In the opace under each description, provide the necessary journal entry(s) in the proper form for the transaction or time period indicated, The company's year-end was December 31, 2019 and all appropriate journal entries were made at that time. The company closes their books on the monthly basis. 1. On January 1, 2020, the company purchased a piece of equipment costing $56,000, paying $8,000 in cash and financing the remainder at 4%. Principal and interest are both due on June 1, 2020. 2. What journal entry would be made on January 31, 2020, with regard to the above transaction? 3. On December 1, 2019, the company paid $7,800 cash for an annual insurance premium. At the time, they debited insurance expense. What entry should be made on January 31, 2020, when they discover the error?

In the opace under each description, provide the necessary journal entry(s) in the proper form for the transaction or time period indicated, The company's year-end was December 31, 2019 and all appropriate journal entries were made at that time. The company closes their books on the monthly basis. 1. On January 1, 2020, the company purchased a piece of equipment costing $56,000, paying $8,000 in cash and financing the remainder at 4%. Principal and interest are both due on June 1, 2020. 2. What journal entry would be made on January 31, 2020, with regard to the above transaction? 3. On December 1, 2019, the company paid $7,800 cash for an annual insurance premium. At the time, they debited insurance expense. What entry should be made on January 31, 2020, when they discover the error?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 40BE: Accrued Interest On May 1, the Garnett Corporation wanted to purchase a $200,000 piece of equipment,...

Related questions

Question

I need the answer as soon as possible

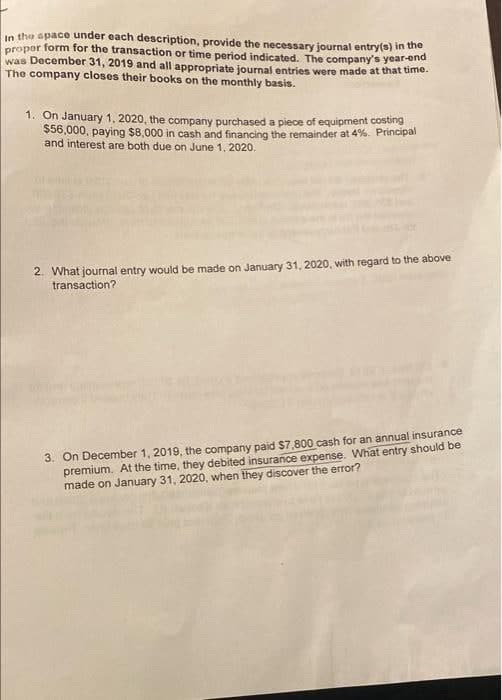

Transcribed Image Text:in the space under each description, provide the necessary journal entry(s) in the

proper form for the transaction or time period indicated. The company's year-end

was December 31, 2019 and all appropriate journal entries were made at that time.

The company closes their books on the monthly basis.

1. On January 1, 2020, the company purchased a piece of equipment costing

$56,000, paying $8,000 in cash and financing the remainder at 4%. Principal

and interest are both due on June 1, 2020.

2. What journal entry would be made on January 31, 2020, with regard to the above

transaction?

3. On December 1, 2019, the company paid $7,800 cash for an annual insurance

premium. At the time, they debited insurance expense. What entry should be

made on January 31, 2020, when they discover the error?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning