accept the offer from Wismer? Show your calculations. (Use a minus sign or parentheses to show a decrease in operating income.)

Expected increase in revenue

More Info

Expected increase in variable manufacturing costs

Expected increase/(decrease) in operating income

The product has variable manufacturing costs of $9.00 per unit and fixed

manufacturing costs of $1.80 per unit (based on $306,000 total fixed costs at current

production of 170,000 units). Therefore, total production cost is $10.80 per unit.

Lewis Company receives an offer from Wismer Company to purchase 5,400 units

for $8.50 each. Selling and administrative costs and future sales will not be affected

by the sale, and Lewis does not expect any additional fixed costs.

Print

Done

Enter any number in the edit fields and then click Check Answer.

3 parts

remaining

Clear All

Check Answer

1:26

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning