PROVIDE COMPUTATION! 5. Cumulative compensation expense at the end of year 1 a. P407,000 c. P430,000 b. P645,000 d. P82,500 6. Cumulative compensation expense at the end of year 2 a. P1,290,000 c. P810,000 b. P330,000 d. P822,000 7. Cumulative compensation expense at the end of year 3 a. P1,221,000 c. P1,215,000 b. P1,290,000 d. P1,500,000

PROVIDE COMPUTATION! 5. Cumulative compensation expense at the end of year 1 a. P407,000 c. P430,000 b. P645,000 d. P82,500 6. Cumulative compensation expense at the end of year 2 a. P1,290,000 c. P810,000 b. P330,000 d. P822,000 7. Cumulative compensation expense at the end of year 3 a. P1,221,000 c. P1,215,000 b. P1,290,000 d. P1,500,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 8RE: On January 2, 2019, Brust Corporation grants its new CFO 2,000 restricted share units. Each of the...

Related questions

Question

PROVIDE COMPUTATION!

5. Cumulative compensation expense at the end of year 1

a. P407,000 c. P430,000

b. P645,000 d. P82,500

6. Cumulative compensation expense at the end of year 2

a. P1,290,000 c. P810,000

b. P330,000 d. P822,000

7. Cumulative compensation expense at the end of year 3

a. P1,221,000 c. P1,215,000

b. P1,290,000 d. P1,500,000

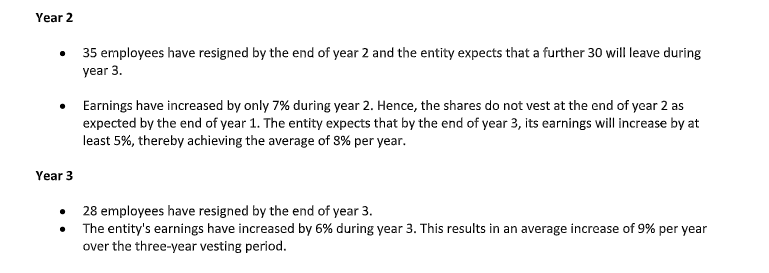

Transcribed Image Text:Year 2

• 35 employees have resigned by the end of year 2 and the entity expects that a further 30 will leave during

year 3.

• Earnings have increased by only 7% during year 2. Hence, the shares do not vest at the end of year 2 as

expected by the end of year 1. The entity expects that by the end of year 3, its earnings will increase by at

least 5%, thereby achieving the average of 8% per year.

Year 3

• 28 employees have resigned by the end of year 3.

• The entity's earnings have increased by 6% during year 3. This results in an average increase of 9% per year

over the three-year vesting period.

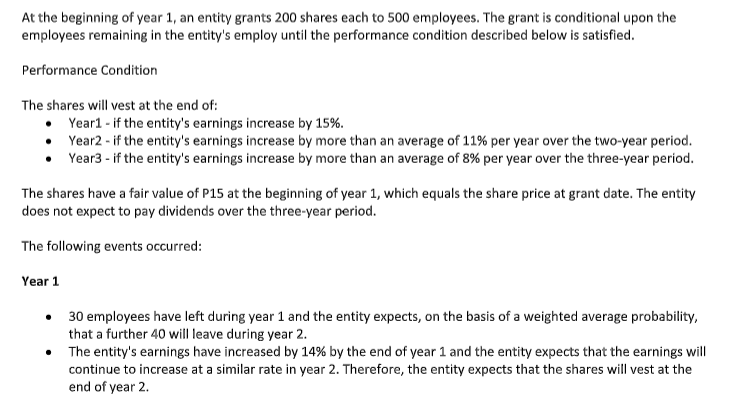

Transcribed Image Text:At the beginning of year 1, an entity grants 200 shares each to 500 employees. The grant is conditional upon the

employees remaining in the entity's employ until the performance condition described below is satisfied.

Performance Condition

The shares will vest at the end of:

Year1 - if the entity's earnings increase by 15%.

Year2 - if the entity's earnings increase by more than an average of 11% per year over the two-year period.

Year3 - if the entity's earnings increase by more than an average of 8% per year over the three-year period.

The shares have a fair value of P15 at the beginning of year 1, which equals the share price at grant date. The entity

does not expect to pay dividends over the three-year period.

The following events occurred:

Year 1

• 30 employees have left during year 1 and the entity expects, on the basis of a weighted average probability,

that a further 40 will leave during year 2.

• The entity's earnings have increased by 14% by the end of year 1 and the entity expects that the earnings will

continue to increase at a similar rate in year 2. Therefore, the entity expects that the shares will vest at the

end of year 2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College