Church Company completes these transactions and events during March of the current year (terms for all its credit sales are 1/10, n/30). March 1 Purchased $32,000 of merchandise from Van Industries, terms 1/15, n/30. March 2 Sold merchandise on credit to Min Cho, Invoice Number 854, for $12,800 (cost is $6,400). March 3 (a) Purchased $960 of office supplies on credit from Gabel Company, terms n/30. March 3 (b) Sold merchandise on credit to Linda Witt, Invoice Number 855, for $6,400 (cost is $3,200). March 6 Borrowed $72,000 cash from Federal Bank by signing a long-term note payable. March 9 Purchased $16,000 of office equipment on credit from Spell Supply, terms n/30. March 10 Sold merchandise on credit to Jovita Albany, Invoice Number 856, for $3,200 (cost is $1,600). March 12 Received payment from Min Cho for the March 2 sale less the discount of $128. March 13 (a) Sent Van Industries Check Number 416 in payment of the March 1 invoice less the discount of $320. March 13 (b) Received payment from Linda Witt for the March 3 sale less the discount of $64. March 14 Purchased $30,000 of merchandise from the CD Company, terms 1/10, n/30. March 15 (a) Issued Check Number 417 for $14,800; payee is Payroll, in payment of sales salaries expense for the first half of the month. March 15 (b) Cash sales for the first half of the month are $51,200 (cost is $40,960). These cash sales are recorded in the cash receipts journal on March 15. March 16 Purchased $1,480 of store supplies on credit from Gabel Company, terms n/30. March 17 Returned $3,000 of unsatisfactory merchandise purchased on March 14 to CD Company. Church reduces accounts payable by that amount. March 19 Returned $480 of office equipment purchased on March 9 to Spell Supply. Church reduces accounts payable by that amount. March 20 Received payment from Jovita Albany for the sale of March 10 less the discount of $32. March 23 Issued Check Number 418 to CD Company in payment of the March 14 purchase less the March 17 return and the $270 discount. March 27 Sold merchandise on credit to Jovita Albany, Invoice Number 857, for $9,600 (cost is $3,840). March 28 Sold merchandise on credit to Linda Witt, Invoice Number 858, for $3,840 (cost is $1,536). March 31 (a) Issued Check Number 419 for $14,800; payee is Payroll, in payment of sales salaries expense for the last half of the month. March 31 (b) Cash sales for the last half of the month are $56,320 (cost is $33,792). These cash sales are recorded in the cash receipts journal on March 31. March 31 (c) Verify that amounts impacting customer and creditor accounts were posted and that any amounts that should have been posted as individual amounts to the general ledger accounts were posted. Foot and crossfoot the journals and make the month-end postings. Assume the following ledger account amounts: Inventory (March 1 beginning balance is $61,000), Z. Church, Capital (March 1 beginning balance is $61,000) and Church Company uses the perpetual inventory system. Required: (a) Post information from the journals in Part 2 to the general ledger and the accounts receivable and accounts payable subsidiary ledgers.

Church Company completes these transactions and events during March of the current year (terms for all its credit sales are 1/10, n/30). March 1 Purchased $32,000 of merchandise from Van Industries, terms 1/15, n/30. March 2 Sold merchandise on credit to Min Cho, Invoice Number 854, for $12,800 (cost is $6,400). March 3 (a) Purchased $960 of office supplies on credit from Gabel Company, terms n/30. March 3 (b) Sold merchandise on credit to Linda Witt, Invoice Number 855, for $6,400 (cost is $3,200). March 6 Borrowed $72,000 cash from Federal Bank by signing a long-term note payable. March 9 Purchased $16,000 of office equipment on credit from Spell Supply, terms n/30. March 10 Sold merchandise on credit to Jovita Albany, Invoice Number 856, for $3,200 (cost is $1,600). March 12 Received payment from Min Cho for the March 2 sale less the discount of $128. March 13 (a) Sent Van Industries Check Number 416 in payment of the March 1 invoice less the discount of $320. March 13 (b) Received payment from Linda Witt for the March 3 sale less the discount of $64. March 14 Purchased $30,000 of merchandise from the CD Company, terms 1/10, n/30. March 15 (a) Issued Check Number 417 for $14,800; payee is Payroll, in payment of sales salaries expense for the first half of the month. March 15 (b) Cash sales for the first half of the month are $51,200 (cost is $40,960). These cash sales are recorded in the cash receipts journal on March 15. March 16 Purchased $1,480 of store supplies on credit from Gabel Company, terms n/30. March 17 Returned $3,000 of unsatisfactory merchandise purchased on March 14 to CD Company. Church reduces accounts payable by that amount. March 19 Returned $480 of office equipment purchased on March 9 to Spell Supply. Church reduces accounts payable by that amount. March 20 Received payment from Jovita Albany for the sale of March 10 less the discount of $32. March 23 Issued Check Number 418 to CD Company in payment of the March 14 purchase less the March 17 return and the $270 discount. March 27 Sold merchandise on credit to Jovita Albany, Invoice Number 857, for $9,600 (cost is $3,840). March 28 Sold merchandise on credit to Linda Witt, Invoice Number 858, for $3,840 (cost is $1,536). March 31 (a) Issued Check Number 419 for $14,800; payee is Payroll, in payment of sales salaries expense for the last half of the month. March 31 (b) Cash sales for the last half of the month are $56,320 (cost is $33,792). These cash sales are recorded in the cash receipts journal on March 31. March 31 (c) Verify that amounts impacting customer and creditor accounts were posted and that any amounts that should have been posted as individual amounts to the general ledger accounts were posted. Foot and crossfoot the journals and make the month-end postings. Assume the following ledger account amounts: Inventory (March 1 beginning balance is $61,000), Z. Church, Capital (March 1 beginning balance is $61,000) and Church Company uses the perpetual inventory system. Required: (a) Post information from the journals in Part 2 to the general ledger and the accounts receivable and accounts payable subsidiary ledgers.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 18E

Related questions

Question

Church Company completes these transactions and events during March of the current year (terms for all its credit sales are 1/10, n/30).

| March 1 | Purchased $32,000 of merchandise from Van Industries, terms 1/15, n/30. |

|---|---|

| March 2 | Sold merchandise on credit to Min Cho, Invoice Number 854, for $12,800 (cost is $6,400). |

| March 3 (a) | Purchased $960 of office supplies on credit from Gabel Company, terms n/30. |

| March 3 (b) | Sold merchandise on credit to Linda Witt, Invoice Number 855, for $6,400 (cost is $3,200). |

| March 6 | Borrowed $72,000 cash from Federal Bank by signing a long-term note payable. |

| March 9 | Purchased $16,000 of office equipment on credit from Spell Supply, terms n/30. |

| March 10 | Sold merchandise on credit to Jovita Albany, Invoice Number 856, for $3,200 (cost is $1,600). |

| March 12 | Received payment from Min Cho for the March 2 sale less the discount of $128. |

| March 13 (a) | Sent Van Industries Check Number 416 in payment of the March 1 invoice less the discount of $320. |

| March 13 (b) | Received payment from Linda Witt for the March 3 sale less the discount of $64. |

| March 14 | Purchased $30,000 of merchandise from the CD Company, terms 1/10, n/30. |

| March 15 (a) | Issued Check Number 417 for $14,800; payee is Payroll, in payment of sales salaries expense for the first half of the month. |

| March 15 (b) | Cash sales for the first half of the month are $51,200 (cost is $40,960). These cash sales are recorded in the cash receipts journal on March 15. |

| March 16 | Purchased $1,480 of store supplies on credit from Gabel Company, terms n/30. |

| March 17 | Returned $3,000 of unsatisfactory merchandise purchased on March 14 to CD Company. Church reduces accounts payable by that amount. |

| March 19 | Returned $480 of office equipment purchased on March 9 to Spell Supply. Church reduces accounts payable by that amount. |

| March 20 | Received payment from Jovita Albany for the sale of March 10 less the discount of $32. |

| March 23 | Issued Check Number 418 to CD Company in payment of the March 14 purchase less the March 17 return and the $270 discount. |

| March 27 | Sold merchandise on credit to Jovita Albany, Invoice Number 857, for $9,600 (cost is $3,840). |

| March 28 | Sold merchandise on credit to Linda Witt, Invoice Number 858, for $3,840 (cost is $1,536). |

| March 31 (a) | Issued Check Number 419 for $14,800; payee is Payroll, in payment of sales salaries expense for the last half of the month. |

| March 31 (b) | Cash sales for the last half of the month are $56,320 (cost is $33,792). These cash sales are recorded in the cash receipts journal on March 31. |

| March 31 (c) | Verify that amounts impacting customer and creditor accounts were posted and that any amounts that should have been posted as individual amounts to the general ledger accounts were posted. Foot and crossfoot the journals and make the month-end postings. |

Assume the following ledger account amounts: Inventory (March 1 beginning balance is $61,000), Z. Church, Capital (March 1 beginning balance is $61,000) and Church Company uses the perpetual inventory system.

Required:

(a) Post information from the journals in Part 2 to the general ledger and the accounts receivable and accounts payable subsidiary ledgers.

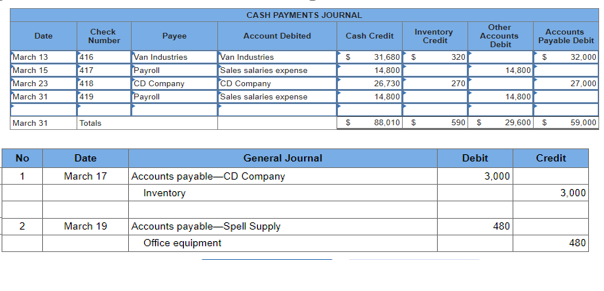

I attached the journals from part two

Transcribed Image Text:March 13

March 15

March 23

March 31

Date

March 31

No

1

2

Check

Number

416

417

418

419

Totals

Date

March 17

March 19

Payee

Van Industries

Payroll

CD Company

Payroll

CASH PAYMENTS JOURNAL

Account Debited

Van Industries

Sales salaries expense

CD Company

Sales salaries expense

General Journal

Accounts payable-CD Company

Inventory

Accounts payable-Spell Supply

Office equipment

Cash Credit

S

$

31,680

14,800

26,730

14,800

88,010

Inventory

Credit

$

$

320

270

Other

Accounts

Debit

590 $

Debit

14,800

14,800

29,600 $

3,000

Accounts

Payable Debit

$

32,000

480

Credit

27,000

59,000

3,000

480

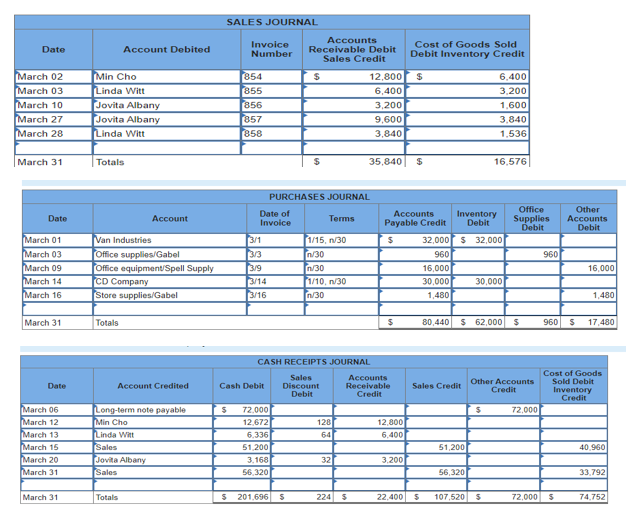

Transcribed Image Text:Date

March 02

March 03

March 10

March 27

March 28

March 31

Date

March 01

March 03

March 09

March 14

March 16

March 31

Date

March 06

March 12

March 13

March 15

March 20

March 31

March 31

Min Cho

Linda Witt

Jovita Albany

Jovita Albany

Linda Witt

Account Debited

Totals

Totals

Van Industries

Office supplies/Gabel

Office equipment/Spell Supply

CD Company

Store supplies/Gabel

Account

Account Credited

Totals

Long-term note payable

MMin Cho

Linda Witt

Sales

Jovita Albany

Sales

SALES JOURNAL

Invoice

Number

$

854

855

856

857

858

3/1

3/3

3/9

3/14

3/16

Cash Debit

PURCHASES JOURNAL

Date of

Invoice

72,000

12,672

6,336

51,200

3,168

56,320

Accounts

Receivable Debit

Sales Credit

$ 201,696

$

S

$

Terms

CASH RECEIPTS JOURNAL

Sales

Discount

Debit

1/15, n/30

n/30

n/30

1/10, n/30

n/30

128

64

12,800

6,400

3,200

32

35,840

224 $

9,600

3,840

$

Accounts

Receivable

Credit

Accounts

Payable Credit

$

12,800

6,400

Cost of Goods Sold

Debit Inventory Credit

3,200

$

32,000

960

16,000

30,000

1,480

Inventory

Debit

Sales Credit

$ 32,000

51,200

56,320

6,400

3,200

1,600

3,840

1,536

16,576

80,440 $ 62,000 $

30,000

$

22,400 $ 107,520 $

Office

Supplies

Debit

Other Accounts

Credit

72,000

960

Other

Accounts

Debit

16,000

72,000 $

1,480

960 $ 17,480

Cost of Goods

Sold Debit

Inventory

Credit

40,960

33,792

74,752

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 20 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning