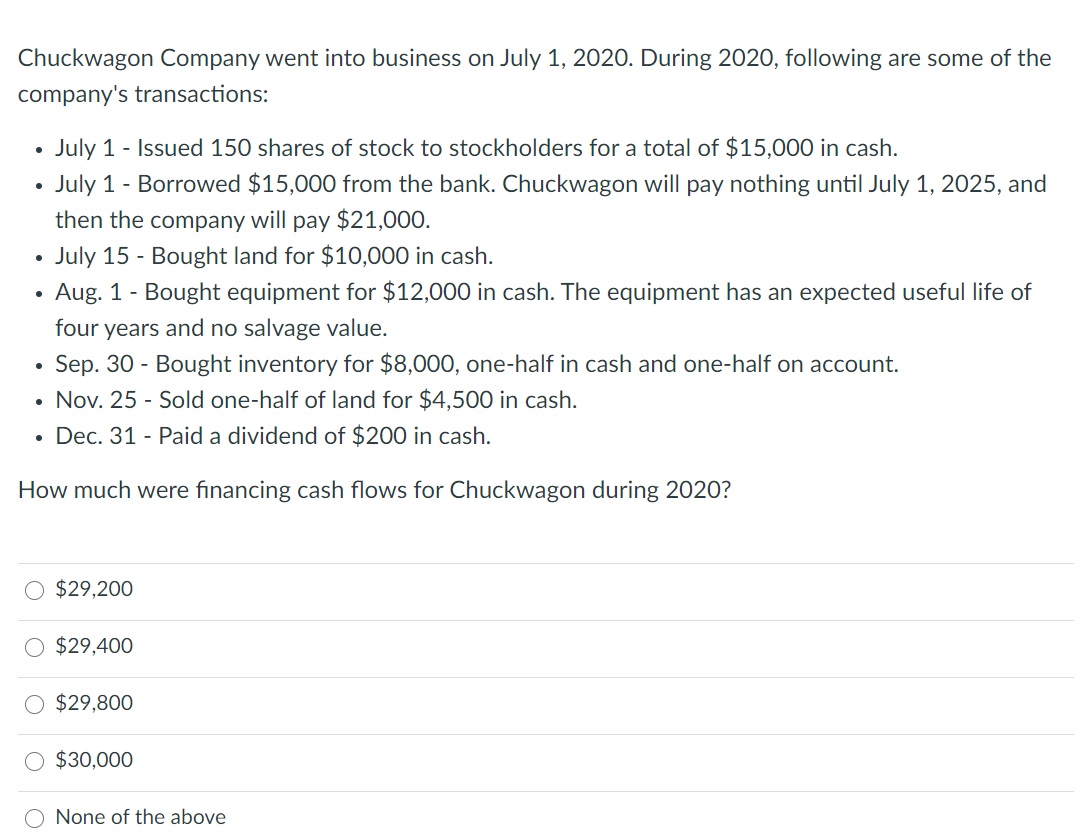

Chuckwagon Company went into business on July 1, 2020. During 2020, following are some of the company's transactions:

Q: Two 2020 transactions of the Rowena Carpio Company are described below: April 1 - Carpio paid the…

A: 1) First entry is for prepaid rent. Entry will be made prepaid rent a/c dr. And credit cash a/c.…

Q: For each of the following independent situations, give the journal entries to adjust and correct the…

A: These are the Journal entries that are recorded in a Company's General Ledger that occurs at the end…

Q: The RIGHT company has the below information in its Income Statement at the end of the year 2019. For…

A: Closing Entry: These are the journal entries which are passed at the end of accounting period. It…

Q: At the end of the year, on December 31, 2019, the bookkeeper of Honey Company prepared an Unadjusted…

A: Net Sale=Sale-Sale return-Sale discount=460,000+4,000-12,000-8,000=444,000

Q: A new merchandising business, Dazzle Corporation started its operations last January 1, 2020.…

A: Adjusting entries are those journal entries which are passed at the end of accounting period in…

Q: The adjusted trial balance of Carla Vista Company at December 31, 2022, includes the following…

A: Equity statement: It is a financial statement extract that shows the total net worth owned by the…

Q: The following financial statement information is from five separate companies.Answer the following…

A: Equity: It represents the shareholders ownership in the business. It is calculated b subtracting…

Q: DALLAS Corp. is preparing the December 31, 2020, year-end financial statements. Following are…

A: A Journal entry is a primary entry that records the financial transactions initially. The…

Q: adjusting entry recorded on that date would include:

A: It is pertinent to note that as per Accrual system of accounting. Transaction are recorded as and…

Q: The Adjusted trial balance of Stowe Company at December 31, 2019, includes the following accounts:…

A: Meaning of Income Statement An income statement is a financial statement that shows you the…

Q: Pope's Garage had the following accounts and amounts in its financial statements on December 31,…

A: Note: Since there are multiple subparts, we will answer only the first three subparts. Income…

Q: In the opace under each description, provide the necessary journal entry(s) in the proper form for…

A: Notes payable for entry 1 = Total cost of equipment - Cash paid = $ 56000 - $ 8000 = $ 48000

Q: The adjusted trial balance of Pharoah Company at December 31, 2022, includes the following accounts:…

A: Owner's Equity, December 31 = Owner's Equity, January 1 + Net Income - Drawings

Q: At the end of the year, on December 31, 2019, the bookkeeper of the Jonny Company prepared an…

A: Statement of changes in owners equity shows all changes in the equity balance of the business for…

Q: Renfro Company purchased a 12-month insurance policy on March 1, 2022 for $1,800. At March 31, 2022,…

A: At the time of recording prepaid insurance, Prepaid insurance should be recorded. At the period end…

Q: Roth Contractors Corporation was incorporated on December 1, 2019 and had the following transactions…

A: Solution: Introduction: Journal entry is an accounting entry to record every transaction takes place…

Q: he following information has been extracted from the accounting records of Lubners Limited on 31…

A: Statement of comprehensive income includes income from continuing operation as well as income from…

Q: Warm-heart company has the below information in its Income Statement at the end of the year 2020.…

A: A closing entry can be defined as a journal entry that shifts the balance of the temporary accounts…

Q: John Doe started his business, Copy Specialties, Inc., on January 5, 2019. The following information…

A: Copy Specialities, Inc. Income Statement For the Month Ended January 31, 2019 Revenue:…

Q: The following information relates to the Muscat Company at the end of 2019. The accounting period is…

A: Prepaid expense is the expense which is paid in advance and not incurred yet. Such expense are not…

Q: Cris Laurente Services purchased a 1- year insurance policy on April 1, 2020 for 6,000. The amount…

A: From April 1, 2020 to December 31, 2020 = 9 months So the insurance premium of 6,000 is an expense…

Q: Kling Company was organized in late 2019 and began operations On January 2, 2020. Prior to the…

A: Expenses refer to the costs incurred by the entity over a specific period of time as a consideration…

Q: Miranda Company borrowed $100,000 cash on September 1, 2019, and signed a one-year 6%,…

A: Step 1 As per accounting concept, all of the outstanding liability is to be shown at each reporting…

Q: The adjusted trial balance of Sunland Company at Decermber 31, 2019, includes the tollowing…

A: Net Income = Revenue - Total Expenses

Q: or the year ended December 31, 2020, Tam's records total franchise revenue in an amount of

A: Revenue to be recognised is equal to = initial amount on signing of contract + yearly revenue +…

Q: For each of the following independent situations, give the journal entries to adjust and correct the…

A: These are the Journal entries that are recorded in a Company's General Ledger that occurs at the end…

Q: Company received RO 20,000 for services to be provided in the

A: Ans. Initially the entry which the company would have passed should be as follows: Cash a/c Dr.…

Q: Manchester Company has BD 9,500 supplies account balance on January 1, 2019. During the year, it…

A: Supplies used = Beginning balance of supplies + supplies purchased - ending balance of supplies =…

Q: Prepare the journal entries that should be made by Sage Hill Corporation in 2021. when the amount is…

A: Cash dividend being commonly found dividend payment in companies, is declared by Board of directors…

Q: A company must prepare IFRS financial statements for the first time on December 31, 2020. According…

A: IFRS: IFRS requires company to prepare opening balance sheet on the transition date. The transition…

Q: Prepare the income statement, statement of changes inequity and statement of financial position for…

A: Financial statements are statements that are prepared at the end of the period in order to analyse…

Q: On July 1, 2020, Wilson Co. pays $16,140 to Anderson Insurance Co. for a 3-year insurance policy.…

A: Journalize the entry:

Q: Great Adventures, Inc. began their business on July 1, 2021. Using the adjusted trial balance…

A: Income statement is one of the basic financial statements, which reports revenue, and expenses, and…

Q: Miller Corporation paid $1,800 and purchased a two-year insurance on September 1, 2020. The policy…

A: Insurance expenses = Total amount paid as prepaid * month / Total duration

Q: Use the following information about Miller Corporation to answer the next four questions. Miller…

A: Prepaid insurance: Prepaid insurance is the portion of an insurance premium that has been paid in…

Q: Part of the Financial Position of Candy Inc. as of Dec. 31, 2019 shows the following:

A: Liquidation of Company Liquidation of the company is the winding process of the company whether by…

Q: the following information to provide the adjusting journal entry that Chipotle should have made on…

A: The adjustment entries are prepared to adjust the revenue and expenses of the current period.

Q: How do you treat a prepaid expense that is divided between two accounting periods? eg( insurance of…

A: JOURNAL ENTRY In The Books of .......................................... Period…

Q: You are provided with the following information for Blossom Company, effective as of its April 30,…

A: Income statement represents the net income or the net loss that includes the reporting of revenues…

Q: yrtricks Ltd., which has a December 31 year end, had the following transactions in December 2020 and…

A: Bank loan can be defined as taking the funds from the financial institutions by the business…

Q: Financial information related to Udder Products Company, a proprietorship, for the month ended April…

A: a. Prepare statement of owner's equity

Q: Sheridan Company’s owner’s equity at the beginning of August 2020 was $ 756000. During the month,…

A: Balance in owner’s equity at the end of August 2020 = beginning owner’s equity + net income -…

Q: Rainmaker Company prepares its financial statements in accordance with IFRS. In 2020, Rainmaker…

A: Calculate the net revaluation gain: Net revaluation gain is calculated by deducting the declined…

Q: Choose the correct.A company must prepare IFRS financial statements for the first time on December…

A: IFRS: IFRS requires company to prepare opening balance sheet on the transition date. The transition…

Q: Open general ledger T-accounts for the following: Cash, Accounts Receivable, Prepaid Insurance,…

A: T Account: General ledgers is graphically represented through T accounts.

Q: The Piper Ventura Illustrators presented the following information pertaining to accounts that will…

A: Solution: Journal entry : An act of recording the daily transaction of a firm in the journal is…

Q: On April 1, 2022, Lansing Corporation opened for business and paid 600 in insurance to cover the…

A: Prepaid expenses are in the nature of current assets which will bring economic benefits to the…

Q: Bixby Co. went into business on October 1, 2020 and had the following transactions:

A: Given: sale of inventory = $7000 + $5000 = $13000 sale of land = $3000 total sales =…

Q: Mely Bhd commenced their business on 1 April 2021 and prepared its first set of accounts to 30 June…

A: Given: Mely Bhd commenced their business on 1 April 2021 First Set = 1 April 2021 to 30 June 2022…

Q: ) Icon International, a software company, incorporated on January 1, 2019 is planning to convert to…

A: The correct date for transition of IFRS standards will be the year in which company starts adopting…

Step by step

Solved in 2 steps

- Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows.Situation You are the assistant accountant for Tyler Corporation. It is mid-January 2020 and you are helping to prepare Tylers balance sheet for December 31, 2019. Tyler will publish this balance sheet on March 1, 2020, after the auditors have completed their work. Tyler has a 100,000 note payable that was issued in 2018 and that is due March 6, 2020. On January 5, 2020, Tyler sold 2,000 shares of its 10 par common stock for 80,000. Its intent is to use these proceeds (plus 20,000 cash it already has on hand) to repay the note payable on March 6. The head accountant says Im not sure how to classify the 100,000 note payable on the December 31, 2019, balance sheet. Check this out for me. Directions Research the related generally accepted accounting principles and prepare a short memo to the head accountant that explains how Tyler should report the 100,000 note payable on its December 31, 2019, balance sheet.On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.

- Blue Company, an architectural firm, has a bookkeeper who maintains a cash receipts and disbursements journal. At the end of the year (2019), the company hires you to convert the cash receipts and disbursements into accrual basis revenues and expenses. The total cash receipts are summarized as follows. The accounts receivable from customers at the end of the year are 120,000. You note that the accounts receivable at the beginning of the year were 190,000. The cash sales included 30,000 of prepayments for services to be provided over the period January 1, 2019, through December 31, 2021. a. Compute the companys accrual basis gross income for 2019. b. Would you recommend that Blue use the cash method or the accrual method? Why? c. The company does not maintain an allowance for uncollectible accounts. Would you recommend that such an allowance be established for tax purposes? Explain.Monona Company reported net income of 29,975 for 2019. During all of 2019, Monona had 1,000 shares of 10%, 100 par, nonconvertible preferred stock outstanding, on which the years dividends had been paid. At the beginning of 2019, the company had 7,000 shares of common stock outstanding. On April 2, 2019, the company issued another 2,000 shares of common stock so that 9,000 common shares were outstanding at the end of 2019. Common dividends of 17,000 had been paid during 2019. At the end of 2019, the market price per share of common stock was 17.50. Required: 1. Compute Mononas basic earnings per share for 2019. 2. Compute the price/earnings ratio for 2019.The controller of Red Lake Corporation has requested assistance in determining income, basic earnings per share, and diluted earnings per share for presentation on the companys income statement for the year ended September 30, 2020. As currently calculated, Red Lakes net income is 540,000 for fiscal year 2019-2020. Your working papers disclose the following opening balances and transactions in the companys capital stock accounts during the year: 1. Common stock (at October 1, 2019, stated value 10, authorized 300,000 shares; effective December 1, 2019, stated value 5, authorized 600,000 shares): Balance, October 1, 2019issued and outstanding 60,000 shares December 1, 201960,000 shares issued in a 2-for-l stock split December 1, 2019280,000 shares (stated value 5) issued at 39 per share 2. Treasury stockcommon: March 3, 2020purchased 40,000 shares at 38 per share April 1, 2020sold 40,000 shares at 40 per share 3. Noncompensatory stock purchase warrants, Series A (initially, each warrant was exchangeable with 60 for 1 common share; effective December 1, 2019, each warrant became exchangeable for 2 common shares at 30 per share): October 1, 201925,000 warrants issued at 6 each 4. Noncompensatory stock purchase warrants, Series B (each warrant is exchangeable with 40 for 1 common share): April 1, 202020,000 warrants authorized and issued at 10 each 5. First mortgage bonds, 5%, due 2029 (nonconvertible; priced to yield 5% when issued): Balance October 1, 2019authorized, issued, and outstandingthe face value of 1,400,000 6. Convertible debentures, 7%, due 2036 (initially, each 1,000 bond was convertible at any time until maturity into 20 common shares; effective December 1, 2019, the conversion rate became 40 shares for each bond): October 1, 2019authorized and issued at their face value (no premium or discount) of 2,400,000 The following table shows the average market prices for the companys securities during 2019-2020: Adjusted for stock split Required: Prepare a schedule computing: 1. the basic earnings per share 2. the diluted earnings per share that should be presented on Red Lakes income statement for the year ended September 30, 2020 A supporting schedule computing the numbers of shares to be used in these computations should also be prepared. Assume an income tax rate of 30%.

- Roseau Company is preparing its annual earnings per share amounts to be disclosed on its 2019 income statement. It has collected the following information at the end of 2019: 1. Net income: 120,400. Included in the net income is income from continuing operations of 130,400 and a loss from discontinued operations (net of income taxes) of 10,000. Corporate income tax rate: 30%. 2. Common stock outstanding on January 1, 2019: 20,000 shares. 3. Common stock issuances during 2019: July 6, 4,000 shares; August 24, 3,000 shares. 4. Stock dividend: On October 19, 2019, the company declared a 10% stock dividend that resulted in 2,700 additional outstanding shares of common stock. 5. Common stock prices: 2019 average market price, 30 per share; 2019 ending market price, 27 per share. 6. 7% preferred stock outstanding on January 1, 2019: 1,000 shares. Terms: 100 par, nonconvertible. Current dividends have been paid. No preferred stock issued during 2019. 7. 8% convertible preferred stock outstanding on January 1, 2019: 800 shares. The stock was issued in 2018 at 130 per share. Each 100 par preferred stock is currently convertible into 1.7 shares of common stock. Current dividends have been paid. To date, no preferred stock has been converted. 8. Bonds payable outstanding on January 1, 2019: 100,000 face value. These bonds were issued several years ago at 97 and pay annual interest of 9.6%. The discount is being amortized in the amount of 300 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 9. Compensatory share options outstanding: Key executives may currently acquire 3,000 shares of common stock at 20 per share. The options were granted in 2018. To date, none have been exercised. The unrecognized compensation cost (net of tax) related to the options is 4 per share. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Show how Roseau would report these earnings per share figures on its 2019 income statement. Include an explanatory note to the financial statements.Prepare general journal entries for the following transactions, identifying each transaction by letter: (a) Gnu Company issued 5,000 shares of 1 par common stock to the Prendergas law firm as partial payment of fees incurred to incorporate the business. Gnu was short of cash, so Prendergas agreed to accept 10,000 cash and the shares of common stock in full settlement of its bill for 55,000. (b) Gnu issued 50,000 shares of 1 par common stock in exchange for a parcel of land for building a shopping plaza. (The list price for the land was 400,000; a similar parcel in the same area sold last week for 380,000. During the past month, the price at which Gnus common stock has traded on the open market has ranged from 5 to 12 per share. Two trades occurred yesterday at 7 and 10 per share.) (c) Gnu purchased 10,000 shares of 1 par value common treasury stock for 70,000. (This is the only treasury stock that Gnu holds.) (d) Gnu sold 4,000 shares of common treasury stock for 32,000. (e) Gnu sold 5,000 shares of common treasury stock for 30,000.Anoka Company reported the following selected items in the shareholders equity section of its balance sheet on December 31, 2019, and 2020: In addition, it listed the following selected pretax items as a December 31, 2019 and 2020: The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for 25.75 and 32.20, respectively. The company is subject to a 30% income tax rate. Required: 1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anokas 2020 annual report. 2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?