CISE5 5.1 IDENTIFICATION 1. A discount given to customers for early payment. 2. An outright deduction from the invoice price. 3. Terms of shipment where the freight charges are shouldered by the buyer but paid by the seller. 4. Terms of shin

CISE5 5.1 IDENTIFICATION 1. A discount given to customers for early payment. 2. An outright deduction from the invoice price. 3. Terms of shipment where the freight charges are shouldered by the buyer but paid by the seller. 4. Terms of shin

Chapter6: Merchandising Transactions

Section: Chapter Questions

Problem 15MC: A customer returns $870 worth of merchandise and receives a full refund. What accounts recognize...

Related questions

Question

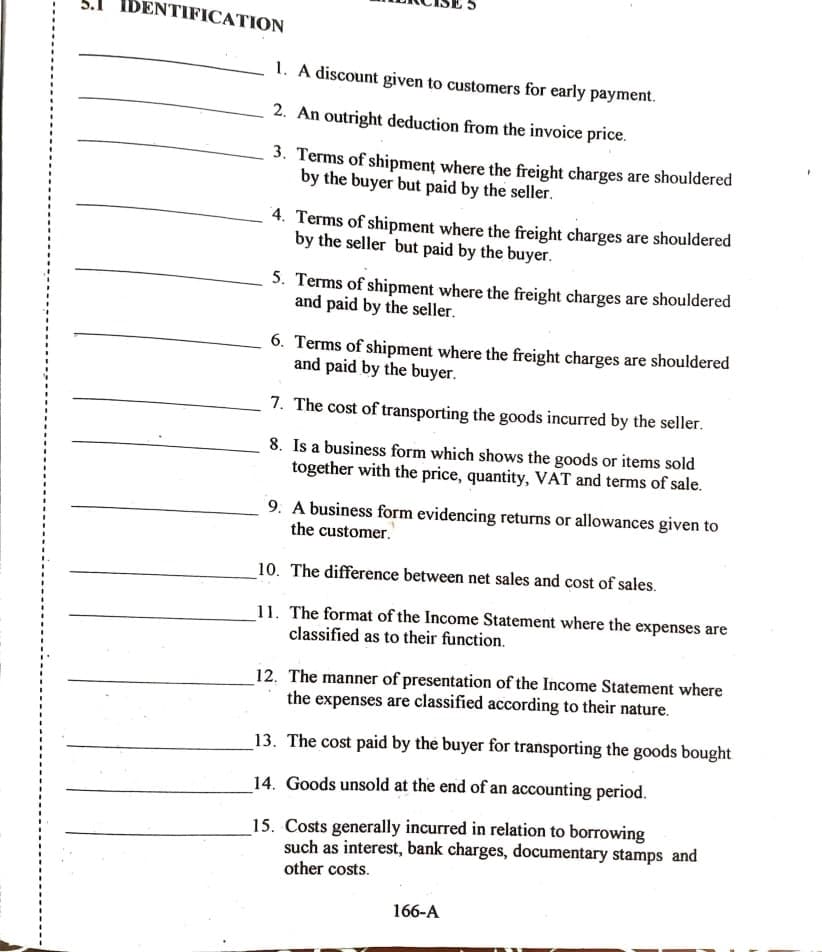

Transcribed Image Text:IDENTIFICATION

1. A discount given to customers for early payment.

2. An outright deduction from the invoice price.

3. Terms of shipment where the freight charges are shouldered

by the buyer but paid by the seller.

4. Terms of shipment where the freight charges are shouldered

by the seller but paid by the buyer.

5. Terms of shipment where the freight charges are shouldered

and paid by the seller.

6. Terms of shipment where the freight charges are shouldered

and paid by the buyer.

7. The cost of transporting the goods incurred by the seller.

8. Is a business form which shows the goods or items sold

together with the price, quantity, VAT and terms of sale.

9. A business form evidencing returns or allowances given to

the customer.

10. The difference between net sales and cost of sales.

11. The format of the Income Statement where the expenses are

classified as to their function.

12. The manner of presentation of the Income Statement where

the expenses are classified according to their nature.

13. The cost paid by the buyer for transporting the goods bought

14. Goods unsold at the end of an accounting period.

15. Costs generally incurred in relation to borrowing

such as interest, bank charges, documentary stamps and

other costs.

166-A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,